In a recent update, VPBank Securities reports that Vinhomes (VHM) has an unrecorded real estate sales backlog of VND 138.2 trillion by the end of Q2/2025, marking a 16.4% increase year-over-year. This substantial backlog serves as a critical reserve, ensuring steady revenue for the company throughout the current fiscal year. Customer deposits continue to outpace accounts receivable, reflecting strong buyer confidence and sustained market demand.

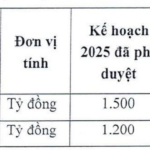

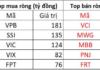

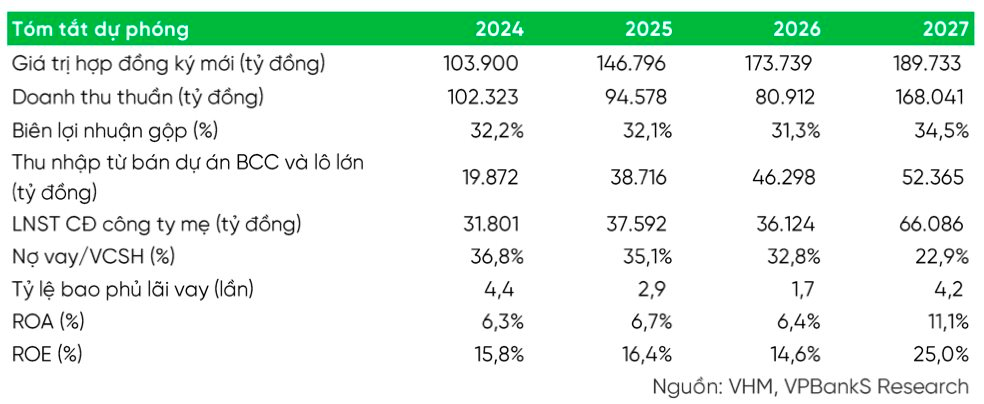

For 2025, VPBankS forecasts VHM’s revenue at VND 94.578 trillion, a 7.6% decline from the previous year due to delayed project handovers. Notably, analysts predict VHM will generate VND 38.716 trillion from bulk sales, primarily in Golden City, Green City, and Green Paradise. Consequently, the company’s post-tax profit attributable to parent shareholders is expected to rise by 18.2%, reaching VND 37.592 trillion.

