Stock Market Outlook for the Week of September 22-26, 2025

During the week of September 22-26, 2025, the VN-Index saw a modest uptick after a period of intense volatility, forming a Long Lower Shadow candlestick pattern. The MACD indicator has maintained a buy signal since May 2025, though its gap with the Signal Line is narrowing. Meanwhile, the Stochastic Oscillator continues to weaken following a sell signal in the overbought zone, indicating lingering short-term volatility risks.

Additionally, trading volume has been declining in recent weeks, making a clear breakout unlikely unless liquidity improves soon.

TECHNICAL ANALYSIS

Trend and Price Oscillation Analysis

VN-Index – MACD Continues to Decline

In the trading session on September 26, 2025, the VN-Index experienced a slight decline, with trading volume remaining below the 20-day average, reflecting investors’ cautious sentiment.

Furthermore, the ADX indicator continues to drop, staying below the gray zone (20 < adx < 25).

Moreover, the VN-Index has fallen below the Middle Band of the Bollinger Bands, while the MACD continues to decline after issuing a sell signal. If these technical indicators do not improve, short-term correction risks will persist.

HNX-Index – Volume Consistently Below Average

In the trading session on September 26, 2025, the HNX-Index saw a slight decline, accompanied by a small-bodied candlestick and volume consistently below the 20-session average, indicating ongoing investor caution.

Additionally, the index remains within a Triangle pattern, with the MACD weakening further after a sell signal. This suggests short-term prospects remain uncertain.

Money Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is currently above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

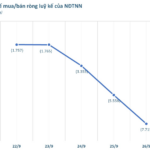

Foreign Investor Flow: Foreign investors continued to net sell in the session on September 26, 2025. If this trend persists in upcoming sessions, the outlook will become increasingly pessimistic.

Technical Analysis Department, Vietstock Advisory Division

– 16:58 September 28, 2025

Market Reversal: Surge in Investment Flows

The market rallied impressively in today’s afternoon session (24/9), with a significant return of capital inflows, particularly favoring banking and securities stocks. The VN-Index reversed course, surging by over 22 points.

Bustling Businesses Distribute Dividends

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.

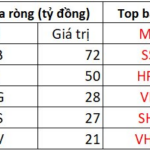

Foreign Block “Dumps” VND 2.2 Trillion in Vietnamese Stocks in Final Week’s Session, Spotlight on a Single Stock

In the afternoon trading session, VCB emerged as the most heavily bought stock across the entire market, with a net buying value of 72 billion.