Following the issuance of Resolution No. 5/2025/NQ-CP dated September 9, 2025, by the Vietnamese Government regarding the pilot implementation of the cryptocurrency market in Vietnam, numerous businesses swiftly seized the opportunity. They established legal entities or invested in organizations related to digital assets within the country.

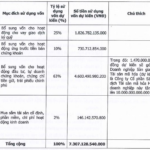

Notably, Vimexchange Cryptocurrency and Digital Asset Trading Joint Stock Company was founded in June 2025 with a charter capital of 10,000 billion VND. This marks the first digital asset company in Vietnam to achieve such a substantial charter capital. The company’s primary business activities include financial support services not classified elsewhere, specifically investment consulting, real estate trading, and real estate brokerage services.

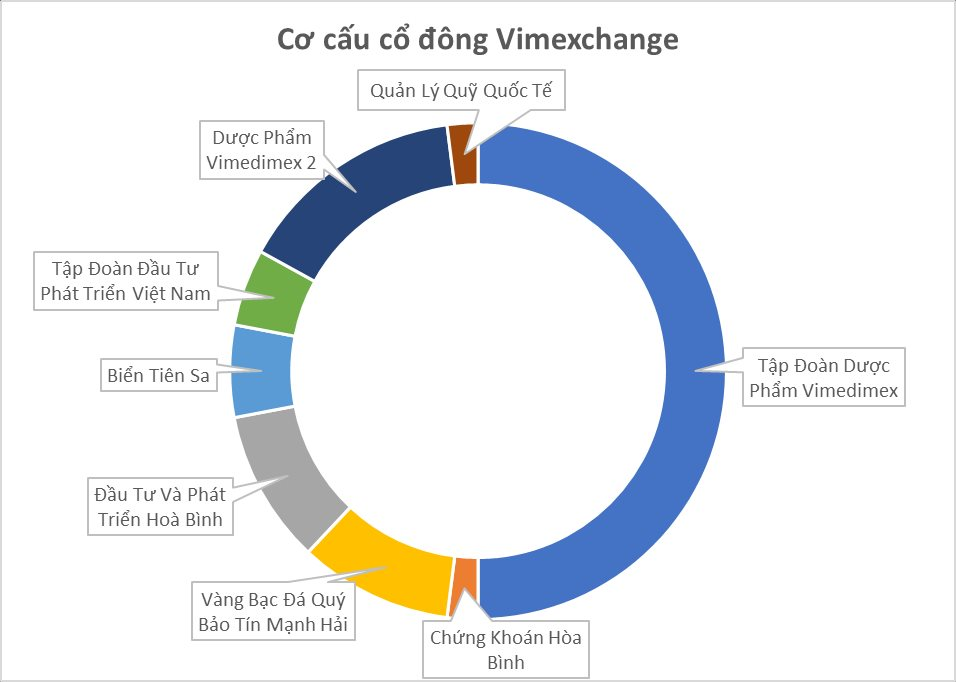

Vimedimex Pharmaceutical Group is among Vimexchange’s shareholders, contributing 5,000 billion VND to hold a 50% stake. Additionally, Hoa Binh Securities—a company within the Vimedimex ecosystem—contributed 200 billion VND, securing a 2% stake in Vimexchange.

Furthermore, Bao Tin Manh Hai Precious Metals and Gems Joint Stock Company is also listed as a founding shareholder of Vimexchange, with a contribution of 1,000 billion VND, equivalent to a 10% ownership stake. Bao Tin Manh Hai Precious Metals and Gems Joint Stock Company is a brand under Bao Tin Manh Hai Joint Stock Company—a large-scale, legally operating gold bar trading enterprise in Northern Vietnam. Bao Tin Manh Hai currently operates 9 locations in Hanoi and 2 branches in Hai Phong and Bac Ninh.

Vimexchange’s shareholder structure also includes other organizations such as Hoa Binh Investment and Development Joint Stock Company, Bien Tien Sa Joint Stock Company, Vietnam Investment and Development Group Joint Stock Company, Vimedimex 2 Pharmaceutical Joint Stock Company, and International Fund Management Joint Stock Company.

Resolution No. 05 outlines specific conditions for granting licenses to provide cryptocurrency market organization services. First, the organization must be a Vietnamese enterprise registered to operate in the field of cryptocurrency-related services.

Second, the contributed charter capital must be in Vietnamese Dong, with a minimum paid-up charter capital of 10,000 billion Vietnamese Dong.

Third, at least 65% of the charter capital must be contributed by organizational shareholders or members, including more than 35% from at least two organizations such as commercial banks, securities companies, fund management companies, insurance companies, or technology enterprises.

Additionally, contributing organizational shareholders or members must have legal status, have operated profitably for the two years preceding the license application, and have audited financial reports for those two years with unqualified audit opinions.

An organization or individual may only contribute capital to one cryptocurrency service provider licensed by the Ministry of Finance.

The total foreign investment in a cryptocurrency service provider must not exceed 49% of its charter capital.

Fourth, the organization must have a registered office and adequate physical, technical, and office equipment, along with a technology system suitable for providing cryptocurrency services.

Fifth, regarding personnel requirements: The CEO must have at least two years of experience in the operations department of financial, securities, banking, insurance, or fund management organizations.

The Chief Technology Officer (or equivalent) must have at least five years of experience in the IT department of financial, securities, banking, insurance, fund management, or technology enterprises.

There must be a minimum of 10 IT personnel with cybersecurity certifications and 10 personnel with securities trading licenses working in other operational departments.

Sixth, the enterprise must establish the following operational procedures: (1) Risk management and information security; (2) Platform services for issuing digital assets; (3) Custody and management of client assets; (4) Transaction and payment processes; (5) Proprietary trading; (6) Anti-money laundering, counter-terrorism financing, and proliferation financing; (7) Information disclosure; (8) Internal control; (9) Transaction monitoring; (10) Conflict of interest prevention, customer complaint resolution, and compensation.

Seventh, the organization’s information technology system must meet Level 4 cybersecurity standards as per information security regulations before deployment.

Leading Securities Firm to Invest Nearly $60 Million in Establishing a Crypto Asset Trading Platform

This leading securities firm is set to offer 365 million shares at an initial price of VND 20,000 per share, significantly boosting its chartered capital from VND 1,460 billion to over VND 5,100 billion. A key allocation of the raised capital will be directed toward establishing a cryptocurrency asset trading platform.