According to the Ministry of Finance, these adjustments aim to ensure consistency across existing regulations, such as Decree 126/2020/NĐ-CP and Circular 40/2021/TT-BTC, while streamlining the tax declaration and payment process for taxpayers.

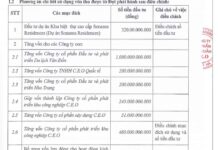

Specifically, starting September 2025, business households and individual entrepreneurs subject to lump-sum tax must use Form 01/CNKD for tax declarations. The required documentation must include comprehensive details on revenue, business sector, location, and scale. The deadline for submitting the lump-sum tax declaration for the following year is December 15th of the current year, enabling tax authorities to determine applicable revenue and tax amounts. Submissions can be made in person at tax offices, via postal services, or through the electronic portal.

Decision 3078/QĐ-BTC also introduces new procedures for adjusting revenue and lump-sum tax amounts. When changes occur in business scale, sector, location, or a switch to the declaration method, business households must file an adjusted declaration using Form 01/CNKD (amended as per Circular 40/2025/TT-BTC guidelines).

Additionally, the Ministry of Finance clarifies supplementary tax filing procedures for taxpayers who identify errors after submitting their initial documentation. Corrections can be made electronically, in person, or via mail, enhancing flexibility and transparency.

Another notable update requires business households and individual entrepreneurs without fixed locations, generating annual revenue exceeding 100 million VND, to declare taxes for each transaction. Supporting documents, including contracts, acceptance records, invoices (if available), and proof of goods/service origin, must accompany the filing. This measure ensures tax compliance aligns with actual business activity.

While the Ministry of Finance has issued nationwide regulations, local tax departments may provide region-specific guidance. Business households should regularly monitor updates from district-level tax authorities to ensure compliance and avoid submission errors or delays.

Under the tax reform roadmap, certain large-scale business households will transition from lump-sum to declaration-based taxation starting 2026.

13,700 Household Businesses Abandon Lump-Sum Tax: Deputy Prime Minister Directs Wave of Support for Enterprises

The Deputy Prime Minister has urged government ministries to thoroughly investigate potential barriers and apprehensions that may deter business households from transitioning into formal enterprises.

Free Accounting Software Now Available for Small Businesses

As Vietnam transitions to a self-declaration tax system for individual businesses by 2026, a leading sales management platform serving over 300,000 businesses has launched a free, user-friendly accounting software. This innovative solution empowers individual businesses to seamlessly adopt accounting practices, ensuring compliance with the new tax regulations.

Beware of Fake Facebook Pages Impersonating the Ministry of Finance for Scams

The Ministry of Finance has issued a warning about a fraudulent Facebook page named “Ministry of Finance – Online Application Portal.” This fake page uses the Ministry’s official imagery and information, falsely claiming to represent the government in recovering funds for victims of online scams. Citizens and businesses are urged to remain vigilant and avoid engaging with this deceptive platform.