Stock Race to Raise Targets

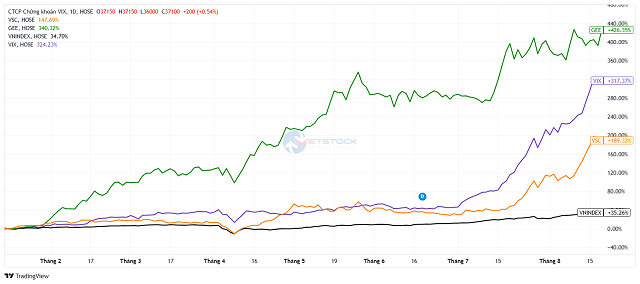

Thanks to the first half results far exceeding expectations, VIX Securities (HOSE: VIX) will soon submit to an extraordinary shareholders’ meeting the plan to raise the 2025 pre-tax profit target to VND 5 trillion and post-tax profit to VND 4 trillion, 3.3 times the old plan. In the first six months, VIX achieved more than VND 2 trillion and VND 1.67 trillion respectively, exceeding nearly 40% of the previous target and nearly six times the same period in 2024. The proprietary trading segment increased by 482%, becoming the main driver, helping VIX complete 40% of the new journey.

| VIX’s profit expectations surge multiple times compared to the old plan |

VPBank Securities (VPBankS) also took advantage of positive results to increase the 2025 pre-tax profit target by 122% to nearly VND 4.5 trillion; while raising total revenue by 58% to nearly VND 7.2 trillion. The bond underwriting and advisory segment is expected to become a new growth driver. In the first half, VPBankS recorded a pre-tax profit of nearly VND 900 billion, up 80% year-on-year but only reaching 20% of the new plan, showing the company places high expectations on the second half.

Although not changing the plan, at the recent extraordinary shareholders’ meeting, the leadership of SSI Securities (HOSE: SSI) said that the nine-month results had achieved more than 90% of the annual target. The enterprise expects to exceed at least 15% by the end of 2025 and even reach over 20% if the market maintains its favorable momentum.

On the contrary, Yuanta Vietnam Securities remains cautious despite the vibrant market. The company reduced the margin lending debt by 9% and total revenue for 2025 by 4% compared to the old plan. After six months, Yuanta Vietnam recorded nearly VND 305 billion in revenue, down 6% year-on-year and achieved more than 38% of the new plan; net profit was more than VND 51 billion, down 28%. The original plan was already 36% higher than in 2024, so if completed, it would still be a record level.

Expected Profit Surge from Divestment

Besides securities companies, many other enterprises have also significantly increased their plans, mainly due to sudden income from divestment.

At the upcoming extraordinary shareholders’ meeting, Vietnam Container (Viconship, HOSE: VSC) will submit to shareholders the plan to raise the pre-tax profit target to VND 1.25 trillion, more than three times the initial figure, thanks to the expected VND 700 billion from the transfer of 20% stake in VIP Port (UPCoM: VGR). In the first half, VSC‘s business activities were also positive, with revenue reaching nearly VND 1.5 trillion, up 14%; net profit was VND 197 billion, up 75%.

| VSC’s new profit plan skyrockets |

Another unit benefiting from financial activities is Gelex Electric (HOSE: GEE). GEE‘s shareholders have just agreed to double the pre-tax profit target for this year to VND 3.5 trillion, due to the expected VND 1.1 trillion from the divestment of Gelex Infrastructure Corporation to focus on the industrial equipment segment.

Along with raising the plan, GEE also increased the cash dividend from 30% to 40% of the charter capital and added a 20% stock dividend plan. The biggest beneficiary is GELEX Group (HOSE: GEX), holding 78.7% of the capital.

| A similar story with GEE |

In the case of Hoang Anh Gia Lai (HAGL, HOSE: HAG), Mr. Duc said that the first-half results had achieved more than 60% of the post-tax profit (VND 1.1 trillion), although there was no contribution from durian. The company plans to raise the profit target to VND 1.5 trillion, and could even reach VND 2.5 trillion if the extraordinary income of over VND 1 trillion in the third quarter is recorded.

Optimism from Public Investment

The accelerated public investment in recent times is creating a boost for many construction companies, not only improving profits but also adjusting plans and dividend policies.

