Why Are Banks Significantly Increasing Real Estate Lending?

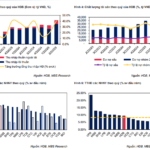

According to the State Bank of Vietnam’s report, as of July 31, the outstanding real estate credit balance of credit institutions reached VND 4,080 trillion, a 16.95% increase compared to the end of 2024, surpassing the overall credit growth rate. Real estate credit accounts for 23.68% of the total outstanding debt in the economy, with a bad debt ratio of 2.43%.

Of this, the outstanding debt for real estate business activities reached VND 1,790 trillion, up 23.87%, accounting for 43.98% of real estate debt. The outstanding debt for consumer and personal real estate use reached VND 2,280 trillion, up 12.04%, accounting for 56.02%.

Statistics from 14 banks as of the end of Q2/2025 show that 10 out of 14 banks have real estate lending growth exceeding 20%. Leading the pack is VIB Bank with over VND 10,159 billion, a 78.3% increase compared to the beginning of 2025.

VIB has been one of the banks aggressively increasing real estate lending recently. While the outstanding debt was VND 1,673 billion at the beginning of 2024, it surged to VND 5,695 billion by the beginning of 2025 (a 240% increase). Other banks like Saigonbank (up 30.9%) and PGBank (up 30.1%) also saw significant growth.

As of July 31, the outstanding real estate credit balance of credit institutions reached VND 4,080 trillion.

Assessing the credit balance, the State Bank of Vietnam notes that real estate credit growth is high, and its proportion in total credit is trending upward, concentrated in real estate business activities.

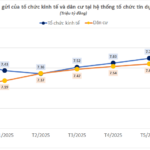

The State Bank observes that the market lacks affordable housing. The ratio of housing price to average household income in Vietnam is 23.7 times, compared to the global average of 14.6 times.

Regarding financial capacity, the State Bank assesses that “some developers have limited financial capacity.” Long-term, stable capital mobilization channels for the real estate market, such as securities and corporate bonds, are underdeveloped, making the market reliant on credit capital.

“Real estate investment is medium to long-term, while banks’ capital mobilization is primarily short-term. This maturity mismatch can lead to liquidity risks if borrowers fail to repay on time,” the State Bank warns.

Relying Solely on Banks for Real Estate is Risky

Dr. Lê Xuân Nghĩa, former Vice Chairman of the National Financial Supervisory Commission and member of the National Financial and Monetary Policy Advisory Council, states that bank credit remains the primary capital source for real estate, accounting for about 25% of total system credit. In the US, Europe, and China, this figure ranges from 25% to 29%.

“In Vietnam, about 40% of real estate credit is for investment, and 60% is for homebuyers. However, relying solely on banks is risky and unsustainable,” Mr. Nghĩa said.

Dr. Cấn Văn Lực, Chief Economist at BIDV, notes that “real estate credit is growing very high.” Specifically, real estate business credit has increased by 20-21%, double the overall system credit growth rate.

To increase capital for the real estate market, Mr. Lực suggests resolving stalled projects, of which there are nearly 3,000 with a total investment of about VND 6,000 trillion.

“Unblocking just 10-15% of these nearly 3,000 projects would inject a significant amount of capital into the economy. This would not only increase supply but also drive economic growth,” Mr. Lực said.

Soaring Land Prices Fuel Persistent Highs in Housing Costs

According to experts, the sharp rise in land prices over recent times has become the most significant bottleneck, driving up input costs for real estate projects—a key factor behind the persistent surge in housing prices.

Peer-to-Peer Lending Pilot by the State Bank: Who Qualifies and What Are the Interest Rates?

Interest rates are mutually agreed upon by both the lender and borrower, ensuring they remain within the maximum limits set forth by the Civil Code.