After a decade, platinum is entering a phase of aggressive net buying amid a backdrop of rising prices compared to gold, reaching new record highs.

Cailian Press reports that compared to gold’s stellar performance in recent years, platinum’s former “value bottom” is attracting significant capital inflows. Driven by expectations of reduced supply, jewelers are positioning platinum as a “fixed substitute” for gold, and with a substantial increase in mid- to long-term hydrogen energy demand, the industry maintains a relatively optimistic outlook for platinum prices in the long term.

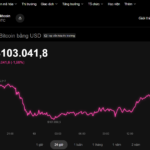

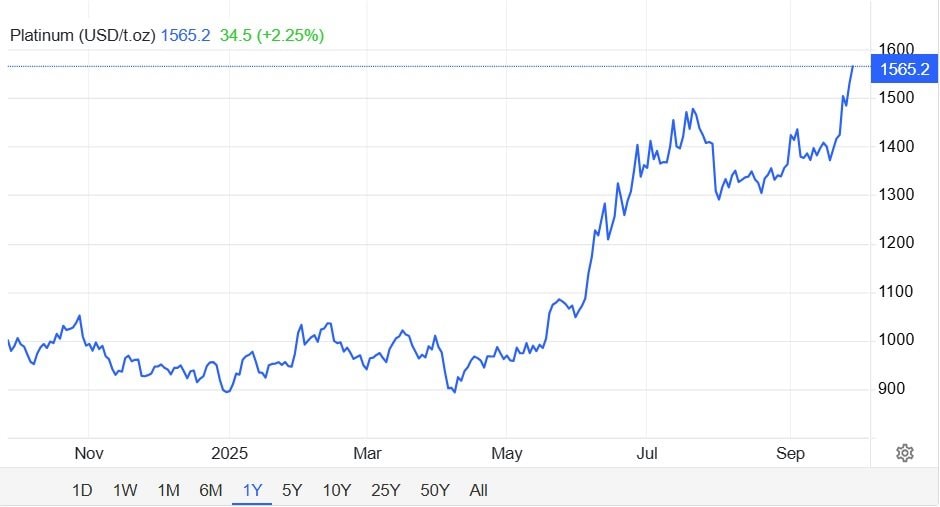

Since June, platinum prices have entered an upward trajectory. According to Trading Economics data, platinum traded at $1,588 per ounce on September 28, 2025, marking a 77% increase year-to-date. This surge far outpaces the performance of gold (42.57%) and silver (56.16%), the most closely watched precious metals in recent times.

“This can be seen as a catch-up rally,” notes Xu Yongqi, a senior analyst for metals and new materials at Hua’an Securities. Compared to the robust price trends of gold and silver in recent years, platinum has, to some extent, formed a “value bottom,” attracting investment capital.

Platinum prices surge since June 2025.

Zhu Zhigang, director of the Platinum Committee at the Guangdong Gold Association (China), states that the sharp rise in platinum prices over a short period reflects speculative sentiment. Meanwhile, with gold prices soaring, some jewelry market traders are deliberately ramping up efforts to promote platinum as a gold alternative.

The CEO of a major jewelry company in China reveals that since the second half of 2024, the company has actively boosted platinum product sales, as platinum offers higher gross profit margins compared to gold products.

Fundamentally, the continuous decline in inventories is a critical support for platinum’s price rally. Data from the World Platinum Investment Council (WPIC) indicates that global platinum reserves are expected to drop to 67 million tons in 2025, sufficient to meet only three months of market demand. In Q1 2025, total global platinum supply fell 10% year-on-year to 45 million tons, while demand rose 10% year-on-year to 71 million tons.

In terms of platinum demand structure, automotive catalysts account for 40%, jewelry for 25%, other industrial applications for 20%, and investment demand for 9%.

Will the long-term upward trend continue?

Zhu Zhigang suggests that the futures market still has room for price increases.

An industry source reveals that many jewelry businesses are actively ramping up platinum product marketing. Once the market reaches a buying consensus amid rising prices, low inventories will struggle to meet short-term demand, potentially further fueling platinum price increases.

Xu Yongqi observes that fundamentally, platinum is in a tight supply and strong demand phase. Global capital expenditure in mining has declined in recent years, reducing output.

In the medium to long term, global hydrogen-related platinum demand is expected to grow significantly. Compared to gold or other precious metals, platinum’s current price increase is not high. After a decade of stagnation, platinum prices are likely to rise over the next three to five years, with potential to reach $2,000 per ounce.

An industry expert notes that there remains a gap between some core hydrogen fuel cell technologies in China and those of leading nations like Japan.

Platinum-carbon catalysts in hydrogen fuel cells play a crucial role in catalyzing the discharge process, with platinum accounting for about half of catalyst costs. As China’s hydrogen energy sector develops, platinum demand is expected to increase significantly in the long term.

WPIC forecasts that total platinum supply in 2025 will be the lowest in five years, with an expected deficit of 30 million tons, marking the third consecutive year of shortfall. By 2030, global platinum demand from hydrogen energy applications is projected to rise from 1% to 11%.

Central Land Green is No Longer a Subsidiary of Regal Group

Over time, many customers and investors have mistakenly believed that Dat Xanh Mien Trung remains a subsidiary within the Regal Group ecosystem. This confusion stems from historical brand associations, but in reality, the two companies are now entirely independent, pursuing distinct and separate development strategies.

Unveiling new horizons for the energy sector in Vietnam

On February 22, in Hanoi, the Ministry of Industry and Trade held a conference (both offline and online with localities) to implement Vietnam’s Hydrogen Energy Development Strategy until 2030, with a vision towards 2050 (Hydrogen Energy Strategy), which was approved by the Prime Minister in Decision No. 165/QD-TTg on February 7, 2024.