At the 3rd Vietnam Economic Forum 2025, themed “What Drives GDP Growth of 8.3%-8.5%,” organized by the Labor Newspaper on September 26, Prof. Dr. Hoang Van Cuong, a member of the Prime Minister’s Policy Advisory Council and the National Assembly’s Economic and Financial Committee, emphasized that achieving an 8% growth rate this year, and sustaining double-digit growth in subsequent years, is imperative for Vietnam to become a high-income nation and escape the middle-income trap.

International experience shows that every nation must undergo a period of high growth, nearing double digits, over an extended period. Vietnam is no exception.

Prof. Dr. Hoang Van Cuong stresses the need to control money supply in the high-end real estate sector.

According to the expert, growth and inflation are like “twin brothers.” It’s unrealistic to expect robust economic growth with zero inflation. The key lies in managing inflation at a reasonable level.

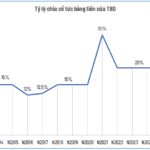

Dr. Cuong noted that in the first eight months of 2025, inflation stood at 3.2%, with a projected full-year rate below 5%. However, risks persist as money supply surges, with credit in eight months 1.4 times higher than the same period last year, while money velocity is only 0.6%.

“Where is this money flowing? If it doesn’t enter production, the risk of inflationary explosions or economic ‘blood clots’ is real,” Dr. Cuong questioned.

The expert highlighted the relationship between inflation and exchange rates: “To achieve high growth, we must keep interest rates low to encourage investment, but this puts pressure on the exchange rate.”

Over the past period, exchange rate fluctuations have exposed this trade-off. The Fed’s 0.25% rate cut weakened the USD, temporarily stabilizing the exchange rate. The State Bank of Vietnam effectively used forward foreign exchange sales and should continue leveraging such technical tools.

Additionally, Prof. Dr. Hoang Van Cuong expressed concern about money flowing into high-end real estate. “Property prices are soaring, while credit for social housing and affordable homes remains limited. This signals that money supply may be misallocated. Tight control over this segment is essential to prevent instability,” he advised.

Regarding the stock market, Dr. Cuong noted a 30% index increase, but corporate performance hasn’t improved proportionally, indicating heavy cash inflows. Margin lending isn’t excessive yet, but without caution, bubble risks persist. Solutions include increasing stock supply, accelerating equitization, and divesting state capital in non-strategic sectors to balance supply and demand while boosting budget revenue.

Another concern Dr. Cuong raised is inflation expectations. When businesses and suppliers anticipate cost increases, they tend to raise prices prematurely, pressuring the market. To break this “expectation barrier,” Vietnam needs targeted policies. For instance, promoting biofuel use over mineral fuel requires tax incentives to lower prices and encourage consumption.

“In my view, fiscal and monetary policies must coordinate flexibly and proactively to minimize external impacts. An 8% growth target this year is feasible. Public debt at 34% of GDP remains safe. Inflation is manageable if we control money supply and prices effectively,” Dr. Cuong stated.

Furthermore, despite the USD weakening due to Fed rate cuts, pressures remain as year-end import demand rises for the shopping season, while exports to the U.S. face tariff risks. Therefore, stabilizing the exchange rate is a macroeconomic priority through year-end.

Over 2,200 Projects Stalled, Totaling $6 Trillion in Investment

Over 2,200 projects, totaling 6 quadrillion VND in capital, are currently stalled. Unlocking these bottlenecks, alongside flexible fiscal and monetary policies, digital transformation, and green growth, is key to achieving the ambitious GDP growth target of 8.3-8.5% by 2025.

Unleashing the Drivers Behind a 8.3%-8.5% GDP Growth Surge

Ministries, sectors, and local authorities must aggressively strive to achieve 100% disbursement of the 2025 public investment capital plan.