Top 50 Most Efficiently Operating Companies

|

The companies featured in the TOP50 ranking were selected based on their consistent business performance over three consecutive years (2022-2024), measured by three key growth indicators: Revenue, Return on Equity (ROE), and Earnings Per Share (EPS). This evaluation aims to objectively assess the management capabilities and adaptability of businesses, encouraging them to implement effective governance and sustainable development strategies. It also seeks to recognize leaders with long-term vision and innovative thinking.

Throughout the 2022-2024 period, despite facing numerous domestic and international market challenges, PVFCCo viewed these as opportunities to accelerate and breakthrough. In response, the company swiftly implemented a series of flexible solutions, adapting to the ever-changing business environment. As a result, PVFCCo not only maintained impressive sustainable growth but also delivered increasing value to shareholders and stakeholders.

According to the organizers, as of 2024, these companies account for 52.5% of the total market capitalization, equivalent to 155 billion USD. The 2024 revenue of the TOP 50 companies reached 51.7 billion USD, an 11.3% increase year-over-year, contributing nearly 35% of the total revenue of listed companies. After-tax profit stood at 10.7 billion USD, up 18.1%, accounting for over 74% of the market’s total profit. The average ROE for the 2022-2024 period was 15.4%, nearly double the average of listed companies.

The organizers highly commend the notable presence of fertilizer and chemical companies in this year’s Top 50 list, including PVFCCo. This company has demonstrated its ability to effectively seize market opportunities amidst significant fluctuations. According to the organizers’ data, PVFCCo achieved an average revenue growth rate of 1.8% during 2021-2024, while maintaining an ROE growth rate of 18.2%.

The “Top 50 Most Efficiently Operating Companies in Vietnam” (TOP50) is a prestigious annual ranking compiled by the Investment Bridge Magazine in collaboration with economic, business, and financial investment experts. It aims to identify and honor the most efficient companies on the Vietnamese stock market. This marks the 15th year of the ranking’s publication (2010-2025).

| DPM’s Assets During 2022-2024 |

– 09:46 29/09/2025

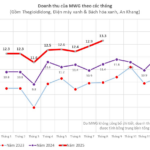

Mobile World Sets New Revenue Peak at 13.3 Trillion VND After Six Consecutive Months of Growth, Witnessing Surprising Developments in Indonesia

EraBlue’s joint venture in Indonesia has seen a remarkable 70% surge in revenue over the past 8 months compared to the same period last year, achieving profitability at the company level.

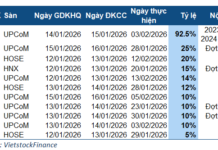

LPBS Set to Boost Capital to Nearly VND 13 Trillion

On September 15th, the Board of Directors of LPBank Securities JSC (LPBS) passed a resolution to offer up to 878 million shares to existing shareholders. This move is expected to increase the company’s chartered capital to VND 12,668 billion, a 3.3-fold increase from its current level. The majority of the proceeds from the offering will be allocated to investments in bonds, deposit certificates, and margin lending.

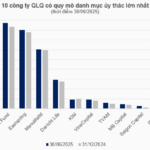

Unraveling the Puzzle: A $26 Billion Investment Trust Landscape in the Fund Management Industry

By the end of Q2 2025, Vietnam’s asset management industry boasted a combined discretionary portfolio value exceeding 614 trillion VND, marking a nearly 5% increase from the year’s start. This growth fueled a surge in management fee revenue. Notably, three firms stood out with colossal portfolios, each managing hundreds of trillions of VND, heavily invested in bonds. Their success is attributed to the robust support from their insurance ecosystem.