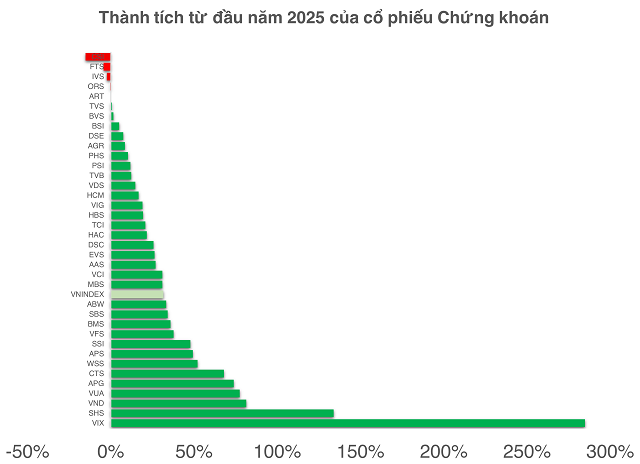

Despite the VN-Index maintaining its historical peak, supported by pillar stocks like VIC, the securities sector has shown less favorable trends, with most stocks entering short-term declines. As significant events approach, this could be a critical test for capital flow and the outlook of an industry often seen as a market “early indicator.”

91.67% of securities stocks below MA20 – a clear correction signal

As of the close on September 29, 33 out of 36 securities stocks—equivalent to 91.67%—traded below the 20-day moving average (MA20), confirming a short-term downtrend. This marks a notable reversal, as the sector was a focal point until late August 2025.

Notably, VIX, the top gainer in 2025 with a peak surge of 4.2 times, has also entered a short-term decline. Leading stocks like SSI, VND, SHS, HCM, VCI, and MBS have collectively lost short-term momentum, reflecting the sector’s cooling after a heated rally.

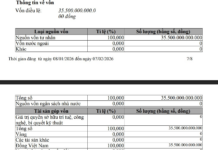

Performance of securities stocks as of September 29.

|

However, year-to-date, 24 out of 36 stocks (66.67%) have outperformed the VN-Index, which has risen 31.6%. This suggests the current correction is more of a “cooling-off” phase rather than a systemic negative signal.

Stocks like BSI and MBS have dropped over 20% from their peaks, reflecting short-term profit-taking pressure, especially as October is seen as a “testing season” for capital flow. Key events include FTSE Russell’s market upgrade review, TCBS’s planned IPO and listing on HOSE, expected to be a highlight of 2025’s IPO season.

Stories remain, but short-term opportunities require scrutiny

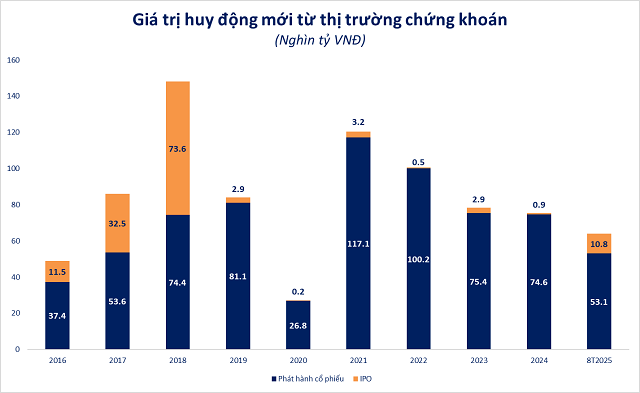

According to Nguyen The Minh, Director of Individual Client Analysis at Yuanta Securities Vietnam, securities firms’ profits have primarily come from margin lending and proprietary trading. However, as the primary market revives with IPOs, bond issuances, and capital increases, investment banking (IB) will emerge as a new growth driver.

“With Decree 245 shortening the IPO-listing process, IB will be the next growth pillar for securities firms, complementing margin and proprietary trading,” Minh noted.

He added that cautious trading in September–October is not unique to Vietnam but is a global trend, as investors adopt defensive strategies ahead of the year-end “Santa Claus rally.”

From a broader perspective, Bui Van Huy, Vice Chairman and Director of Investment Research at FIDT, believes that late 2024 to 2025 will see a surge in large-scale IPOs and capital raises, particularly in securities, infrastructure, and energy.

“This trend reflects businesses’ confidence in the market’s capital absorption capacity. New capital will not only expand securities firms’ equity for margin activities but also enhance governance and transparency—critical for market upgrades,” Huy emphasized.

In the short term, experts agree that securities stocks are consolidating after a strong rally rather than entering a prolonged downturn. This shifts the focus from momentum-based strategies to selecting firms with solid fundamentals, strong capital, and the ability to leverage primary market, IB, and digital asset opportunities.

– 08:01 30/09/2025

Vietstock Daily September 30, 2025: Market Polarization Persists

The VN-Index has rebounded, surpassing the Middle line of the Bollinger Bands. However, trading volume has declined for the fourth consecutive session, remaining below the 20-session average, indicating persistent investor caution. Meanwhile, the Stochastic Oscillator has already signaled a buy opportunity. If the MACD follows suit with a similar signal in upcoming sessions, the potential for sustained upward momentum will strengthen.

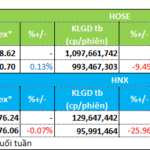

Market Pulse 29/09: Continued Divergence in Market Trends

At the close of trading, the VN-Index climbed 5.78 points (+0.35%) to reach 1,666.48, while the HNX-Index dipped 0.91 points (-0.33%) to 275.15. Market breadth favored decliners, with 469 stocks falling and 258 advancing. Similarly, the VN30 basket saw red dominate, as 18 members declined, 10 rose, and 2 remained unchanged.