On the morning of September 30th, the 8th Conference of Professional National Assembly Deputies continued its proceedings. Deputies discussed the Draft Law on Deposit Insurance, focusing on key aspects such as fee mechanisms, payout procedures, insurance coverage, and investment activities of the Deposit Insurance Organization.

Divergent Views on Insurance Coverage

The Draft empowers the Governor of the State Bank of Vietnam (SBV) to set deposit insurance fees, applying either a uniform rate or differentiated rates based on the credit system’s characteristics during specific periods. It also allows temporarily deferred fee payments for specially controlled credit institutions, with refunds contingent on restructuring plans.

Another significant update is the earlier triggering of payout obligations. In exceptional cases, the SBV Governor may authorize full payment of insured deposits to depositors.

Regarding investments, the Draft expands the scope to permit the Deposit Insurance Organization to trade bonds and deposit certificates issued by state-owned commercial banks or enterprises with over 50% state-owned capital.

|

Additionally, the Organization may deposit funds and engage in other government-regulated investments, subject to stringent risk controls to safeguard capital.

The Economic and Financial Committee’s review highlights differing opinions. Some deputies propose removing the exclusion of “deposits by individuals or related parties owning over 5% of a credit institution’s charter capital” from insurance coverage. They argue that the current payout cap of VND 125 million, coupled with supplementary reserve funds, justifies this change.

Others seek clarification on why mandatory savings deposits from microfinance organizations are uninsured and whether deposits at policy banks fall under the insurance scope.

Concerning fees, some deputies worry that differentiated rates could burden struggling credit institutions, hindering bad debt resolution. They advocate for a phased approach based on clear risk classification criteria. For people’s credit funds, which currently pay both deposit insurance fees and the System Safety Guarantee Fund fees, a sharing mechanism is deemed necessary for fairness.

Critics also argue that the VND 125 million payout limit is outdated relative to current living standards, urging flexible adjustments under SBV regulations to protect depositors’ rights and align with practical needs.

Calls for Robust Risk Management in Investment Activities

Deputy Tô Ái Vang (Can Tho) emphasized the Deposit Insurance of Vietnam’s critical role in safeguarding depositors’ interests and stabilizing the credit system. After 13 years, the law has maintained financial-banking stability and promoted sustainable development.

On fees, Vang recommends specifying the Deposit Insurance Organization’s rights and responsibilities in fee increase plans, rather than leaving details to government guidance. He also calls for dedicated risk control provisions to ensure safe investment practices.

Deputy Thái Quỳnh Mai Dung (Phu Tho) noted that the Draft only ensures deposit data confidentiality, lacking provisions for data security as required by the Personal Data Protection Law. She urged financial-banking institutions to enhance IT capabilities alongside personal data protection.

Deputy Lý Tiết Hạnh (Gia Lai) proposed expanding insurance coverage beyond Vietnamese dong deposits. She highlighted citizens’ use of foreign currency, certificates, and other financial products, arguing that limiting coverage to VND deposits would hinder resource mobilization.

Hạnh also suggested mechanisms for the Deposit Insurance Organization to support sustainable banking development and reduce fiscal burdens during crises, beyond mere payout guarantees.

Deputy Governor Đoàn Thái Sơn explained that international standards insure only local currency deposits. Insuring foreign currency deposits could exacerbate currency hoarding, undermining national monetary policy.

Sơn stressed that countries employ mechanisms to limit currency substitution and ensure financial stability. Expanding coverage to foreign currencies would complicate SBV’s monetary management.

He reaffirmed that the Deposit Insurance of Vietnam’s role in systemic financial safety is a key focus of the law revision, with new policies designed to concretize this responsibility.

SBV representatives stated that drafters will incorporate deputies’ feedback, collaborate with reviewers, and finalize the Draft for upcoming National Assembly sessions.

*VIẾT LONG – MINH TRÚC*

– 14:43 30/09/2025

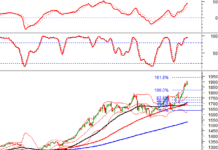

Vietcap Securities Updates on Vietnam’s Market Upgrade Potential

Vietcap Securities (VCI) has released an update on the FTSE market upgrade process following their recent trip to London. In collaboration with FTSE, VCI will co-host the Vietnam Access Day 2025 event on September 18th.

Asian Bank Revises Vietnam’s Growth Forecast Upward

The Asian Development Bank (ADB) has revised its growth forecast for Vietnam, projecting a 6.7% expansion in 2025, while adjusting the 2026 outlook to 6.0%. The latest report underscores Vietnam’s promising trajectory but emphasizes the need for accelerated structural reforms and sustainable infrastructure investments to sustain this momentum.

Revolutionary Proposal to Resolve Land Valuation Challenges

The proposed land price list is meticulously structured based on land type, region, and location. Provincial People’s Councils determine the land price table every five years, with the next update set to be announced and implemented starting January 1, 2026. Revisions and additions will be made as necessary to ensure accuracy and relevance.