In the first eight months of 2025, Vietnam’s pangasius exports reached USD 1.4 billion, a 10% increase compared to the same period in 2024, solidifying its position as a key sector in Vietnam’s seafood industry. Processed products also saw impressive growth, signaling a positive trend in product diversification.

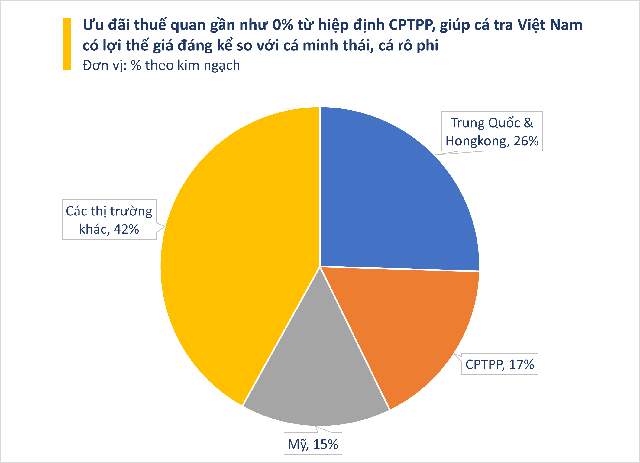

Exports of pangasius to China and Hong Kong in the first eight months of this year decreased by 4% year-on-year, reaching only USD 357 million, accounting for 25% of Vietnam’s total pangasius exports. In August alone, exports to this market also dropped by 4% year-on-year, to USD 55 million.

Countries benefiting from the CPTPP agreement led the growth in pangasius imports from Vietnam during the first eight months, with a 36% increase to USD 242 million compared to the same period last year—the highest among all market blocs.

Japan, Canada, Mexico, and Chile reported stable demand, particularly for high-quality fillets and deeply processed products. This is primarily due to the near-zero tariffs under the CPTPP agreement, giving Vietnamese pangasius a significant price advantage over cod and tilapia. Additionally, these countries require clear quality standards and traceability, which many Vietnamese businesses have successfully met, thereby increasing average order values.

Beyond the CPTPP, South America is emerging as an ideal destination for Vietnamese pangasius exports. By the end of August 2025, exports to Brazil, considered the gateway to South America, reached USD 118 million, a 54% increase year-on-year, driven by the demand for alternatives to local tilapia and growing consumer familiarity with pangasius.

The CPTPP and South American regions not only offset the decline in exports to China but also offer opportunities for higher profits through high-quality orders, better payment terms, and higher profit margins. This is why both the CPTPP and South America are becoming the new growth engines for Vietnamese pangasius.

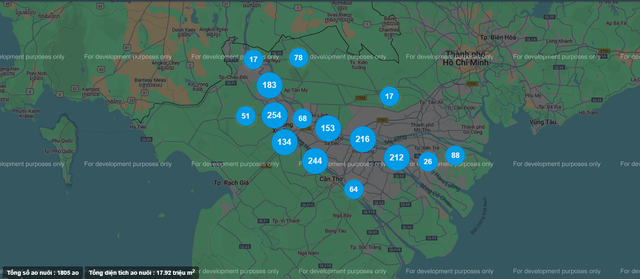

Number and location of pangasius farming ponds in Vietnam.

In the latter half of this year, the supply of raw pangasius is tightening, with export prices expected to recover in Q4/2025. According to VASEP, this presents an opportunity for businesses to secure contracts in fast-growing markets like the CPTPP and South America, ahead of the year-end holiday season. Meanwhile, the U.S. and EU remain stable markets with high sustainability standards, requiring the pangasius industry to enhance quality to maintain market share.

The ASEAN market, with its vast potential, saw pangasius exports to Thailand reach USD 52 million in the first eight months of this year, a 31% increase, and to the Philippines reach USD 26 million, also up 31% year-on-year.

If businesses simultaneously strengthen their positions in the three key pillars—CPTPP, South America, and traditional markets like the U.S., EU, and ASEAN—the Vietnamese pangasius industry will establish a multi-polar market structure, reducing dependency on any single market and enhancing resilience to global trade fluctuations.

Vietnam’s Fruit and Vegetable Exports Reach Unprecedented High

In September, Vietnam’s fruit and vegetable industry achieved a historic milestone, with export turnover reaching nearly $1.3 billion—the highest level ever recorded. Durian exports, the king of fruits, are leading the charge, propelling the sector toward a new record and paving the way to potentially hit the $8 billion mark this year.

Revolutionizing Supply Chains: A Game-Changing Opportunity for Vietnamese Household Goods

In the wake of post-Covid-19 supply chain reshaping, global brands are seeking new destinations beyond China. This presents a golden opportunity for Vietnam’s home appliance industry, provided it leverages its manufacturing strengths, aligns with international standards, and establishes a distinct brand identity.

“Unraveling the Opportunities and Challenges for the Textile and Footwear Industry in the Coming Years”

On September 9, at the Trade Promotion Conference with the Vietnamese Trade Offices Abroad for August 2025, chaired by the Minister of Industry and Trade, representatives from the Vietnam Textile and Apparel Association and the Vietnam Leather, Footwear and Handbag Association shared new challenges and proposed solutions to overcome difficulties, enhance competitiveness, and seize opportunities in the international market.