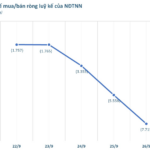

The VN-Index experienced a volatile trading week from September 22 to September 26, marked by significant fluctuations. Positively, the benchmark index rebounded to the 1,660-point level, reflecting a modest 2-point increase from the previous week’s close. Foreign investors continued their strong net selling pressure, offloading thousands of billions of dong. Over five sessions, net outflows totaled VND 7,715 billion.

Experts largely view this period as a phase to absorb excess supply and establish entry points for new capital inflows.

3 Sectors Poised to Attract Strong Year-End Capital Inflows

Nguyễn Trọng Đình Tâm – Deputy Director of Analysis, ASEAN Securities Corporation

According to Tâm, the VN-Index has primarily traded sideways within the 1,600–1,700 range over the past month. This sideways movement coincides with shrinking liquidity, while the upward momentum in several sectors (banking, securities, etc.) has temporarily stalled.

This cautious market behavior is attributed to: (1) increased profit-taking after four months of robust gains, (2) foreign investors’ net selling pressure impacting large-cap stocks in the short term, and (3) anticipation of market upgrade news. FTSE Russell is scheduled to announce its market classification decision on October 8 (Vietnam time).

Despite short-term sideways movement, Tâm characterizes this as a normal technical phase, especially given the absence of significant corrections following the explosive rally. The current period will help absorb supply pressure and create entry points for fresh capital.

Regarding persistent foreign outflows, Tâm identifies two primary causes:

First, profit-taking following the market’s strong rally. Unlike individual investors, foreign capital—dominated by institutional and fund investors with substantial assets—tends to distribute sales over multiple sessions.

Second, cross-market asset reallocation. Large-scale investors like foreign funds diversify portfolios to optimize returns and mitigate risks. This trend is amplified by recent rallies in gold and cryptocurrency prices.

However, Tâm forecasts that foreign selling pressure will ease if Vietnam secures an upgrade to secondary emerging market status under FTSE Russell’s classification. This would attract inflows from emerging market funds.

“Even if foreign outflows persist, domestic investors (accounting for over 70% of trading volume) and new capital driven by low interest rates will balance market pressures,” he notes.

Vietnam has fulfilled FTSE Russell’s requirements for an upgrade from frontier to secondary emerging market status. Key milestones include Circular 68/2024/TT-BTC, which addresses non-prefunding mechanisms for foreign investors, and Decree 245/2025/NĐ-CP and Circular 25/2025/TT-NHNN, which streamline administrative procedures to attract foreign capital.

The upgrade decision hinges on foreign investor feedback regarding Vietnam’s new trading mechanisms. While upgrade probabilities are high, a delay in October could trigger cautious trading in securities stocks and heightened VN-Index volatility.

However, any such impact would be short-lived, given supportive factors: (1) accommodative macro policies (expansionary fiscal and monetary measures), (2) IPO waves, and (3) digital asset narratives.

For Q3/2025 earnings, Tâm highlights the following sectors with positive growth prospects:

The securities sector is expected to report profit surges, driven by (i) record liquidity and (ii) strong performance in proprietary trading portfolios. Listed securities firms’ net profits are projected to grow 50–60% year-on-year.

Residential real estate net profits are estimated to rise 25–30% year-on-year, fueled by robust project handovers and improved financials due to early bond redemptions and declining lending rates since 2024.

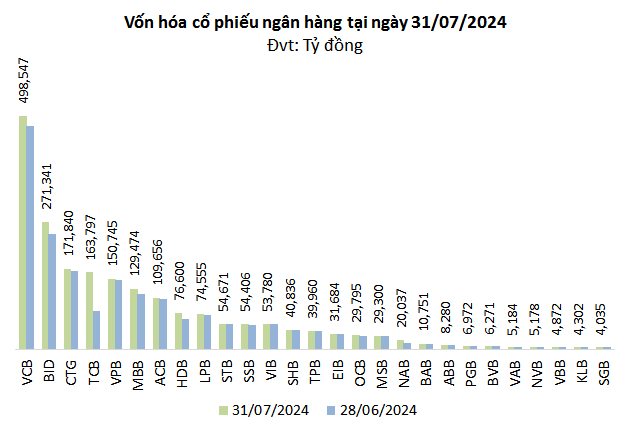

Banks, the largest profit contributors, are forecast to achieve 15–20% LNTT growth, supported by (1) sustained credit expansion, (2) declining NPL ratios aided by Resolution 42, and (3) narrowing CIRs amid digital transformation.

VN-Index Trajectory Remains Uncertain

Nguyễn Thái Học – Securities Analyst, Pinetree

Học notes that Vietnam’s stock market ended the week with a “green exterior, red interior” dynamic. VIC and VHM contributed over 14 points to the VN-Index, yet the index gained only 3 points. Early-week declines gave way to a Doji candle on Tuesday, signaling indecision. Wednesday’s Marubozu candle indicated buying dominance.

Subsequent sessions saw accumulation around MA10 and MA20. However, market direction remains uncertain due to low liquidity and investor hesitation. New participants are wary of current price levels, while existing holders are reluctant to sell.

Real estate and public investment rebounded, but lacked sufficient capitalization to drive the index. Banking stocks, reacting to MA50 support, remain the primary VN-Index drivers.

Next week, VN-Index direction remains uncertain amid market stalemate, weak liquidity, and fragmented capital flows. Banks, after 10 low-liquidity sessions, are likely to signal a clear trend, guiding the index.

Học predicts a potential retreat to 1,600 points to attract sidelined investors, though deep declines are unlikely. “I favor a positive scenario: banks forming short-term bottoms, supporting the index and enabling challenges to previous highs,” he concludes.

Vietstock Weekly (Sept 29 – Oct 3, 2025): Liquidity Lacks Momentum – Can the Market Break Through?

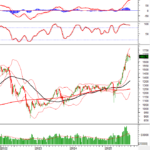

The VN-Index edged higher following a volatile week of trading. While the MACD indicator has maintained a buy signal since May 2025, its divergence from the Signal Line is narrowing. Meanwhile, the Stochastic Oscillator continues to weaken after a sell signal in overbought territory, suggesting short-term volatility remains a risk. Additionally, declining trading volumes in recent weeks indicate a lack of momentum, making a clear breakout unlikely unless liquidity improves soon.

Foreign Investors Aggressively Offload Over 1 Trillion VND in Blue-Chip Stock During September 22-26 Week

Foreign investors continued their intense net selling pressure, offloading thousands of billions of dong worth of shares each session, with a particular focus on blue-chip stocks.

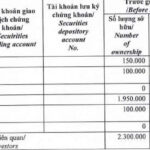

Bustling Businesses Distribute Dividends

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.