The primary driving force behind Vietnam’s infrastructure sector stems from the escalating pressure to disburse public investment capital as 2025 enters its final quarter. According to Prime Minister’s Directive No. 169/CĐ-TTg, based on the Ministry of Finance’s report, public investment capital disbursement by the end of August 2025 reached

46.3%

of the annual plan.

This implies that in the last four months of the year, the entire system must disburse a colossal amount of capital, exceeding

450 trillion VND

(approximately 53.7% of the plan), to achieve the government’s 100% target.

This is an immensely challenging task, requiring the decisive involvement of ministries, sectors, and localities, creating a “final sprint” across major construction sites. This pressure is expected to translate into substantial workloads and cash flows for construction companies in the coming months.

Momentum from Mega Projects

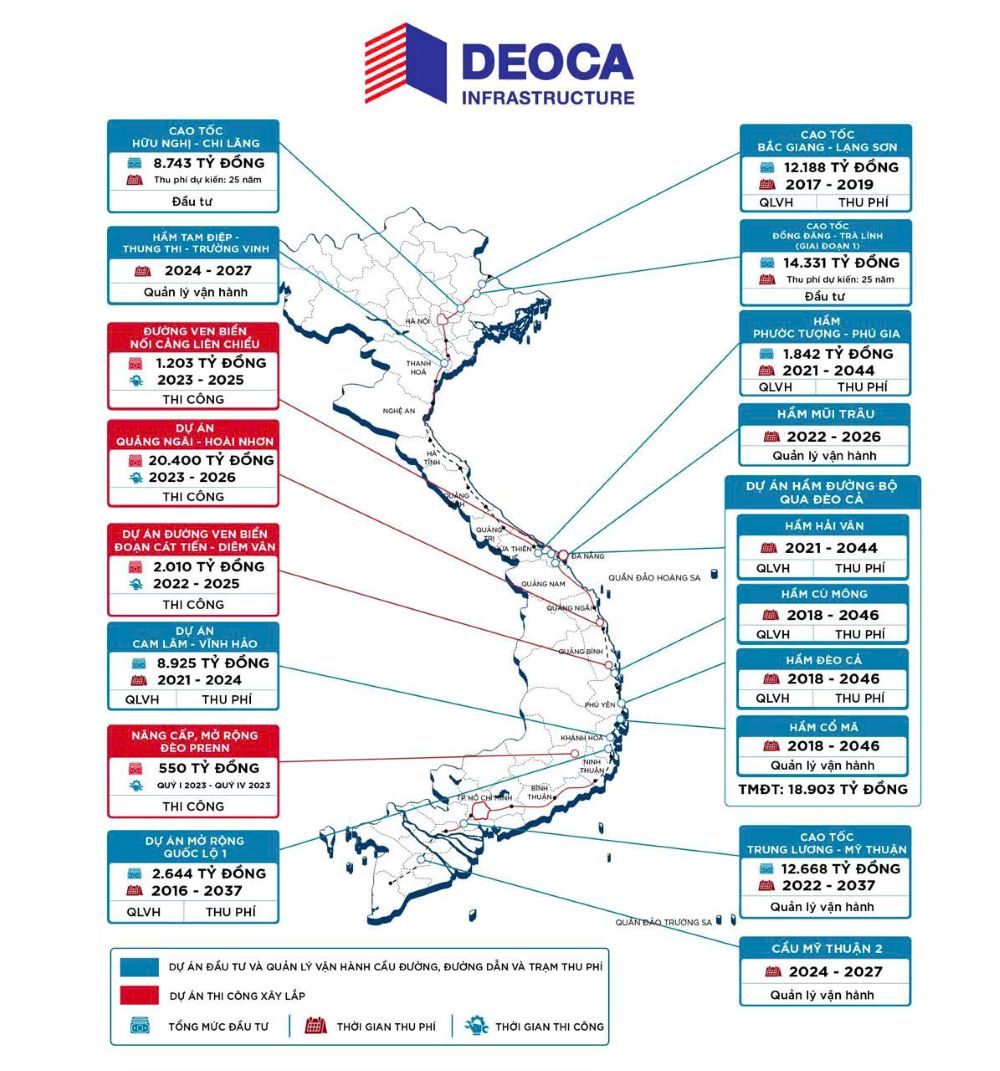

Deo Ca Group’s current construction focus is on two key northern expressway projects:

Huu Nghi – Chi Lang

(total investment over 11 trillion VND) and

Dong Dang – Tra Linh

(total investment nearly 23 trillion VND). To accelerate progress, the Group launched a “100-day campaign to open the route,” mobilizing nearly 6,000 personnel and 2,600 pieces of equipment, aiming to open the route by December 19, 2025. Currently, the implementation value of both projects has surpassed 36% of the contract value.

Additionally, Deo Ca is executing several other critical projects, including the Quang Ngai – Hoai Nhon Expressway, Binh Dinh Coastal Road, and the coastal road connecting Lien Chieu Port (Da Nang), fostering expectations of cash flow and profits as the construction segment enters its final stretch.

MBS Research’s report also provides an optimistic forecast for Deo Ca Infrastructure Investment JSC (HHV)’s business results. Specifically, Q3/2025 net profit is projected to grow by

65% year-on-year, reaching 165 billion VND. For the entire year 2025, MBS predicts the company’s net profit could reach

630 billion VND, corresponding to a

48%

increase compared to 2024.

