According to the announcement, the auction of the entire lot of 38,529,750 shares (87.97% of the capital) will take place at HNX on October 24, 2025, with a starting price of 964.34 billion VND. This move comes as Viettronics, a trillion-VND contractor, continues to operate at a loss and faces challenges with several real estate projects.

Originally established as the Electronics Research Department under the Ministry of Machinery and Metallurgy in 1970, Viettronics has a long history of development before officially operating as a joint-stock company in 2007, with state capital managed by SCIC.

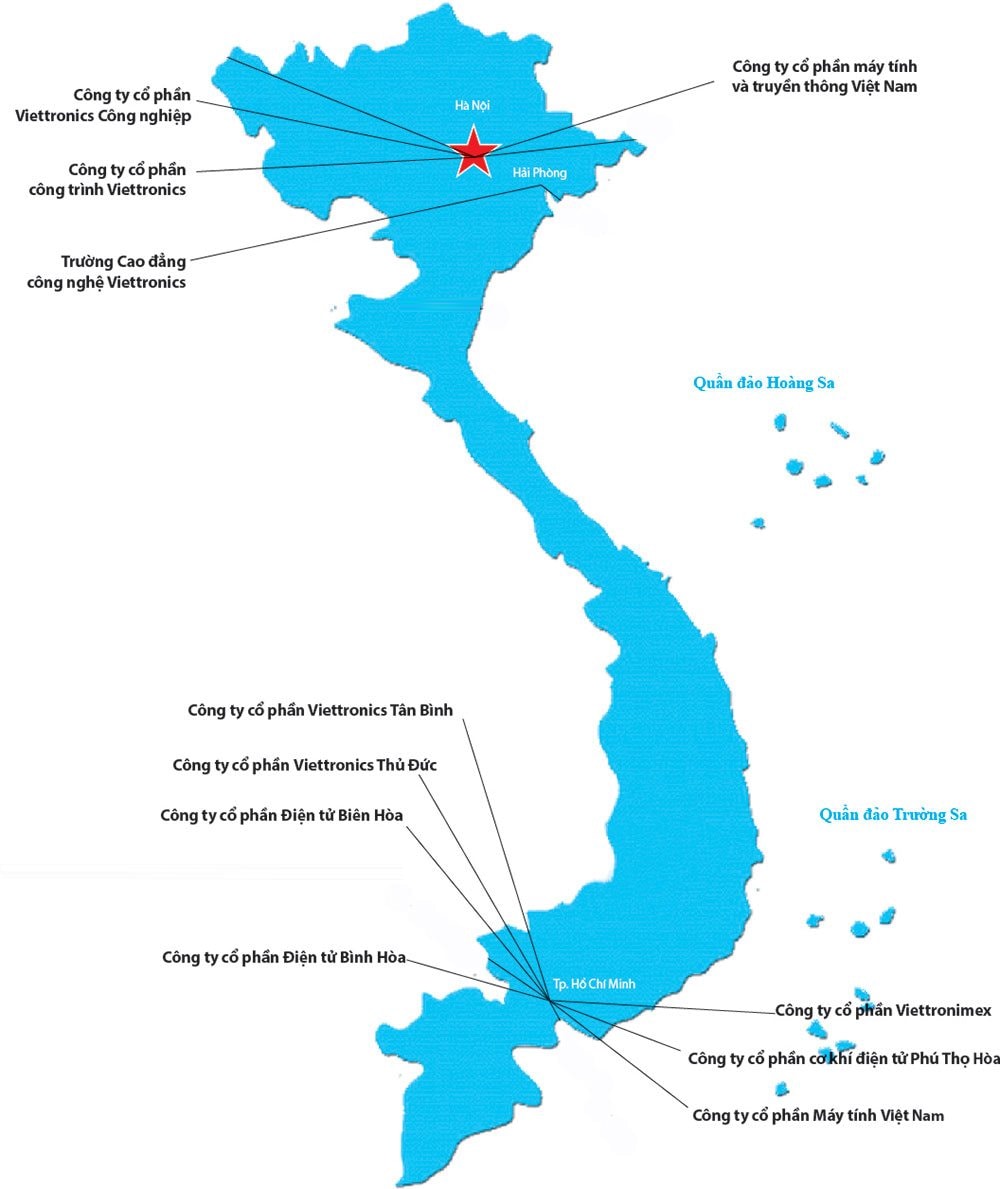

From its roots in electronics, VEC has expanded into various sectors, including energy, industrial and building electromechanics, medical electronics, and education. Notably, VEC is a familiar contractor in the electricity sector, having won 42 bids since 2017 with a total value exceeding 1,578 billion VND, primarily as a consortium partner in projects managed by the Project Management Units for Northern and Central Power Projects.

