Market liquidity is showing signs of improvement compared to the previous session. The trading value of HOSE this morning reached over 12 trillion VND, a 17.36% increase, but still remains relatively low compared to the one-month average. However, trading on HNX recorded a 21.33% decrease from the previous session, with only over 34 million units traded, equivalent to nearly 756 billion VND.

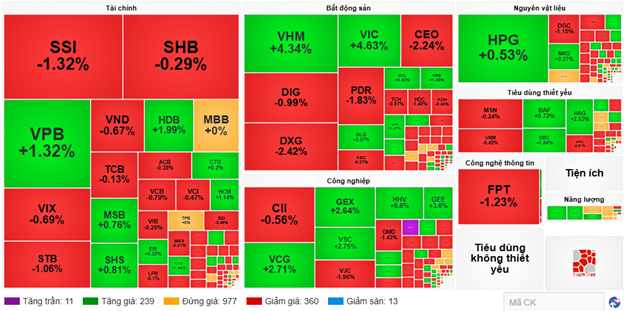

Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing over 7 points to the index’s rise. VHM also added a total of 4.23 points. Conversely, VCB had the most negative impact this morning, subtracting nearly 1 point from the index.

| Top 10 stocks impacting VN-Index in the morning session of 29/09/2025 (calculated in points) |

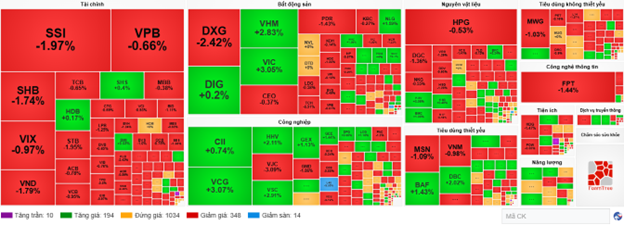

Divergent trends continued to dominate, with most sectors fluctuating within a narrow range. The real estate sector led the market with a significant 2.8% increase, driven by positive contributions from VIC (+4.63%), VHM (+4.34%), VRE (+1.36%), KSF (+6.76%), and NLG (+2.07%).

Additionally, the industrial sector saw active trading, with strong buying pressure on stocks like VCG (+2.71%), GEX (+2.64%), VSC (+2.75%), GEE (+3.6%), and CDC reaching their upper limits. However, several stocks experienced notable adjustments, including ACV (-1.54%), VJC (-1.96%), GMD (-1.43%), VGC (-2.17%), VTP (-1.1%), and BMP (-1.32%).

On the downside, the information technology sector had the most negative performance this morning, with leading stocks like FPT down 1.23% and ELC down 2.17%.

Source: VietstockFinance

|

Foreign investors continued to net sell, with a value of over 647.12 billion VND across all three exchanges. Selling pressure was concentrated on SSI, with a value of 156.1 billion VND. Meanwhile, VPB and GEX led the net buying list with values of 82.69 billion VND and 67.62 billion VND, respectively.

| Enter Title |

10:35: Financial sector underperforms, VN-Index struggles at 1,660 points

Tug-of-war dynamics persisted, with selling pressure gradually gaining the upper hand, pushing major indices into negative territory. As of 10:30, the VN-Index was down 3.17 points, trading around 1,657 points. The HNX-Index also declined slightly, trading around 275 points.

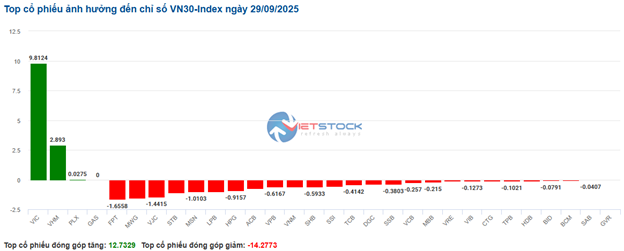

Stocks in the VN30 basket were predominantly in the red, with only a few maintaining positive momentum. Specifically, FPT, MWG, VJC, and STB subtracted 1.65 points, 1.57 points, 1.44 points, and 1.12 points, respectively, from the index. In contrast, only VIC, VHM, and PLX maintained strong buying support, contributing over 12.7 points to the VN30-Index.

Source: VietstockFinance

|

The financial and information technology sectors faced heavy selling pressure, with major players like VCB down 0.95%, BID down 0.99%, TCB down 0.65%, CTG down 0.39%, FPT down 1.54%, and ELC down 1.09%.

Conversely, the real estate sector showed strong upward momentum, supporting the overall market’s rise, primarily driven by VIC (+3.6%) and VHM (+2.73%).

Compared to the opening session, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks remaining unchanged. Sellers gained the upper hand, with 346 stocks declining (14 hitting the lower limit) versus 194 advancing (10 hitting the upper limit). The financial sector remained the focal point, with nearly all stocks in the red.

Source: VietstockFinance

|

Opening: Strong divergence in financial and real estate sectors

At the start of the 29/09 session, as of 9:30, the market showed strong divergence with over 1,200 stocks referenced. The VN-Index and HNX-Index fluctuated around their reference points at 1,659 and 276, respectively. However, the breadth remained positive, with over 210 stocks advancing.

Sector performance was mixed. On the positive side, the energy sector saw several leading stocks rise from the opening, including BSR (+0.73%), PLX (+0.43%), PVD (+1.1%), and PVS (+0.59%).

Major stocks in the financial and real estate sectors, such as VCB, TCB, VRE, and BID, weighed on the market, collectively pulling it down by over 1.3 points. Conversely, VIC, CTG, and VPB led the upward trend, contributing over 1.8 points.

– 12:00 29/09/2025

Bank Stock Plunges as Brokerage Firms Unload Massive 300 Billion VND in Final Trading Session of the Week

Proprietary trading firms extended their net selling streak on the Ho Chi Minh Stock Exchange (HoSE), offloading a total of VND 446 billion worth of shares.

Vietstock Weekly (Sept 29 – Oct 3, 2025): Liquidity Lacks Momentum – Can the Market Break Through?

The VN-Index edged higher following a volatile week of trading. While the MACD indicator has maintained a buy signal since May 2025, its divergence from the Signal Line is narrowing. Meanwhile, the Stochastic Oscillator continues to weaken after a sell signal in overbought territory, suggesting short-term volatility remains a risk. Additionally, declining trading volumes in recent weeks indicate a lack of momentum, making a clear breakout unlikely unless liquidity improves soon.

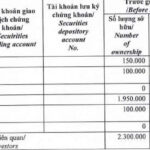

Dragon Capital Emerges as Major Shareholder in Taseco Land

Dragon Capital, through its member funds, has acquired 20.58 million TAL shares, elevating its ownership stake to 6.3555% and establishing itself as a major shareholder in Taseco Land.