Recently, Vicasa Steel Joint Stock Company – VNSteel (Stock Code: VCA, HoSE) announced a transaction of shares by insiders related to the company’s internal personnel.

Vietnam National Steel Corporation (VNSteel, Stock Code: TVN, UPCoM) has registered to sell nearly 9.9 million VCA shares, equivalent to a 65% stake in Vicasa Steel – VNSteel.

The transaction is expected to take place via public auction on the Hanoi Stock Exchange (HNX) from October 7, 2025, to October 30, 2025.

Illustrative image

The purpose of this transaction is to restructure VNSteel’s investment portfolio in line with the Restructuring Plan for the period up to 2025, as outlined in Decision No. 113/QĐ-VNS dated April 25, 2024, by the VNSteel Board of Directors.

If successful, VNSteel will no longer be the parent company of Vicasa Steel – VNSteel, as it will hold no VCA shares.

Previously, VNSteel announced a public auction of nearly 9.9 million VCA shares in batches, with a starting price of 12,790 VND per share, totaling approximately 126.3 billion VND for the entire batch.

In terms of business performance, Vicasa Steel – VNSteel reported a net revenue of over 884.5 billion VND in the first half of 2025, a 40.4% increase compared to the same period in 2024, according to the reviewed financial report.

After deducting taxes and fees, the post-tax profit reached nearly 2 billion VND, a 9.4% increase year-over-year.

As of June 30, 2025, the company’s total assets increased by 13.4% from the beginning of the year to nearly 363 billion VND. Inventory stood at over 200.8 billion VND, accounting for 55.3% of total assets, while short-term receivables were nearly 109.6 billion VND, representing 30.2% of total assets.

On the liabilities side, total payables reached over 168.7 billion VND, a 32.2% increase from the beginning of the year. Short-term loans and financial leases accounted for 115.6 billion VND, or 68.5% of total liabilities.

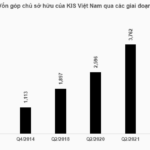

KIS Vietnam Proposes Shareholders to Approve Capital Increase Surpassing VND 4,500 Billion

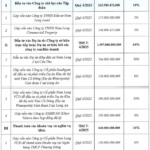

KIS Vietnam Securities Corporation (KIS Vietnam) announces an extraordinary shareholders’ meeting scheduled for October 15th. The agenda includes approving a rights issue of over 78.9 million shares to existing shareholders, aiming to raise the company’s capital to more than VND 4,551 billion.

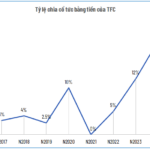

TFC Announces Record-Breaking Cash Dividend Payout

Trang Joint Stock Company (HNX: TFC) has announced a record-breaking cash dividend payout for 2024, marking the highest in the company’s history. Shareholders will receive a 20% cash dividend, equivalent to 2,000 VND per share. The ex-dividend date is set for September 30th.