Half of the Market: Financial and Real Estate Stocks

“The market is lacking quality stocks, particularly in the technology and innovation sectors. With only the old, already surged stocks available, foreign investors feel limited in their choices,” said Thomas Nguyen, Director of Overseas Markets at SSI Securities, during a side event in early August.

Thomas Nguyen’s observation comes as Vietnam’s stock market anticipates an upgrade to emerging market status by FTSE Russell, one of the world’s leading index providers. Since the beginning of the year, the VN-Index has surged by 400 points, equivalent to a 31.5% increase.

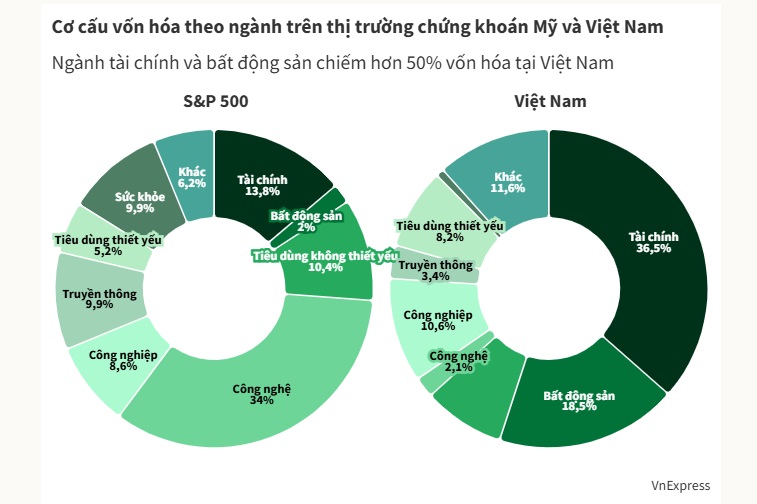

As of September 19, the total market capitalization of all companies listed on Vietnam’s stock exchanges reached over 9.5 quadrillion VND (approximately 352 billion USD). However, financial and real estate sectors dominate, accounting for more than 50% of the total capitalization. In contrast, manufacturing and information technology sectors contribute only 10.6% and 2.1%, respectively.

This contrasts sharply with developed markets like the U.S. In the S&P 500, technology companies hold the largest share at 34%, followed by consumer discretionary (10.4%), healthcare (9.9%), and communication services (9.9%). Banks and real estate contribute just over 15% of the index’s capitalization.

The S&P 500 is a capitalization-weighted index comprising 500 of the largest U.S. publicly traded companies, representing about 70% of the U.S. stock market.

In Japan, according to the MSCI Japan Index, the industrial sector leads with 24.84%, followed by consumer staples at 17.07%. Financials and real estate contribute 16.56% and 2.27%, respectively.

The MSCI Japan Index tracks 183 companies, representing 85% of Japan’s market capitalization. Leading companies include industrial giants like Toyota, Sony, Hitachi, Nintendo, and Mitsubishi.

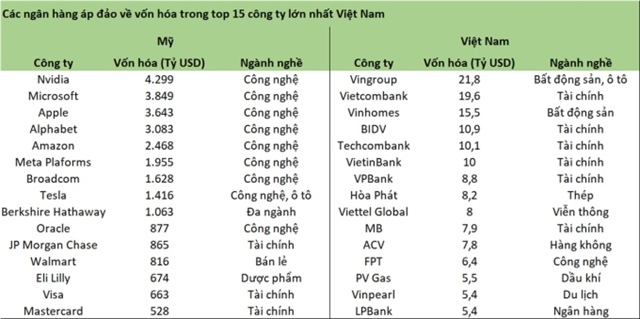

Echoing similar sentiments, Nguyen The Minh, Director of Research and Retail Development at Yuanta Securities Vietnam, noted that the market lacks high-quality stocks in terms of capitalization. Vietnam’s stock market has over 1,600 listed companies, but their total market value is only around 300 billion USD. This translates to an average capitalization of approximately 187.5 million USD per company.

In contrast, Thailand, with just over 600 listed companies, boasts a market capitalization of nearly 400 billion USD. This results in an average company value of 700 million USD. “This highlights that most Vietnamese stocks are mid-cap and small-cap,” The Minh observed.

Banks dominate the top 15 largest companies by market capitalization. Photo: Trong Hieu. |

Nguyen The Minh warned that the heavy concentration in banking and real estate sectors poses significant risks. While positive performance in these sectors boosts the index, real estate is cyclical. “If this sector underperforms, the market could plummet,” he cautioned.

In 2022, real estate companies like Tan Hoang Minh, Van Thinh Phat, Novaland, Phat Dat, and Hai Phat faced challenges due to legal issues and bond market turmoil. Consequently, the VN-Index dropped by 51%, falling from 1,500 to just over 1,000 points.

A representative from Dragon Capital Vietnam Fund Management (DCVFM) also noted that the market lacks diversity in listed sectors. High-growth potential sectors like technology, healthcare, and renewable energy have relatively low representation. “This limits portfolio diversification for large capital flows, reducing Vietnam’s attractiveness to strategic investors,” the DCVFM expert shared.

