Market liquidity decreased compared to the previous session, with the order-matching volume of the VN-Index reaching over 808 million shares, equivalent to a value of more than 23.3 trillion VND; the HNX-Index reached over 69.3 million shares, equivalent to a value of more than 1.5 trillion VND.

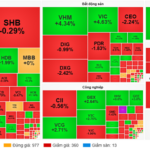

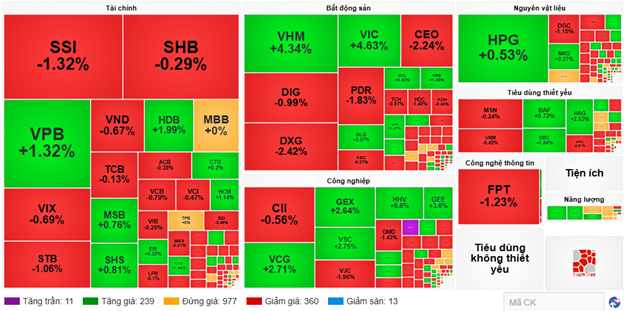

The VN-Index opened the afternoon session with a tug-of-war but buyers maintained a stronger position, helping the index stay above the reference level and close in a positive green at the end of the session. In terms of influence, VIC, VHM, VPB, and GEE were the most positively impacting codes on the VN-Index, contributing over 13.1 points. Conversely, FPT, VCB, HVN, and BSR faced selling pressure, taking away more than 2.6 points from the overall index.

| Top 10 stocks impacting the VN-Index on September 29, 2025 (calculated in points) |

In contrast, the HNX-Index showed a rather pessimistic trend, negatively impacted by codes such as IDC (-2.72%), CEO (-2.24%), BAB (-2.11%), HUT (-1.63%), and others.

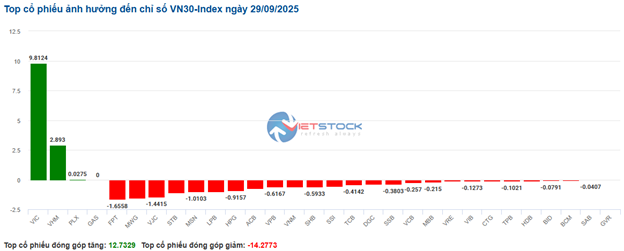

| Top 10 stocks impacting the HNX-Index on September 29, 2025 (calculated in points) |

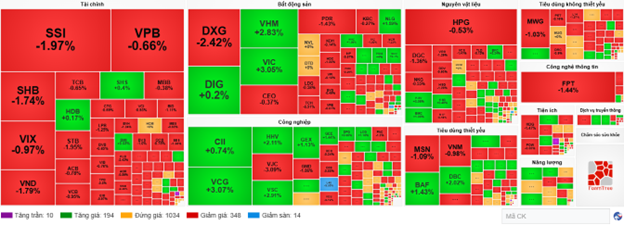

At the close, although red dominated most sectors, the VN-Index still increased slightly by 0.18%. Among these, the real estate sector led the market with a 2.24% increase, mainly from codes VIC (+5.37%), VHM (+2.93%), KSF (+2.56%), and VRE (+2.04%). The finance sector followed with a slight increase of 0.01%. Conversely, the information technology sector recorded the strongest decline in the market, dropping 1.91%, primarily due to FPT (-2.05%), CMG (-0.13%), and ELC (-0.43%).

Regarding foreign trading, foreign investors continued to net sell over 759 billion VND on the HOSE, concentrated in codes SSI (174.67 billion), DIG (138.26 billion), VNM (114.61 billion), and DXG (88.47 billion). On the HNX, foreign investors net sold over 35 billion VND, focused on IDC (15.14 billion), PVS (8.41 billion), SHS (7.48 billion), and CEO (3.99 billion).

| Foreign net buying and selling trends |

Morning Session: VIC and VHM Support the Index, Foreign Investors Sell SSI Strongly

The supportive efforts of VIC and VHM helped the index maintain a positive green despite the market’s overall selling bias. At the mid-session break, the VN-Index increased by over 8 points (+0.49%), reaching 1,668.76 points; the HNX-Index rose by 0.17%, reaching 276.54 points. Market breadth recorded 373 gainers, 250 losers, and 977 unchanged stocks.

Market liquidity showed signs of improvement compared to the previous session. The trading value of HOSE this morning reached over 12 trillion VND, up 17.36%, but still quite low compared to the one-month average. However, trading on HNX recorded a 21.33% decrease compared to the previous session, only reaching over 34 million units, equivalent to nearly 756 billion VND.

