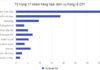

Recently, the UK-based organization Z/Yen Partners and the China Development Institute released the 38th Global Financial Centres Index (GFCI 38). Ho Chi Minh City (HCMC) saw a significant rise, gaining 10 GFCI points to reach a total of 664.

This improvement propelled HCMC up by three ranks since the March ranking, climbing from 98th to 95th place. Notably, Vietnam’s economic hub surpassed Bangkok in the rankings, as Thailand’s capital dropped six positions from 96th to 102nd, scoring 657 points.

Ho Chi Minh City gains 10 points, ranking 95th in the Global Financial Centres Index (Photo: Internet)

Globally, New York City retained its top position with 766 points, followed by London, Hong Kong, and Singapore. Remarkably, the top 10 global cities maintained their rankings unchanged.

According to the GFCI survey, HCMC is also among the 16 financial centers projected to experience robust growth over the next 2-3 years. Of these 16 centers, eight are in the Asia-Pacific region, and six are in the Middle East and Africa. This highlights the growing importance of these regions in the global financial landscape.

On August 1st, Prime Minister Pham Minh Chinh, Head of the Steering Committee for the International Financial Center in Vietnam, signed Decision No. 114/QĐ-BCĐTTTC, outlining the action plan to establish an International Financial Center in Vietnam.

The plan aims to launch International Financial Centers (IFCs) in Ho Chi Minh City and Da Nang by the end of 2025. This initiative is a pivotal step to attract medium and long-term financial resources, laying the groundwork for Vietnam’s socio-economic growth in the new era.

Strategically, HCMC will focus on attracting diverse capital flows, including equities, bonds, investment banking, and asset management funds. Meanwhile, Da Nang will develop niche markets leveraging its advantages in seaports, international airports, the East-West Economic Corridor, and coastal industries.

The GFCI 38 index is constructed using a factor assessment model, combining expert survey responses with quantitative data. Over 4,800 financial professionals participated in the online survey, rating financial centers on a scale of 10 for business-friendliness.

For quantitative data, GFCI utilized 140 data inputs from third-party sources, including the World Bank, OECD, and UN. These data points cover areas such as business environment, human resources, infrastructure, and financial sector development.

Ho Chi Minh City’s 1.6km Road Expansion Project Faces Over $43 Million Cost Overrun

The upgrade and expansion project of Nguyen Duy Trinh Road, previously funded at over 832 billion VND, has now been increased to more than 1,859 billion VND, classified as a Group A project, and is set to be completed before 2028.

Trade Defense Strategies for Vietnam in the New Global Context

For nearly two decades, trade defense cases targeting Vietnamese goods have been on a steady rise. Businesses are advised to proactively monitor shifts in supply chains, increase domestic value-added ratios, and reduce reliance on raw materials from countries facing tariffs.