Lam Dong Minerals and Construction Materials (HOSE: LBM) is a typical example. The company raised the pre-tax profit target by 91% to VND 172 billion, while doubling the cash dividend. In the first six months, revenue reached nearly VND 615 billion and pre-tax profit was VND 95 billion, up 47% and 58% year-on-year, achieving 54-55% of the new plan. LBM said that the concrete segment is favorable thanks to consecutive wins in construction projects and highway expansions.

| LBM’s profit forecast is optimistic as public investment surges |

Binh Duong Construction and Transportation (Becamex BCE, HOSE: BCE) also raised its plan after the second-quarter results turned positive. The parent company’s pre-tax profit target was raised to more than VND 137 billion, up 125% compared to the old plan. However, the six-month performance was very modest compared to the new expectations.

When Caution Takes the Lead

Not all enterprises are aggressively raising targets. Some are making more cautious adjustments as the business context is no longer as favorable as initially expected.

Thang Long Corporation (HNX: TTL) reduced the revenue plan by 5% to VND 1.7 trillion, although the first-half profit was more than VND 20 billion—the highest in nine years and exceeding 68% of the annual target. TTL‘s leadership said the company prioritizes effective bids rather than pursuing growth at all costs, considering the plan reduction a necessary step in the context of 2025’s forecasted challenges.

The leadership of FPT (HOSE: FPT) also signaled caution by updating the new scenario for 2025: revenue growth of about 15% and profit growth of 18-19%, lower than the targets set at the shareholders’ meeting (20% revenue growth and 21% profit growth).

Meanwhile, Dong Nai Water Supply (Dowaco, UPCoM: DNW) adjusted its plan downward due to exchange rate losses from foreign currency loans. This year’s revenue decreased by 2% to VND 1.16 trillion; while post-tax profit (including exchange rate differences) decreased by 8% to VND 248 billion. In the first half, Dowaco recorded nearly VND 656 billion in revenue, up slightly by 1%, but profit decreased by 40% to more than VND 122 billion—the lowest in six years.

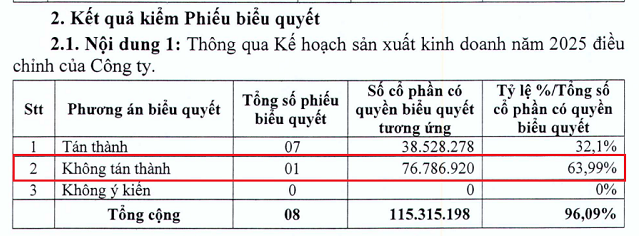

Compared to the adjusted plan, the company achieved about 56% of revenue and 40% of profit, but the proposal was not approved by major shareholders.

Dowaco wanted to adjust the plan but was unsuccessful. Source: Dowaco

|

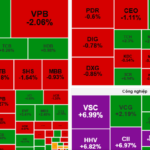

Strong Stock Price Reactions

In the market, many stocks continuously hit new highs before companies announced target increases. VIX stock surged to nearly VND 40,000 per share, the highest ever, more than three times the early July level. Similarly, SSI also increased by 90%.

VSC became the focus, rising 144% in just over a month to nearly VND 40,000 per share before the business plan adjustment announcement; with average liquidity per session reaching about 25 million shares, many times higher than earlier in the year. From June to now, VSC‘s market price has increased by a total of 250%.

| VIX stock impresses from early July |

Meanwhile, BCE, after months of hovering around VND 10,000 per share, suddenly surged by more than 20% just before the new plan announcement, doubling the increase from the beginning of the year. GEE rose 42% in one month to over VND 130,000 per share. Since April, this stock has increased by 170%, the highest since its listing in 2022. LBM also set a new peak with an increase of more than 30% in the second half of July to mid-August.

On the contrary, FPT decreased by more than 10% during the target reduction announcement, raising the total decrease from the beginning of the year to over 20%.

Since the beginning of the year, the prices of the above stocks have all doubled, compared to just a few dozen percent of the VN-Index

|

– 08:17 29/09/2025

Vietnam’s Youngest Centrally Governed City Sets New Growth Record, Exports Hit Billion-Dollar Milestone in Less Than a Year

Over the first nine months, the GRDP is estimated to surge by 9.7% to 10.2%, marking the highest growth rate in several years.

Tomorrow’s Stock Market, September 26: Seizing Investment Opportunities in Attractive Stocks

Vietnamese stocks on September 25 witnessed a divergence in capital flows across sectors, presenting investors with opportunities to strategically allocate funds in the upcoming September 26 session.