IPO Roadmap and Capital Utilization Plan

The highly anticipated CTCP Gelex Infrastructure is set to offer approximately 100 million shares to the public, equivalent to a 12% increase in its chartered capital.

The expected price range is between VND 28,000 – 30,000 per share. If successful, CTCP Gelex Infrastructure could raise around VND 3,000 billion, which will be allocated to real estate projects.

In terms of timeline, Gelex has submitted its application to the State Securities Commission and expects approval by October 2025. The auction is slated for November–December 2025, with listing planned as early as January 2026, and no later than Q2/2026.

Post-transaction, Gelex Group’s ownership in CTCP Gelex Infrastructure is expected to decrease from 79% to approximately 71%.

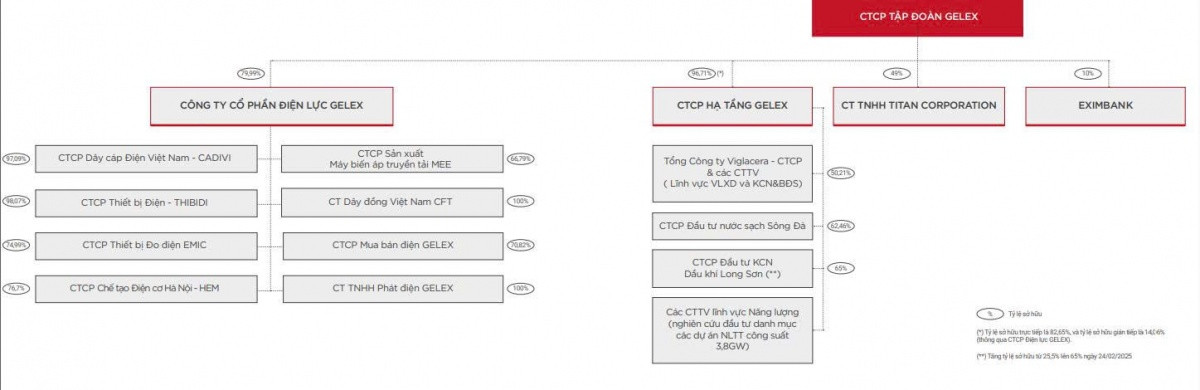

Overview of CTCP Gelex Infrastructure’s Ecosystem

Positioned as a strategic cornerstone, CTCP Gelex Infrastructure is a holding company overseeing core business segments, including industrial real estate, construction materials, and utility infrastructure.

At the heart of this ecosystem is Viglacera Corporation (HoSE: VGC), where CTCP Gelex Infrastructure holds a 50.21% stake. Viglacera is a leading industrial park (IP) developer, managing 16 IPs with over 4,500 hectares of land, attracting more than USD 20 billion in FDI.

Dong Van 4 Industrial Park by Viglacera.

Additionally, Viglacera is a major player in the construction materials sector, operating 5 sanitaryware factories, 7 tile factories, 4 glass factories, and 13 brick and tile factories. Notably, VGC is undergoing a comprehensive restructuring of its core businesses, merging subsidiaries, and divesting underperforming investments to enhance revenue and profit margins in 2025-2026.

The IP segment is further strengthened by Long Son Petroleum Industrial Park Investment JSC (UPCoM: PXL), after Gelex Infrastructure invested VND 934 billion to increase its stake to 65%. The Long Son Petroleum Industrial Park project (800-1,250 hectares) is being developed into a modern Data Center hub.

Furthermore, the M&A strategy includes the acquisition of the Can Gio High-End Residential Area project (nearly 30 hectares) from Saigon General Services Corporation, a Tasco Group subsidiary, for VND 619 billion.

High-end and industrial real estate are being advanced through a joint venture with Titan Corporation and Frasers Property (Singapore). This partnership is executing 5 projects in Bac Ninh, Hung Yen, and Quang Ninh with a total investment of nearly VND 8,000 billion, and has recently been approved for the Tran Duong – Hoa Binh Industrial Park (Hai Phong) spanning nearly 208 hectares.

Aerial view of the Song Da Water Plant.

In the utility infrastructure sector, Gelex Infrastructure holds a 62.46% stake in Song Da Clean Water Investment JSC (UPCoM: VCW), which supplies clean water to approximately 1/4 of Hanoi’s population. Phase 2 of the project aims to double capacity to 600,000 m³/day, expected to complete by late 2025.

Financial Health and Business Performance

In terms of scale, CTCP Gelex Infrastructure holds a pivotal position within the group. As of December 31, 2024, its total assets reached nearly VND 35,580 billion, accounting for 66% of Gelex Group’s total assets. In 2024, CTCP Gelex Infrastructure reported net revenue of VND 12,710 billion and pre-tax profit of VND 1,625 billion.

The first half of 2025 showed robust recovery, with both construction materials and industrial real estate segments reporting impressive gross profit growth of 33% and 36%, respectively, year-on-year.

The primary driver of this growth is Viglacera, whose after-tax profit for the first six months of 2025 more than doubled compared to the same period last year, reaching nearly VND 840 billion.

Market Impact and Context

Gelex Ecosystem (as of late 2024)

The IPO of CTCP Gelex Infrastructure is expected to have a positive impact on multiple fronts. The capital raise will accelerate infrastructure and real estate projects, directly improving business performance.

Additionally, the listing of this key subsidiary will enable the market to more transparently value each business segment within the Gelex ecosystem.

This transaction occurs amidst a vibrant IPO market, with trading volumes reaching USD 1.5-2 billion per session, and Vietnam’s stock market upgrade on the horizon.

Another beneficiary is VIX Securities JSC (HoSE: VIX). According to its 2025 semi-annual financial report, VIX holds an investment in CTCP Gelex Infrastructure valued at VND 960 billion.

Driven by this and other investments in the Gelex ecosystem, VIX reported after-tax profit of VND 1,674 billion in the first six months, surpassing 40% of its annual target, and is set to revise its profit goals upward.

TCBS Secures Stock Code TCX, Poised for HOSE Listing in October

Technological Commercial Securities Corporation (TCBS) has officially been granted the stock code TCX by the Vietnam Securities Depository and Clearing Corporation (VSDC).

“All Recent Reforms Aim to Elevate Vietnam’s Market Status, Says Mr. Bui Hoang Hai (SSC)”

At the Vietnam Financial Advisors Summit (VWAS) held on the afternoon of September 25th under the theme “New Era, New Momentum,” Mr. Bui Hoang Hai, Vice Chairman of the State Securities Commission (SSC), emphasized that market upgrading is not merely an endpoint but a means to achieve a more transparent, stable, and efficiently operating market. This transformation aims to provide investors with greater opportunities to pursue profitable returns.