“We will launch our retail banking services in Indonesia this year, with Vietnam as our next target,” shared CEO Coen Jonker.

Tyme Group is no stranger to the industry. Founded in South Africa in 2019, this digital bank serves 11 million customers in its home country before relocating its headquarters to Singapore in 2022.

Tyme’s first breakthrough in Southeast Asia was the launch of GoTyme Bank in the Philippines that same year. Through a strategic partnership with Gokongwei Group, one of the Philippines’ leading conglomerates, the bank has attracted over 6.5 million customers in less than three years.

Tyme has now achieved “unicorn” status with a valuation exceeding $1 billion, backed by prominent investors such as Brazil’s digital bank Nubank and China’s Tencent Holdings.

Tyme’s standout feature is its ultra-fast customer experience, enabling account opening in just 5 minutes via a mobile app. In the Philippines, customers can easily deposit and withdraw cash at Gokongwei’s network of supermarkets and affiliated outlets.

For Indonesia, Tyme plans to acquire an existing bank. In Vietnam, the company has already established a data processing facility in preparation for its market entry.

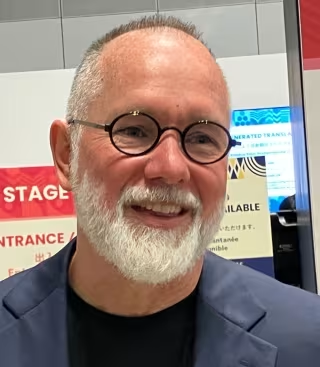

CEO Tyme Group Coen Jonker

|

“With our digital banking expertise from South Africa, we are expanding into the Southeast Asian market,” affirmed Mr. Jonker. Digital banks like Tyme operate on a technology-driven model rather than traditional physical branches, optimizing operational costs through AI and cloud computing.

In the Philippines, the government has supported the digital banking wave by issuing 6 licenses, with plans for 4 more. Deposits at these 6 digital banks grew 30% year-on-year, surpassing 100 billion Pesos ($1.7 billion) by March-end. Although this accounts for only 0.5% of total industry deposits, the impressive growth rate is attracting major players to the market.

Beyond Tyme, tech giants like Indonesia’s GoTo and Singapore’s Grab are also operating digital banks across Southeast Asia, often integrating financial services with platforms like ride-hailing to create ecosystems and attract customers.

Even foreign financial conglomerates, such as Japan’s Aeon Financial Services, have entered the market with a digital bank in Malaysia, adopting an Islamic finance model suited to the predominantly Muslim nation.

According to Temasek Holdings, Google, and Bain & Company, digital lending balances in six major Southeast Asian countries grew from $48 billion in 2022 to $71 billion in 2024, representing 7% of total loans. By 2030, this figure is projected to reach $200–300 billion, or 14% of total loans. Indonesia, Vietnam, and the Philippines—the region’s most populous nations—are the fastest-growing markets.

Southeast Asia’s potential is further highlighted by the gap between smartphone ownership and bank account penetration. In Indonesia, 80% of adults own smartphones, yet only 56% have bank accounts, according to the World Bank.

“ASEAN nations are focusing on digitalization to expand financial access, making this market potentially easier to enter than other developing regions,” noted Aki Fukuchi, an economist at Japan’s Institute for International Monetary Affairs.

However, the competition is fierce, as traditional banks are also accelerating their digital transformation to counter fintech disruptors. Australia’s experience—where only 1 of 4 digital banks licensed in 2019 remains—underscores the challenge of competing with established financial institutions.

“To survive against incumbent banks, a unique value proposition is essential,” concluded Mr. Fukuchi.

– 10:35 29/09/2025

Yamaha PG-1 Rival to Honda Heads Home: Delivers Equal Power with Just 1.58L/100km Fuel Efficiency and Unmatched Water-Wading Capability

Elevate your ride with the Honda’s high-mounted exhaust, engineered for exceptional water-wading capabilities. This innovative design ensures seamless performance, even in challenging terrain, making it the ultimate choice for adventurers seeking reliability and versatility.

From Steel Mill to Vietnam’s Largest Construction & Interior Superstore Giant: How Hoa Sen Group Redefined Differentiation

From a humble steel sheet manufacturer and distributor, Hoa Sen Group has meticulously crafted Vietnam’s premier ecosystem for construction materials and interior solutions. This distinction stems from strategic choices, relentless technological innovation, and an unwavering commitment to social responsibility and sustainable development.

Agribank Honored with Three Outstanding Financial Products and Services in 2025, Solidifying Its Leadership Position

The 3rd Vietnam High-Level Financial Advisor Forum – 2025 has recognized outstanding financial products and services. Among the honorees, the Agricultural and Rural Development Bank of Vietnam (Agribank) stood out, receiving accolades in three distinct categories.