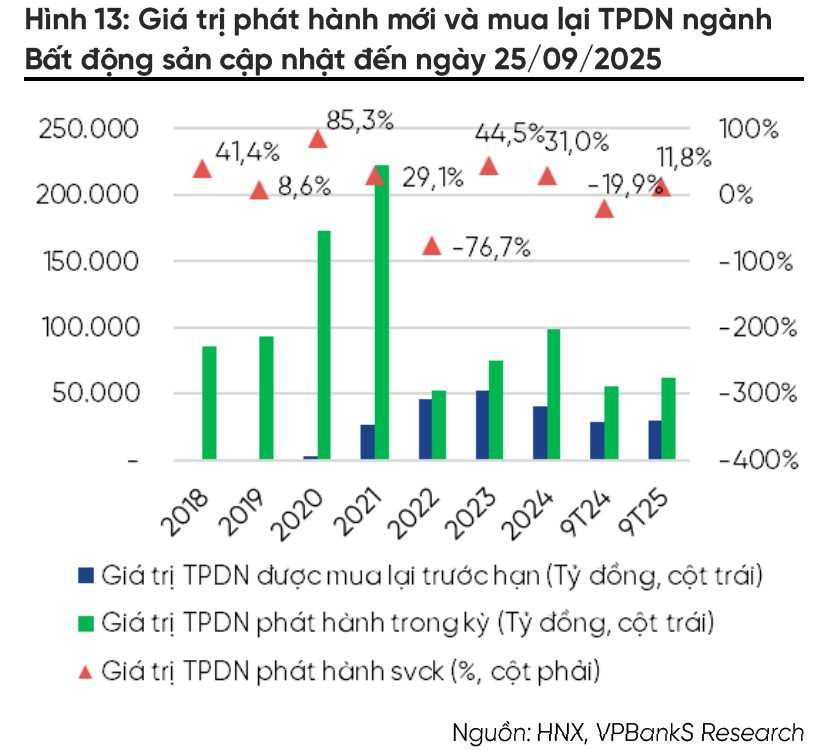

According to VPBankS’s residential real estate report, corporate bond issuance has shown significant improvement, with companies actively repurchasing bonds before maturity.

Fundraising activities through corporate bonds in the real estate sector have rebounded, with the total value of individual corporate bond issuances from the beginning of 2025 to September 25 reaching 61.72 trillion VND, an 11.8% increase year-on-year.

Excluding bonds issued by VIC and VHM, the total issuance value in the first nine months of 2025 reached 37.72 trillion VND, a 31.5% increase year-on-year, indicating a surge in bond issuance by smaller developers.

Companies are also enhancing risk management by repurchasing bonds before maturity, with a total repurchase value of 40.324 trillion VND (up 30% year-on-year), equivalent to 65% of new issuances.