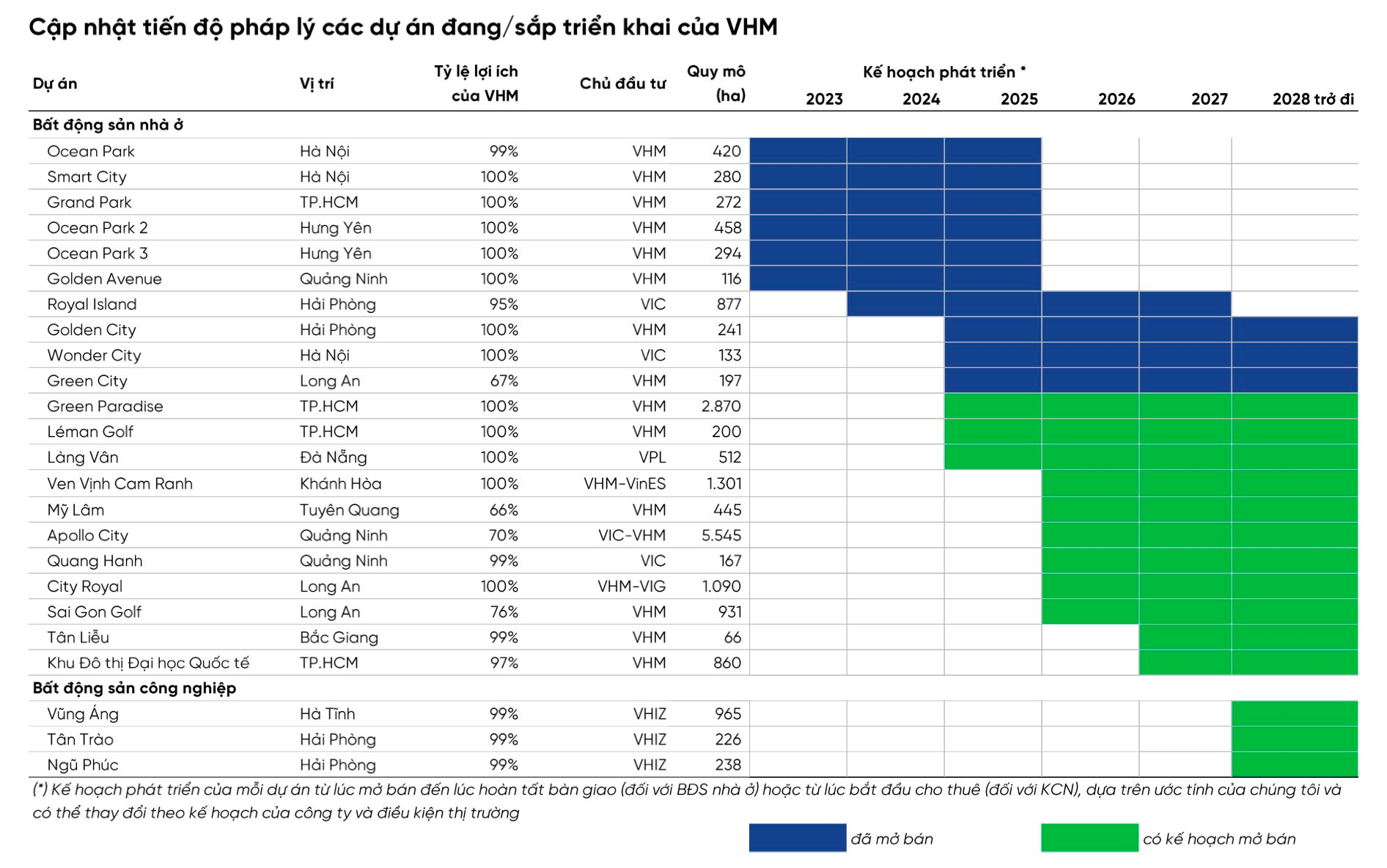

Alongside short-term achievements, Vinhomes is accelerating pipeline projects to sustain long-term growth. Beyond ongoing developments like Vinhomes Wonder City, Green City, and Golden City, the company plans to launch new projects in 2025, including Green Paradise, Làng Vân, and Lêman Golf. VPBankS projects VHM’s new contract sales to surge by 41.3% year-over-year, reaching VND 146.796 trillion in 2025 and VND 189.733 trillion by 2027.

Another significant advantage stems from synergies within the Vingroup ecosystem. The parent group is directly investing in key infrastructure projects, such as the District 7 – Cần Giờ metro line, the Hanoi – Quang Ninh railway, and the Hoàng Gia Bridge in Hai Phong (scheduled for July 2025 completion). These initiatives enhance connectivity to Vinhomes urban areas and bolster real estate markets in strategic regions. Notably, Green Paradise (Cần Giờ) will operate on wind energy in collaboration with VinEnergo, pioneering a sustainable green urban model.

Additionally, VPBankS highlights that Vingroup’s involvement in national infrastructure projects may expedite project approvals and expand land reserves in prime locations, benefiting both Vingroup and Vinhomes.

Vinhomes’ long-term growth is further fueled by its expansion into industrial zones. In September 2025, the company commenced construction on the Vung Ang Industrial Park (965 ha, Ha Tinh) and Tan Trao Industrial Park (226 ha, Hai Phong). These projects are slated for operation between 2028 and 2030, adding a stable, long-term revenue stream for the company.

Vinhomes Green Paradise: Exclusively Distributed by NewstarLand

NewstarLand solidifies its position as a leading brand in the real estate market, earning the trust of Vinhomes as the exclusive distribution agent for the prestigious Vinhomes Green Paradise project.