Among the top 10 stocks influencing the VN-Index, VIC had the most positive impact, contributing over 7 points to the index. Additionally, VHM added a total of 4.23 points to the overall index. Conversely, VCB had the most negative impact this morning, taking away nearly 1 point from the index.

| Top 10 stocks impacting the VN-Index in the morning session of September 29, 2025 (calculated in points) |

Divergent trends continued to dominate, with most sectors fluctuating within a narrow range. Among these, the real estate sector continued to lead the market with an outstanding 2.8% increase, thanks to positive contributions from codes VIC (+4.63%), VHM (+4.34%), VRE (+1.36%), KSF (+6.76%), and NLG (+2.07%).

Additionally, the industrial sector traded actively, with strong buying focus on stocks like VCG (+2.71%), GEX (+2.64%), VSC (+2.75%), GEE (+3.6%), and CDC reaching the upper limit. However, several stocks recorded notable adjustments, such as ACV (-1.54%), VJC (-1.96%), GMD (-1.43%), VGC (-2.17%), VTP (-1.1%), and BMP (-1.32%).

Conversely, the information technology sector recorded the most negative performance this morning, with leading stocks like FPT declining 1.23% and ELC dropping 2.17%.

Source: VietstockFinance

|

Foreign investors continued to net sell with a value of over 647.12 billion VND across all three exchanges. Selling pressure was concentrated in SSI with a value of 156.1 billion VND. Meanwhile, VPB and GEX led the net buying list with values of 82.69 billion and 67.62 billion VND, respectively.

| Enter Title |

10:35 AM: Financial Sector Underperforms, VN-Index Struggles at 1,660 Points

Tug-of-war continued, with selling pressure gradually gaining the upper hand, causing major indices to turn red. As of 10:30 AM, the VN-Index decreased by 3.17 points, trading around 1,657 points. The HNX-Index slightly declined, trading around 275 points.

Stocks in the VN30 basket showed a dominant red trend, with only a few maintaining positive green. Specifically, FPT, MWG, VJC, and STB took away 1.65 points, 1.57 points, 1.44 points, and 1.12 points from the overall index, respectively. Conversely, only VIC, VHM, and PLX maintained good buying pressure, contributing over 12.7 points to the VN30-Index.

Source: VietstockFinance

|

The financial and information technology sectors faced strong selling pressure, with major players like VCB down 0.95%, BID down 0.99%, TCB down 0.65%, CTG down 0.39%, FPT down 1.54%, and ELC down 1.09%.

Conversely, the real estate sector showed strong upward momentum, supporting the overall market’s rise, primarily driven by two industry giants: VIC up 3.6% and VHM up 2.73%.

Compared to the opening, buyers and sellers engaged in a fierce tug-of-war, with over 1,000 stocks unchanged. Sellers gained the upper hand, with 346 decliners (14 hitting the lower limit) and 194 advancers (10 hitting the upper limit). The financial sector remained the focal point, almost entirely covered by an unoptimistic red trend.

Source: VietstockFinance

|

Opening: Strong Divergence in Financial and Real Estate Sectors

At the start of the September 29 session, as of 9:30 AM, the market showed strong divergence with over 1,200 reference stocks. The VN-Index and HNX-Index fluctuated around the reference level at 1,659 points and 276 points, respectively. However, market breadth remained positive, with over 210 gainers.

Green and red trends were mixed across sectors. On the positive side, the energy sector saw some leading stocks increase positively from the opening, such as BSR up 0.73%, PLX up 0.43%, PVD up 1.1%, and PVS up 0.59%.

Major stocks in the financial and real estate sectors like VCB, TCB, VRE, and BID weighed on the market, pulling it down by over 1.3 points. Conversely, VIC, CTG, and VPB led the upward trend, pulling the market up by over 1.8 points.

– 16:30 29/09/2025

VN-Index’s Deceptive Rally Leaves Investors Facing Heavy Losses

The stock market’s deceptive “green on the outside, red on the inside” state has left many investors’ accounts in the red, as losses mount despite superficial signs of stability.

Market Pulse 29/09: VIC and VHM Lead the Index, Foreign Investors Offload SSI

The robust support from VIC and VHM propelled the index into positive territory, despite the broader market leaning towards selling pressure. At the mid-session break, the VN-Index climbed over 8 points (+0.49%), reaching 1,668.76 points, while the HNX-Index rose by 0.17%, settling at 276.54 points. Market breadth showed 373 gainers, 250 decliners, and 977 unchanged stocks.