When FOMO Overshadows Reason

During numerous land fever episodes, from Bac Ninh and Hoa Lac to Phu Quoc, it’s common to see crowds rushing to view properties and place deposits within hours. This reflects the FOMO (Fear of Missing Out) mindset, where investors fear losing profitable opportunities if they don’t act quickly.

Many investors admit they commit funds not due to thorough research on planning or legalities but because “everyone else is buying, and I don’t want to miss out.”

One of the most glaring manifestations of FOMO in real estate is the tendency to chase rumors. Merely mentioning a new highway, airport, or industrial zone can cause land prices to skyrocket, even if the infrastructure is only a proposal on paper.

Consequently, many investors succumb to herd mentality, making buying decisions based on others’ actions rather than a thorough analysis of the property’s intrinsic value. Numerous cases involve hasty transactions, with deposits made within hours, bypassing legal checks or planning reviews.

Additionally, FOMO often comes with unrealistic profit expectations. Many believe land prices can double or triple in a short period, despite real estate being a long-term investment requiring vision and patience.

Risks of the FOMO Frenzy

In reality, many buyers purchase at peak prices. When the market cools and liquidity stalls, they’re left with hard-to-sell assets, often incurring significant losses if they need to liquidate quickly.

Moreover, FOMO leads many investors into fraudulent projects, land with planning restrictions, or excessive financial strain due to bank leverage.

To mitigate FOMO-related risks, investors must remain rational and establish clear principles before committing funds. Primarily, investments should be based on intrinsic value—thoroughly analyzing infrastructure, actual demand, and rental potential rather than relying on rumors.

Simultaneously, legal due diligence is mandatory. Only projects with transparent documentation and official transaction approval should be considered.

Another critical factor is cash flow management. Avoid excessive borrowing beyond repayment capacity, especially in volatile markets, to prevent being caught at the peak.

Finally, investors should adopt a long-term mindset, viewing real estate as a sustainable wealth-building channel rather than pursuing short-term speculative gains.

HVH Plans to Invest Additional VND 140 Billion in Euro Villas Project Developer in Phú Thọ

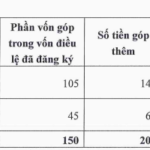

On September 26th, the Board of Directors of HVC Investment and Technology Joint Stock Company (HOSE: HVH) approved adjustments to the capital contribution in its subsidiary, HVC and Ho Guom Hoa Binh Investment Limited Liability Company (HVC Hoa Binh).

Billion-Dollar Contractor with Prime Hanoi Real Estate Up for Sale by SCIC Despite Poor Business Performance

After numerous unsuccessful attempts, the State Capital Investment Corporation (SCIC) is once again initiating plans to fully divest its capital from Viettronics Corporation (VEC), a leading Vietnamese electronics and informatics company listed under the stock code VEC.

Emerging Real Estate Hotspots: Hà Nam, Hưng Yên, Vĩnh Phúc Attract Major Players Like Sun Group, Phú Mỹ Hưng, Bim Group in a Wave of Investment

Amidst Hanoi’s constrained land availability and escalating property prices, neighboring provinces such as Hà Nam, Hưng Yên, and Vĩnh Phúc have emerged as vibrant real estate markets. These satellite regions are witnessing a surge in housing supply, robust buyer demand, and competitive pricing, positioning them as attractive alternatives for both investors and homebuyers.