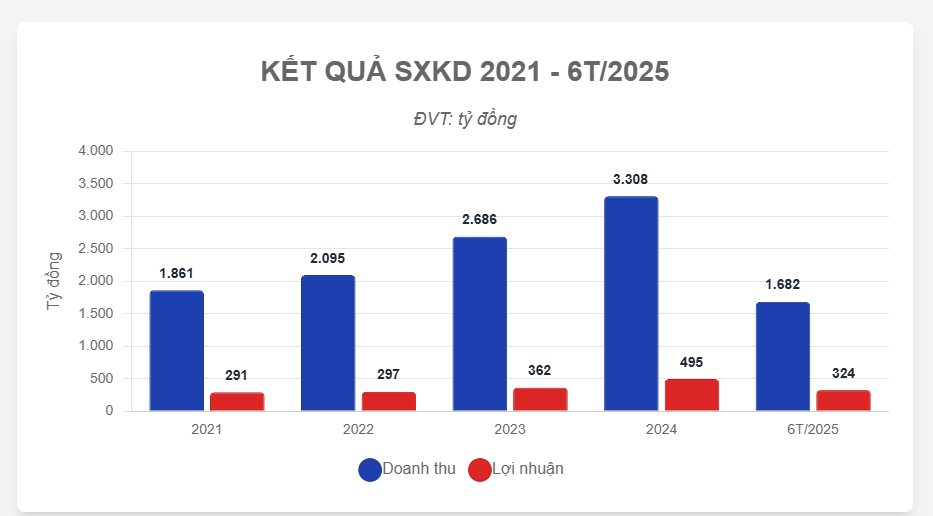

Reflecting on the first half of 2025, HHV recorded stable business results. Consolidated revenue reached over 1,682 billion VND, up 12% year-on-year, and post-tax profit hit 324 billion VND, a robust 33% increase, completing 58% of the annual plan.

The foundation for this growth lies in two core business segments. The BOT toll collection segment, accounting for nearly 58% of 2024 revenue, maintained stable cash flow with total vehicle traffic through toll stations in the first six months increasing by 11.9% year-on-year. The construction segment is the primary growth driver in the current phase, with the remaining contract value (backlog) as of Q2/2025 reaching nearly 2 trillion VND.

Work items HHV is undertaking during the 2016 – 2037 period. Source: Deo Ca Group

With an 80% market share in Vietnam’s tunneling sector and as the sole entity capable of executing special-class tunnel construction, Deo Ca holds a significant advantage. The Group’s future project pipeline is extensive, including the Quy Nhon – Pleiku Expressway, Cat Lai Tunnel, and notably the North-South High-Speed Railway project, with a total research workload of 245 km of tunnels valued at 10 billion USD.

Despite the optimistic outlook, HHV’s business operations face certain challenges. Due to the nature of the infrastructure investment industry, the company’s financial leverage ratio is high, with a Debt-to-Equity ratio of

2.37 times, imposing considerable interest expense pressure. Additionally, land clearance and waste disposal issues at project sites pose real risks that could impact progress.

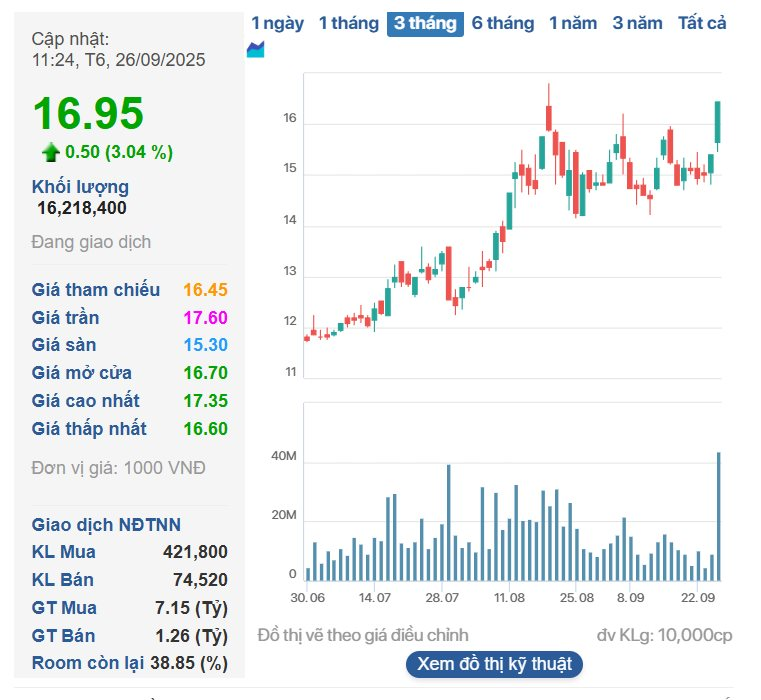

Over the past three months, HHV shares have recorded an impressive rally, surging from around 12,000 VND/share at the end of June 2025, corresponding to a more than 41% increase.

Chinese Conglomerate Eyes Key Vietnamese Projects: Minister of Construction Responds

Minister Trần Hồng Minh expressed confidence in the corporation’s ability to expand its collaboration and investment in Vietnam’s key infrastructure projects.

What Makes the $218 Million Cable-Stayed Bridge in Southern Vietnam Special? Built Entirely by Vietnamese, Praised by the Prime Minister for Its Superior Design, Yet Costing Half as Much as Its Predecessor

The Mỹ Thuận 2 Bridge boasts five key advantages over its predecessor, as meticulously analyzed by the Prime Minister himself.