In a recent report, KBSV Securities highlights the strong potential of Saigon Cargo Services Corporation (SCS, stock code: SCS) to participate in the Long Thanh Cargo Terminal Project.

According to company disclosures, Airports Corporation of Vietnam (ACV) has exclusively engaged SCS throughout the planning, design, and operational strategy development phases for the Long Thanh cargo terminal. Analysts emphasize SCS’s favorable position to secure the project, citing its extensive experience in cargo terminal operations (48% market share at Tan Son Nhat Airport), robust financial health, substantial cash reserves, and ACV’s significant stake in SCS.

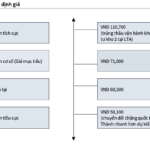

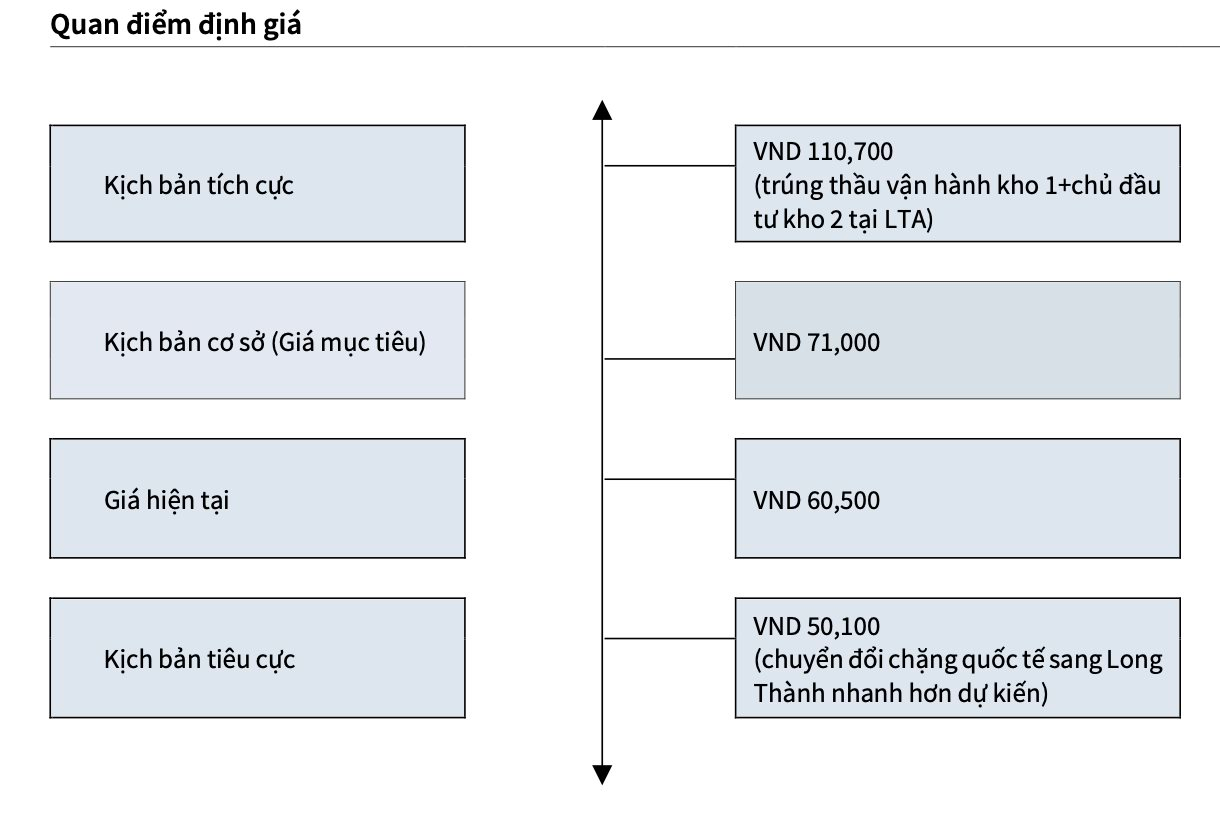

While official announcements regarding the project’s investor and operator (expected by year-end) are pending, KBSV has not factored SCS’s potential Long Thanh win into its base valuation. However, successful participation would significantly enhance SCS’s long-term growth prospects and justify a higher market valuation.

SCS previously identified Long Thanh cargo terminal operations as a strategic priority for 2025. The company is actively strengthening its financial and human resources capabilities to partner effectively with ACV.

This project holds significant importance for SCS’s future. Once Long Thanh Airport becomes operational, a substantial portion of international cargo is expected to shift there, alleviating pressure on Tan Son Nhat Airport and directly impacting SCS’s current operations.

At the 2025 Annual General Meeting, Mr. Nguyen Quoc Khanh, SCS CEO, revealed that Phase 1 of the project includes three warehouses: one fast-track warehouse with a 100,000-ton capacity and two general cargo warehouses, each with a 550,000-ton capacity. While ACV is the investor for Warehouse 1 (Component 3), the operator remains undetermined.

“In my view, SCS will likely play a role in Warehouse 1, as training specialized aviation personnel is not a simple task,” Mr. Khanh stated. He emphasized the close collaboration with ACV, noting SCS’s involvement since the design phase and ACV’s incorporation of SCS’s design input.

Established in 2008, Saigon Cargo Services Corporation is the second-largest air cargo terminal operator at Tan Son Nhat International Airport, holding a 48% market share. Key shareholders include Gemadept Corporation (33.4%) and Airports Corporation of Vietnam (13.6%). Cargo terminal operations are SCS’s core business, with ongoing equipment investments to increase handling capacity to 350,000 tons annually.

