Rising Demand for Condominiums Among Young Buyers

Growing Demand for Condominiums

Despite soaring property prices, since 2019, the proportion of young individuals entering the housing market, particularly in the condominium segment, has been on the rise compared to previous generations.

Data from real estate trading floors reveals that transactions from buyers aged 25–35 are increasing, now accounting for over 40% of total transactions. Notably, in some projects, this group represents up to 70% of transactions.

Research by the Vietnam Real Estate Market Assessment Institute (VARS IRE) indicates that young buyers are purchasing homes at a higher rate than previous generations, with distinct preferences. Unlike their parents, young buyers are less inclined to save long-term for land or central townhouses. Instead, they favor condominiums in suburban areas with good infrastructure, affordable prices, and a modern lifestyle.

Although young buyers are increasingly purchasing homes, most face barriers due to slower income growth compared to rising property prices, debt repayment pressures, and higher living costs. They prioritize projects with attractive sales policies, focusing on potential factors like proximity to metro lines or expanding roads for future rental or resale opportunities, alongside their housing needs.

Illustrative image: Increasing demand for condominiums among young buyers.

Mr. Hòa, Deputy Marketing Manager at a tech company in Ho Chi Minh City, shared that with a stable job and monthly income exceeding 40 million VND, he utilized a preferential installment loan to purchase a condominium at The Gió Riverside by An Gia in Đông Hoà Ward, HCMC, intending to rent it out as a long-term asset. “I took a bank loan to buy it, so I plan to generate income through renting,” Mr. Hòa said.

Mr. Hòa was attracted to the project due to its favorable sales policy at the Gió Đông tower. Beyond an 18.5% discount, buyers receive 100% interest coverage for 36 months, a 5-year principal grace period, and a 60-month debt moratorium. “This suits me as I won’t face financial pressure during the project’s first two years. By the third year, when the condominium is handed over and operational, rental income will offset subsequent loan interest costs. Additionally, the property’s value tends to rise post-operation, benefiting both rental income and asset appreciation,” Mr. Hòa explained.

Similarly, Mr. Tùng (32), also from HCMC, is exploring a condominium project on Highway 13, Bình Hoà Ward. With limited initial capital, he leveraged the developer’s sales policies to purchase a 3.2 billion VND unit. Supported by family and personal savings, Mr. Tùng aims to invest in rental properties rather than immediate occupancy, as he currently resides with his family in District 3. “I expect prices to rise with infrastructure development, allowing me to sell at a higher value,” Mr. Tùng noted.

Declining deposit interest rates over the past two years are drawing investors back to real estate. According to DKRA Group’s latest survey, 50% of property buyers in HCMC and surrounding areas are investors, primarily seeking long-term profits.

Positive Market Dynamics

HCMC’s real estate market is witnessing a significant shift, with investment buyers increasingly outpacing those purchasing for actual residence. This trend is driven by multiple factors: price appreciation expectations, the search for safe investment havens, and the appeal of rapidly developing satellite areas.

Illustrative image: Positive factors influencing project liquidity in the real estate market.

Additionally, HCMC and its neighboring areas are experiencing their most robust infrastructure development phase in years. Key projects like HCMC’s Ring Road 3, metro lines 1, 2, and 3A, the HCMC-Mộc Bài expressway, and several completed highways are creating a synchronized connectivity network, directly boosting property values and investor expectations.

The TOD (Transit-Oriented Development) model is particularly impactful, with HCMC adding 46 land plots totaling over 7,300 hectares. Eleven pilot sites along metro lines 1, 2, and Ring Road 3 are expected to transform suburban areas into new urban centers. Experts predict property values in these areas could rise 20–30% post-infrastructure completion.

Another notable trend is the influx of capital from Northern investors, who find HCMC’s rental property market more profitable than other regions with similar investments.

Experts predict HCMC’s real estate market could enter a boom phase by 2030, driven by the completion of major infrastructure projects.

HVH Plans to Invest Additional VND 140 Billion in Euro Villas Project Developer in Phú Thọ

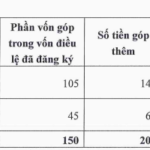

On September 26th, the Board of Directors of HVC Investment and Technology Joint Stock Company (HOSE: HVH) approved adjustments to the capital contribution in its subsidiary, HVC and Ho Guom Hoa Binh Investment Limited Liability Company (HVC Hoa Binh).

Border Province Surpasses Annual Budget Target by Mid-September

This province has surpassed its assigned target by an impressive 100%, marking a significant achievement in its performance.