At the 3rd Vietnam Economic Forum in 2025, themed “What Drives GDP Growth of 8.3% – 8.5%,” organized by Lao Dong Newspaper on September 26th, Dr. Can Van Luc, Chief Economist at BIDV, stated that the State Bank of Vietnam’s monetary policy margin is currently very limited, making further interest rate cuts highly challenging. The central bank’s refinancing interest rate stands at approximately 4.5% per year, slightly higher than the U.S. overnight lending rate of 4.25%.

“Lowering interest rates further would be risky due to concerns about foreign exchange outflows. The Governor of the State Bank has also addressed the National Assembly, stating that if exchange rates become volatile, interest rate adjustments will be considered. Therefore, reducing rates is difficult, not to mention the potential strain on money supply and inflation,” Dr. Luc explained.

Dr. Can Van Luc, Chief Economist at BIDV

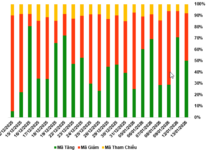

According to the expert, credit growth is excessively high, making it an unreliable channel for economic stimulus. Credit has already grown by approximately 11%, with a 20% increase compared to the same period last year. Real estate credit has expanded rapidly, making it impossible to rely on bank credit to drive economic growth while managing bad debt risks.

In contrast, fiscal policy still has significant room for maneuver. Focus should be placed on reducing taxes and fees, as well as accelerating public investment disbursement. It is crucial to strategize fiscal policies for the upcoming year, especially as Vietnam is revising numerous laws related to taxes and fees.

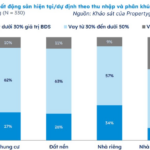

Reform efforts should prioritize private sector development, including state-owned enterprises. A more sustainable real estate market, aligned with citizens’ income levels, is essential. Regarding trade policies, Dr. Luc noted that exports and foreign direct investment (FDI) are showing signs of slowing down. Decisive measures are needed to reform business investment activities and strengthen domestic capabilities, such as updating strategies for the textile industry in the current context.

SHS: With a Debt of $130 Billion, Is Real Estate “Hijacking” Credit Flows Meant for Manufacturing Businesses?

SHS emphasizes that it’s not real estate “stealing” the share of production, but rather the production sector itself hasn’t fully utilized the available credit. Banks are flush with capital, even in surplus, yet businesses remain hesitant to borrow.

Central Bank Boosts Credit Limit for Agriculture, Forestry, and Fisheries to VND 185 Trillion

The State Bank of Vietnam (SBV) has recently announced an expansion of its credit program for the agriculture, forestry, and fisheries sectors, increasing the total funding to VND 185 trillion. This initiative will be implemented through commercial banks, offering loans at interest rates 1-2% lower than the average market rate.

Proposed Upgrade of Quang Tri Airport to Accommodate ‘Super Aircraft’

The Ministry of Finance has recently submitted a proposal to the Ministry of Construction, suggesting a review and adjustment of the Master Plan for the Development of the National Airport System for the period 2021-2030, with a vision towards 2050. As part of this proposal, the Ministry recommends upgrading Quang Tri Airport from a 4C to a 4E classification, enabling it to accommodate wide-body aircraft such as the A350.