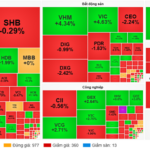

The Vietnamese stock market concluded the first trading session of the week with a mixed performance, characterized by a “green exterior, red interior” dynamic. By the close of the September 29th session, the VN-Index rose by nearly 6 points to reach 1,666.48, driven by the supportive efforts of Vingroup-affiliated stocks and select banking shares.

However, the broader market sentiment leaned towards decline, with 233 stocks on the HoSE exchange ending in the red, significantly outpacing the 86 gainers. Trading liquidity remained at moderate levels, with matched order values on HoSE totaling approximately VND 23,380 billion.

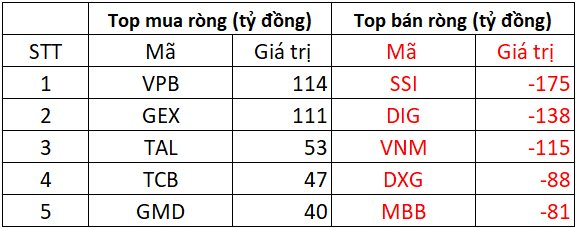

Amid this backdrop, foreign investors extended their net selling streak, offloading over VND 807 billion across the market. Specifically:

On HoSE, foreign investors net sold approximately VND 749 billion

On the buying side, VPB and GEX led the market with net purchases of VND 114 billion and VND 111 billion, respectively. TAL, TCB, and GMD followed suit, with net buying values ranging from VND 40 billion to VND 53 billion.

Conversely, SSI witnessed the most significant foreign divestment, with net sales of roughly VND 175 billion. DIG and VNM also faced substantial foreign selling pressure, each recording over VND 100 billion in net outflows. Additionally, DXG and MBB saw net selling of approximately VND 81-88 billion.

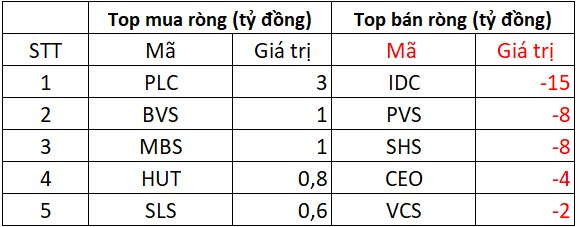

On HNX, foreign investors net sold nearly VND 36 billion

In terms of purchases, PLC attracted VND 3 billion in net inflows, while BVS, MBS, HUT, and SLS received net investments ranging from a few hundred million to VND 1 billion.

On the selling side, IDC led with VND 15 billion in net outflows. PVS and SHS followed, each with VND 8 billion in net selling. Foreign investors also offloaded a few billion dong from VCS and CEO.

On UPCOM, foreign investors net sold VND 23 billion

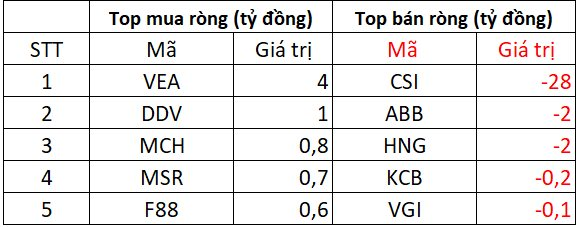

On the buying side, VEA and DDV saw net purchases of VND 1-4 billion, while MCH, MSR, and F88 attracted a few hundred million dong each.

Conversely, CSI faced the most significant selling pressure with VND 28 billion in net outflows. ABB and HNG each recorded VND 2 billion in net selling, while KCB and VGI experienced minor outflows of a few hundred million dong.

Market Pulse 29/09: VIC and VHM Lead the Index, Foreign Investors Offload SSI

The robust support from VIC and VHM propelled the index into positive territory, despite the broader market leaning towards selling pressure. At the mid-session break, the VN-Index climbed over 8 points (+0.49%), reaching 1,668.76 points, while the HNX-Index rose by 0.17%, settling at 276.54 points. Market breadth showed 373 gainers, 250 decliners, and 977 unchanged stocks.

Expert Insights: Seizing the Opportunity to Accumulate 3 High-Potential Stock Groups Poised for Strong Capital Inflows

Next week, Pinetree experts forecast that without new factors boosting demand, the VN-Index could potentially retreat to around 1,600 points.