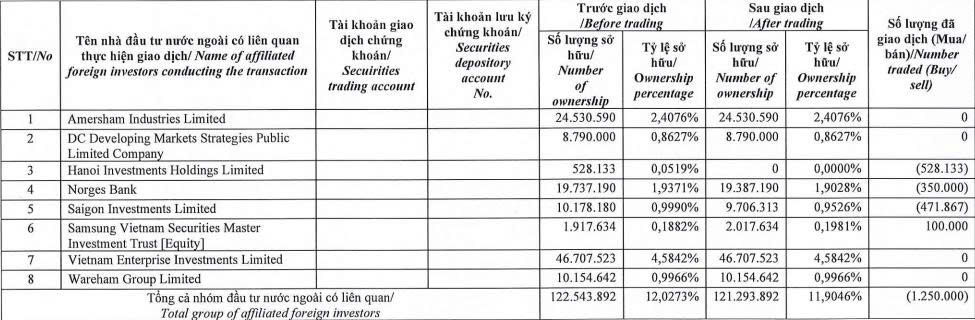

Dragon Capital, represented by Ms. Truong Ngoc Phuong, has recently reported transactions involving shares of Dat Xanh Group (Stock Code: DXG, HoSE). On September 22, 2025, Dragon Capital, through its member fund Samsung Vietnam Securities Master Investment Trust [Equity], sold 100,000 DXG shares.

Conversely, the firm also sold a total of 1.35 million DXG shares through three member funds. Specifically, Hanoi Investments Holdings Limited sold 528,133 shares, Norges Bank sold 350,000 shares, and Saigon Investments Limited sold 471,867 shares.

Source: DXG

Following these transactions, Dragon Capital’s holdings in DXG decreased from over 122.5 million shares to nearly 121.3 million shares, reducing its ownership stake from 12.0273% to 11.9046% of Dat Xanh Group’s capital.

In other developments, Dat Xanh Group recently announced a Board of Directors resolution approving a subsidiary’s initiative to develop a Saigon Riverfront project in Ho Chi Minh City. The subsidiary, wholly owned by the group, is yet to be disclosed.

The project, a high-rise residential and commercial complex, spans 23,000 m² with six 40-story blocks, a total construction area of 286,000 m², and approximately 3,000 units. The total investment is estimated at 7 trillion VND.

Legally, the project aligns with the 1/2000 zoning plan and has secured investment approval and a 1/500 site plan endorsement.

Notably, Dat Xanh Group’s land expansion coincides with signs of recovery in the real estate market. The company has also prepared capital since early 2025 to support this growth.

According to the 2025 mid-year audited financial report, Dat Xanh Group’s cash and bank deposits totaled nearly 3.375 trillion VND, an increase of approximately 2.048 trillion VND from the beginning of the year. At the end of Q1 2025, this figure was over 5.191 trillion VND.

Additionally, in early August 2025, Dat Xanh Group announced a resolution to issue 93.5 million private placement shares, approved at the 2025 Annual General Meeting. The issuance is expected in Q3-Q4 2025.

Priced at 18,600 VND per share, the offering is projected to raise 1.739 trillion VND. Proceeds will be invested in Ha An Real Estate Investment and Business JSC (a DXG subsidiary), which will then invest in Phuoc Son Investment JSC.

Real Estate Investment Funds Pull Back from the Market

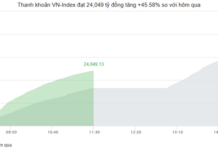

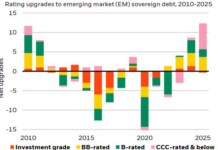

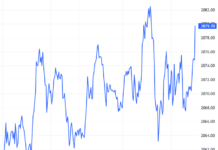

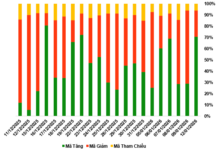

During the week of September 22–26, 2025, investment funds exhibited a pronounced selling trend, particularly concentrated within the real estate sector. This activity unfolded against a backdrop of significant divergence in the VN-Index, highlighting a dynamic and shifting market landscape.

TAL Defies Market Trends, Attracts Foreign Investor Capital

Taseco Land (HoSE: TAL) has successfully secured nearly VND 1.5 trillion in fresh capital from its investors, marking a significant milestone for the company. This influx of funds has officially increased the company’s chartered capital from VND 3.118 trillion to VND 3.6 trillion. As a result, Taseco Land’s equity has surged from VND 4.3 trillion to an impressive VND 5.8 trillion.

Dragon Capital, SHS, VietinbankSC, and Others Inject Nearly VND 1.5 Trillion into Taseco Land, Instantly Yielding Over 50% “Paper Profit”

Taseco Land has successfully concluded its private placement round, raising a total of VND 1.492 trillion. Notably, the offering attracted significant interest from prominent market players. Among them, the fund group managed by Dragon Capital stood out, investing approximately VND 620 billion to acquire a 5.55% stake, thereby becoming a major shareholder in this real estate enterprise.

Chairman of HoREA Le Hoang Chau: To Lower Housing Prices, All Costs Must Be Reduced Simultaneously, Including a Special Type of Expense

Mr. Le Hoang Chau, Chairman of the Ho Chi Minh City Real Estate Association, asserts that to effectively lower housing prices, the primary focus must be on reducing costs across the board. This includes land use fees, construction expenses, and input costs such as sand, gravel, steel, cement, electricity, and fuel. Additionally, Mr. Chau emphasizes the need to reduce a critical yet often overlooked cost: compliance expenses associated with legal and regulatory requirements.