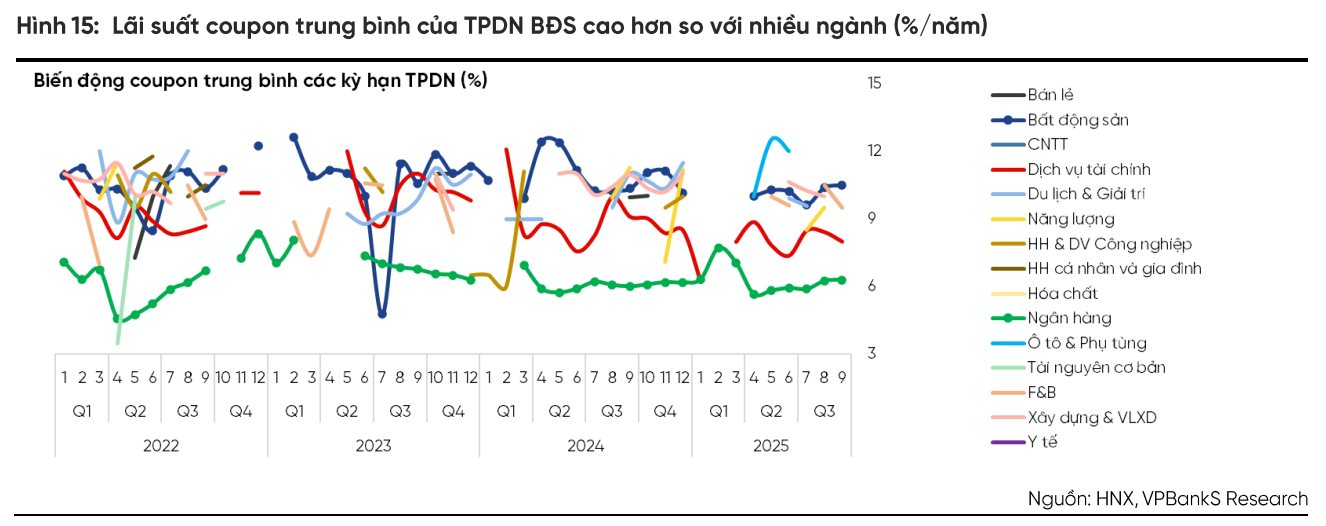

VPBankS attributes this trend to high-interest rates on real estate bonds (9-12% per annum), while companies can now access bank loans at lower costs. Repurchasing also reduces maturity pressure, improves financial health, and boosts investor confidence.

Amid tighter regulations on the corporate bond market to protect investors and control credit risks, many companies have increased their reliance on bank loans, taking advantage of the low-interest-rate environment. This credit channel has become a primary funding source for project development and debt repayment, including corporate bond obligations.

Real estate credit (including business and consumer real estate credit) accounted for 23.7% of the total outstanding loans in the economy as of July 2025, up from 21-22% in 2022-24, continuing to significantly contribute to the banking system’s credit growth target.

Therefore, VPBankS expects the interest rate environment and lending policies to remain supportive of real estate activities in the medium term.

In June, approximately 7.464 trillion VND in compensation was paid to over 40,000 bondholders of companies within the Van Thinh Phat Group, equivalent to 24.81% of the bond face value. This marks a crucial step in restoring investor confidence and sets a legal precedent for protecting bondholder rights in similar cases.

From now until the end of 2025, approximately 47.449 trillion VND in real estate corporate bonds will mature, including 12.824 trillion VND from bonds that have defaulted on interest payments. In 2026, the maturing bond value is estimated at 123.124 trillion VND, with 11.631 trillion VND also belonging to the defaulting group.

After surpassing the peak maturity period of 2026-2027, VPBankS anticipates that the real estate corporate bond market will regain growth momentum, with reduced funding costs and expanded capital diversification opportunities for companies.

Market Pulse 29/09: Continued Divergence in Market Trends

At the close of trading, the VN-Index climbed 5.78 points (+0.35%) to reach 1,666.48, while the HNX-Index dipped 0.91 points (-0.33%) to 275.15. Market breadth favored decliners, with 469 stocks falling and 258 advancing. Similarly, the VN30 basket saw red dominate, as 18 members declined, 10 rose, and 2 remained unchanged.

Market Pulse 29/09: VIC and VHM Lead the Index, Foreign Investors Offload SSI

The robust support from VIC and VHM propelled the index into positive territory, despite the broader market leaning towards selling pressure. At the mid-session break, the VN-Index climbed over 8 points (+0.49%), reaching 1,668.76 points, while the HNX-Index rose by 0.17%, settling at 276.54 points. Market breadth showed 373 gainers, 250 decliners, and 977 unchanged stocks.

Dr. Can Van Luc: State Bank’s Monetary Policy Room Extremely Limited, Further Interest Rate Cuts Pose Significant Risks

According to this expert, further reducing interest rates would be perilous due to concerns over “currency outflows,” not to mention the potential strain on the money supply and inflation dynamics.