Beyond the lack of quality stocks, The Minh pointed out that Vietnam’s market also lacks derivative products based on stocks or listed funds. “The market’s products remain basic, with no swap contracts or options available,” the Yuanta Securities expert noted.

Similarly, the DCVFM representative observed that Vietnam currently offers only equity funds, bond funds, and some basic ETFs. In contrast, developed markets feature diverse products like money market funds, REITs, target-date index funds, gold ETFs, and even leveraged/inverse ETFs.

The expert emphasized that introducing such products would provide investors with varied risk levels, liquidity options, and profit objectives. More importantly, diversification would attract idle capital, enhance capital quality, and align Vietnam’s market with international standards.

Investors monitor stock prices at a brokerage in District 1, Ho Chi Minh City. Photo: An Khuong |

Encouraging IPOs and Listings

To address the shortage of quality stocks, regulators are focusing on encouraging companies to conduct IPOs and list on the stock market. At a July event, Pham Thi Thuy Linh, Head of the Stock Market Development Department at the State Securities Commission, announced new regulations linking IPOs with listings.

“We aim to streamline the processes for both stages. Companies will be able to list immediately after their IPO,” Thuy Linh explained. She believes this approach meets current demands and is eagerly awaited by many businesses.

Additionally, under the 2019 Securities Law, companies must demonstrate two consecutive years of profitability and no accumulated losses to conduct an IPO. This requirement is particularly challenging for tech startups, which often incur initial losses due to high R&D investments.

In March, the Institute for Digital Economy Strategy (IDS) under the Ministry of Finance proposed allowing unprofitable startups to IPO. IDS experts argue that Vietnam has several tech companies with global competitive potential but face capital-raising barriers for expansion.

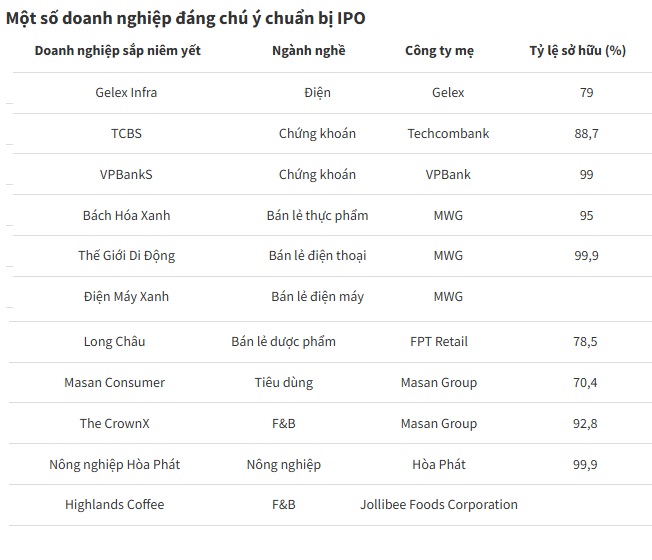

Tran Quoc Toan, Director of Branch 2 at Mirae Asset Securities, believes that IPOs by well-established companies will provide investors, especially institutional and foreign ones, with more diverse options.

As an issuance advisor, Thomas Nguyen suggested that the State Securities Commission implement policies encouraging foreign-invested enterprises (FIEs) to IPO in Vietnam. He believes these high-quality companies could reduce the dominance of banking and real estate sectors.

As an issuance advisor, Thomas Nguyen suggested that the State Securities Commission implement policies encouraging foreign-invested enterprises (FIEs) to IPO in Vietnam. He believes these high-quality companies could reduce the dominance of banking and real estate sectors.

For instance, Samsung’s four factories in Vietnam generated 60 billion USD in revenue (approximately 1.5 quadrillion VND) in 2024. Non-financial giants like Vingroup, Vinhomes, and Hoa Phat have never reached this figure. After expenses, Samsung’s 2024 profit from Vietnam was 3.5 billion USD, over three times that of Vietcombank, the most profitable listed company.

Beyond encouraging listings, the Ministry of Finance plans to introduce new products like intraday trading and short selling. At a July event, Nguyen Son, Chairman of the Vietnam Securities Depository, announced that these products are integrated into the KRX system and will launch soon. He also revealed plans for midday trading sessions.

From an investor perspective, DCVFM suggested tax incentives for long-term investments in funds to encourage domestic capital. Such policies would help individuals save for long-term goals like retirement, education, and healthcare, promoting sustainable investment behavior. This would stabilize capital flows, ensuring efficient allocation to listed companies, especially in the private sector, which needs funding for expansion, innovation, and job creation.

Trong Hieu

– 07:00 29/09/2025

Expert Insights: Seizing the Opportunity to Accumulate 3 High-Potential Stock Groups Poised for Strong Capital Inflows

Next week, Pinetree experts forecast that without new factors boosting demand, the VN-Index could potentially retreat to around 1,600 points.

Gelex Infrastructure Unveils IPO Plan: Targeting $28,000–$30,000 per Share, Aiming to Raise $300 Million, Potentially Valuing Company at $1 Billion

According to BVSC Securities, Gelex Infrastructure Corporation is poised to raise approximately VND 3,000 billion, a strategic move to bolster capital for its real estate segment and re-evaluate the market’s perception of the “engine” that currently constitutes two-thirds of the group’s total assets.