However, VEC’s current appeal to investors lies not in its core business but in its valuable land assets and real estate projects.

The allure of VEC for investors today centers on its prime land holdings in strategic locations. Viettronics and its subsidiaries currently manage and hold the rights to use several notable land plots, including 15 Tran Hung Dao (544.89 m²), 29F Hai Ba Trung (288 m²) in Hanoi, and 197 Nguyen Thi Minh Khai (425.52 m²) in Ho Chi Minh City.

Additionally, VEC owns a project at Lot 14-E5 in the Cau Giay New Urban Area (4,300 m²), where the company plans to collaborate with a member of the Thang Long Investment Group (TIG) to construct a mixed-use building. Meanwhile, the VTB Green Building project in Ho Chi Minh City (with an ongoing investment value of 9.33 billion VND) remains stalled due to unresolved legal issues.

This is not the first time SCIC has attempted to divest from Viettronics. In the past, SCIC has planned to sell its stake at least three times, all of which were unsuccessful, most recently in February 2023 due to a lack of investor registrations. The primary reasons are believed to be the high starting price relative to market value and the company’s lackluster financial performance.

The paradox of a “trillion-VND contractor with meager profits” is evident in VEC’s financial results. Despite securing large contracts, the parent company remains mired in losses. Specifically, the parent company’s after-tax profit has been consistently negative for years, recording losses of 6.27 billion VND in 2024 and 5.3 billion VND in 2023. This trend continued in the first half of 2025, with a loss of 3.04 billion VND. These figures starkly highlight the company’s poor business performance, even though the consolidated profit of the entire corporation remains positive.

Furthermore, VEC’s financial statements have received numerous exceptions from auditors, related to the failure to provision for approximately 63.6 billion VND in hard-to-recover receivables, 18.63 billion VND in obsolete inventory at the Viettronics Thu Duc subsidiary, and nearly 4.58 billion VND in idle fixed assets that have not been depreciated.

On the stock market, VEC shares have reacted positively to the divestment news. At the close of trading on September 26, 2025, VEC’s share price stood at 15,300 VND, up 7.75% from the reference price. However, this price remains significantly lower than the starting price for the upcoming auction, which is equivalent to approximately 25,028 VND per share.

With a more “attractive” starting price and the ongoing potential of its land assets, investors must carefully weigh the appeal of the real estate holdings against the risks posed by prolonged business losses and the critical issues raised by auditors.

Emerging Real Estate Hotspots: Hà Nam, Hưng Yên, Vĩnh Phúc Attract Major Players Like Sun Group, Phú Mỹ Hưng, Bim Group in a Wave of Investment

Amidst Hanoi’s constrained land availability and escalating property prices, neighboring provinces such as Hà Nam, Hưng Yên, and Vĩnh Phúc have emerged as vibrant real estate markets. These satellite regions are witnessing a surge in housing supply, robust buyer demand, and competitive pricing, positioning them as attractive alternatives for both investors and homebuyers.

Establishing Real Estate Trading Centers to Drive Down Housing Prices

The Ministry of Construction is set to propose a pilot resolution to the Government for the establishment of a state-managed real estate trading center. This initiative aims to introduce legal oversight over the supply and transaction prices of real estate, encompassing both primary and secondary markets.

Which Real Estate Sector is Experiencing the Most Significant Price Surge?

Real estate prices are surging, with land plots leading the charge at a remarkable 44% increase. Close behind, apartments have seen a 42% rise. Other property types, including private houses, project land, and townhouses, have also experienced growth, with increases of 28%, 14%, and 1% respectively during the same period.

Soaring Land Prices Fuel Persistent Highs in Housing Costs

According to experts, the sharp rise in land prices over recent times has become the most significant bottleneck, driving up input costs for real estate projects—a key factor behind the persistent surge in housing prices.