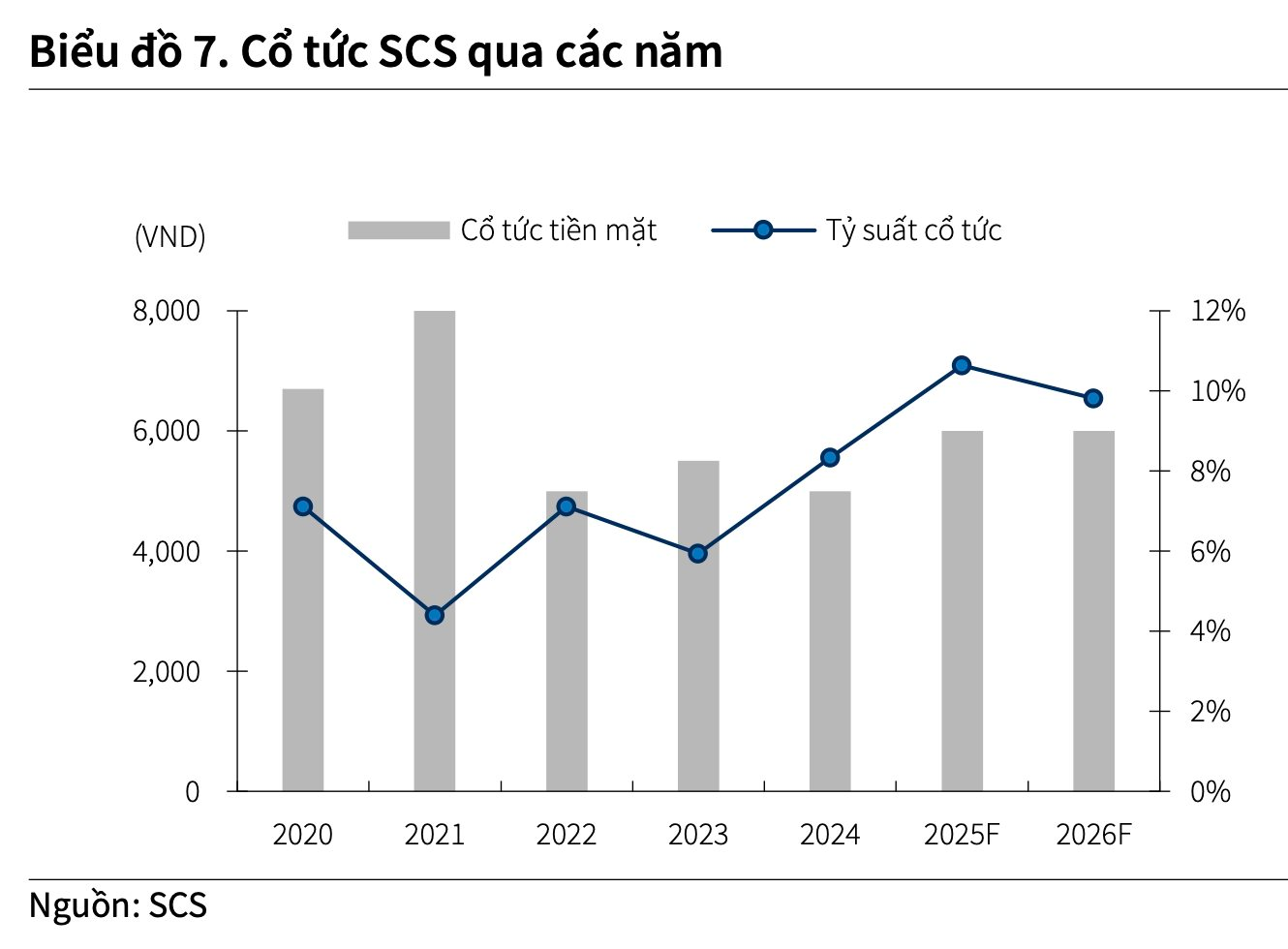

SCS has consistently maintained high cash dividend payouts in recent years. At the June shareholder meeting, a 3,000 VND/share dividend for 2025 was approved.

Given its strong financial position, substantial cash reserves, debt-free status, and conservative dividend guidance, KBSV anticipates SCS will sustain high cash dividend payouts in the coming years, projecting 6,000 VND/share dividends for 2025 and 2026.

In Q2 2025, SCS reported net revenue of 292 billion VND, a 10% year-over-year increase. Gross profit rose accordingly. For the first half of 2025, SCS achieved 558 billion VND in net revenue (up 17%) and 359 billion VND in net profit (up 7% from H1 2024).

KBSV’s CAGR projections present two scenarios: a positive case assumes a 2% annual cargo volume decline through 2030, offset by 5% annual service price increases due to Long Thanh advantages and pricing flexibility. Conversely, a negative scenario forecasts a 12% annual volume drop and 6% price erosion, creating margin pressures.

“Industry Titan Poised to Secure $16 Billion Project Bid, Commits to 6,000 VND/Share Dividend by 2026”

In 2025, one of the enterprise’s strategic priorities is to prepare for the operation of the cargo terminal at Long Thanh International Airport.

Proactively Developing a $3.5 Billion Investment Plan for the Thu Thiem – Long Thanh Railway Line

The Thu Thiem – Long Thanh railway project is being urged to swiftly resolve legal hurdles, paving the way for its prompt implementation and the connection of two major airports.