According to a recent report by Avison Young Vietnam, the industrial and residential sectors in provinces surrounding Hanoi are poised for robust growth, driven by several key advantages: advanced inter-regional connectivity, substantial FDI inflows, a plentiful labor force, vast land reserves, and reasonable development costs. These factors collectively propel the region’s industrialization and urbanization goals.

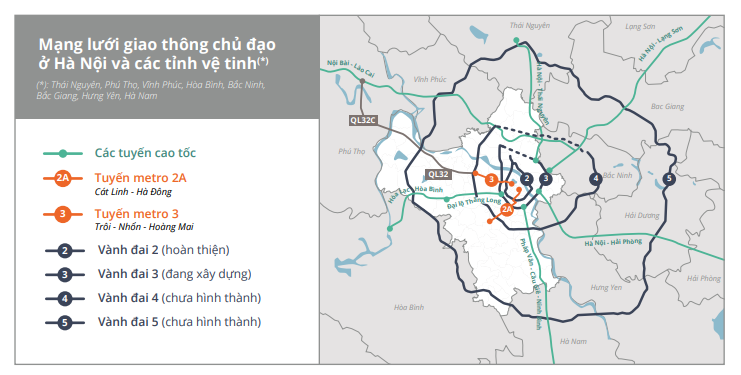

In terms of infrastructure, the transportation network in Northern Vietnam is rapidly expanding, thanks to new ring roads encircling Hanoi and an increasingly comprehensive inter-provincial highway system. Planned projects such as Ring Roads 4 and 5 are set to alleviate congestion and foster the growth of satellite cities.

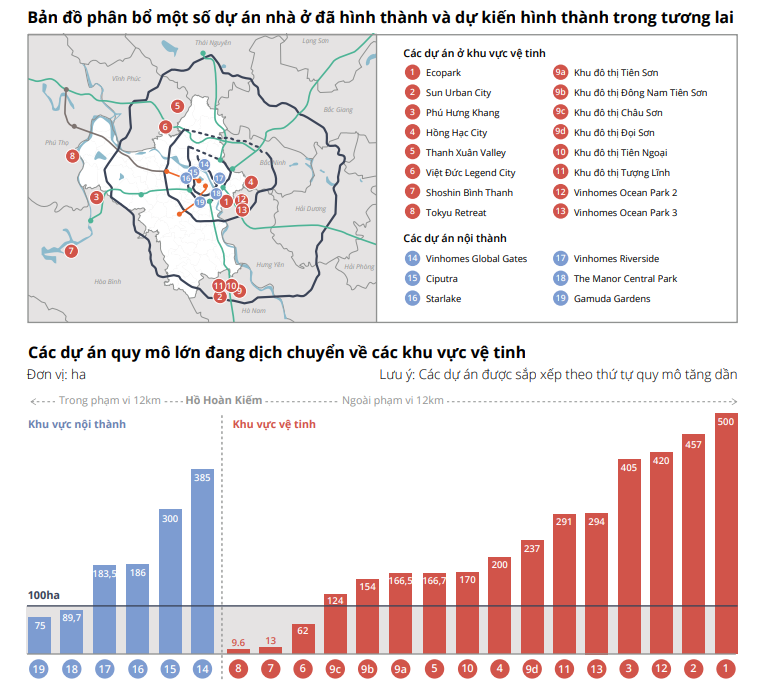

While Hanoi faces dwindling land availability, neighboring provinces offer extensive land areas at competitive prices. This has spurred the relocation of numerous large-scale projects, spanning hundreds of hectares, to Hanoi’s satellite regions.

The surge in real estate development in Hanoi’s satellite provinces.

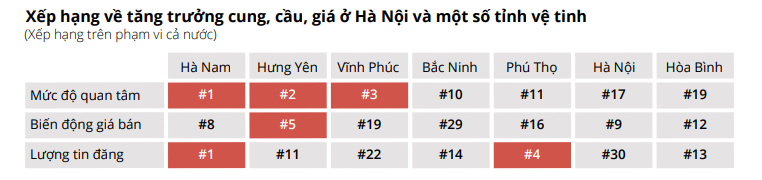

Avison Young highlights Ha Nam, Hung Yen, Vinh Phuc, and Phu Tho as vibrant markets characterized by robust residential supply, strong buyer demand, and competitive pricing. These satellite markets, with their ample land resources and attractive land lease rates, have become prime destinations for major real estate developers such as Sun Group, Phu My Hung, and Bim Group.

