Sunshine Group Joint Stock Company (HNX: KSF) has announced the results of its share issuance to publicly acquire all shares of Sunshine Homes Joint Stock Company (SSH). This transaction marks the official consolidation of Sunshine Homes into Sunshine Group.

Sunshine Group is a diversified conglomerate operating in real estate, finance, technology, and construction. Sunshine Homes, a subsidiary, specializes in real estate development, serving as the investor behind major projects in Hanoi, including Sunshine City within the Ciputra urban area, and luxury residential developments in Tay Ho and Long Bien districts.

Approved by the State Securities Commission, the exchange ratio is set at 1 SSH share for 1.6 newly issued KSF shares. The issuance concluded on September 17, with over 599.8 million KSF shares allocated to shareholders, achieving 99.96% of the planned target.

Following the merger, Sunshine Group’s chartered capital increased from VND 3,000 billion to VND 8,997 billion.

With a share price of VND 85,800 (as of September 26), the company’s market capitalization exceeds VND 77,000 billion, positioning it as the second-largest real estate enterprise in the market, trailing only Vinhomes (VHM).

As of September 17, the company has 434 shareholders, including 426 domestic and 8 foreign investors. The sole major shareholder is Mr. Do Anh Tuan, Chairman of the Board, holding over 552.7 million shares, equivalent to 61.43% of the chartered capital.

Post-issuance, Mr. Tuan’s assets saw a significant increase. Owning over 552.7 million KSF shares, 19.5 million SCG shares, and nearly 18 million KLB shares, his total listed assets amount to approximately VND 48,270 billion (around USD 1.85 billion), a VND 9,000 billion rise since the merger. This places him third among Vietnam’s wealthiest individuals on the stock market.

Born in 1975, Mr. Tuan holds a degree in technology from the University of Natural Sciences (Vietnam National University, Hanoi). Prior to entering business, he served in a government role as Head of the Information Technology Department at the Central Emulation and Reward Board.

In 2021, he briefly held the position of Deputy General Director at KienlongBank (KLB).

Mr. Tuan is the founder and current Chairman of Sunshine Group, also holding leadership roles in affiliated entities within the Sunshine ecosystem, such as SCG and KSFinance.

For 2025, Sunshine Group targets revenue of VND 50,000–60,000 billion, a 20-fold increase from 2024, with pre-tax profits estimated at VND 8,000–12,000 billion.

Justifying this ambitious goal, Mr. Tuan noted that the company plans to deliver thousands of low-rise and high-rise units across projects like Noble Palace Long Bien, Noble Palace Tay Ho (Golf Mansion and Boutique Mansion zones), Noble Palace Tay Thang Long, and Sunshine Sky City, totaling approximately VND 100,000 billion. This forms a key basis for achieving the VND 60,000 billion revenue target.

“Sunshine Group has navigated through challenging phases in the real estate market and the pandemic. Therefore, this year and next will be our time to reap the rewards,” Mr. Tuan stated.

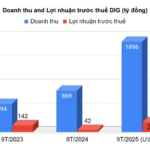

DIC Corp (DIG) Reports 5x Profit Surge in 9 Months, Yet Only 29% of Target Met, Teasing a Deal Yielding VND 748 Billion in Gross Profit

At the Analyst Meeting held on the afternoon of September 26th, the leadership of DIC Corporation (DIC Corp, HoSE: DIG) unveiled remarkable estimated business results for the first nine months of 2025, showcasing explosive growth. They also outlined the foundations for confidently achieving the full-year plan, despite having only completed just over a quarter of the profit journey.

Prime Metro Station Locations of the Upcoming $1.6 Billion Line: Sunshine Riverside, Starlake, and Numerous Benefiting Projects

Hanoi is set to commence construction on the Nam Thang Long – Tran Hung Dao section of Metro Line 2, with the groundbreaking ceremony scheduled for the upcoming October 10th anniversary.

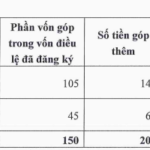

HVH Plans to Invest Additional VND 140 Billion in Euro Villas Project Developer in Phú Thọ

On September 26th, the Board of Directors of HVC Investment and Technology Joint Stock Company (HOSE: HVH) approved adjustments to the capital contribution in its subsidiary, HVC and Ho Guom Hoa Binh Investment Limited Liability Company (HVC Hoa Binh).