Additionally, the trend of population decentralization to satellite areas has become more pronounced following administrative boundary adjustments, as evidenced by the growing interest in real estate within provinces adjacent to Hanoi.

From thriving Tier-1 industrial zones

Moreover, provinces such as Bac Ninh, Bac Giang, Vinh Phuc, Hung Yen, and Ha Nam have emerged as FDI hotspots. This influx of investment has generated significant demand for industrial zone infrastructure, factory spaces, warehouses, and related facilities.

“Industrial land rental prices in Tier-1 markets are rising faster than the overall Northern average,” notes Mr. Vu Minh Chi, Director of the Industrial Zone Services Department at Avison Young Vietnam.

Rental prices in Tier-1 markets may increase by 5-7% annually, compared to 2-3% in other Northern markets. In Hai Phong, for instance, rental rates have climbed from $95–97/m²/term (2023) to $125–130/m²/term (2025), reflecting a compound annual growth rate (CAGR) of approximately 14.5%–15.8%.

“Previously, much of the land was agricultural, but it has now been repurposed for industrial use. Compensation and land clearance costs are generally lower than in the South, helping to reduce initial investment costs and maintain competitive rental rates,” Mr. Chi adds. In late August, four industrial zones were simultaneously launched in Bac Ninh, Phu Tho, Hanoi, and Ninh Binh, promising long-term development potential with their abundant land reserves.

To housing solutions – three distinct approaches

The significant presence of FDI enterprises has increased labor demand and spurred migration. In 2024, Bac Ninh led the nation in population movement, followed by Hung Yen, Hanoi, Bac Giang, and Vinh Phuc. Consequently, the substantial housing demand in these satellite provinces not only addresses short-term accommodation needs for professionals but also encourages the workforce to settle permanently.

Avison Young Vietnam reports that housing solutions in Hanoi’s satellite markets are evolving along three main paths.

First, large FDI companies are investing in dormitories and accommodations for managers, employees, and workers: Samsung provides over 30,000 housing units in Thai Nguyen and Bac Ninh, while Foxconn and Texhong offer similar facilities in Bac Giang and Quang Ninh, respectively.

Second, industrial zone developers are either independently constructing or collaborating with residential real estate developers to build commercial housing and serviced apartments on land near or within industrial zones. In Ha Nam, numerous serviced apartment projects by an industrial zone developer were fully subscribed upon launch.

Third, there is a growing trend of developing large-scale urban areas. Leveraging extensive land availability and reasonable land costs, urban projects exceeding 100 hectares are concentrated in Hanoi’s outer districts and are expanding into former areas of Ha Nam, Vinh Phuc, Hung Yen, and Hoa Binh.

Avison Young Vietnam assesses that the real estate market in provinces surrounding Hanoi has the potential for independent growth, not reliant on Hanoi’s central core, due to its unique appeal for capital and labor. Investment focus will thus continue to shift to these areas, as evidenced by heightened interest, price fluctuations, and an increasingly diverse range of offerings in the industrial and residential real estate segments.

Establishing Real Estate Trading Centers to Drive Down Housing Prices

The Ministry of Construction is set to propose a pilot resolution to the Government for the establishment of a state-managed real estate trading center. This initiative aims to introduce legal oversight over the supply and transaction prices of real estate, encompassing both primary and secondary markets.

Hanoi’s Nghia Do Park Transforms with a Unique Guitar-Shaped Pedestrian Bridge

Nghĩa Đô Park in Hanoi has undergone a stunning transformation, showcasing a unique pedestrian bridge shaped like a guitar spanning the lake. This eye-catching feature promises to become a must-visit check-in spot in the capital city.

Which Real Estate Sector is Experiencing the Most Significant Price Surge?

Real estate prices are surging, with land plots leading the charge at a remarkable 44% increase. Close behind, apartments have seen a 42% rise. Other property types, including private houses, project land, and townhouses, have also experienced growth, with increases of 28%, 14%, and 1% respectively during the same period.