Following a week of recovery, the stock market recorded a relatively positive session on September 29th. Subsequently, the market experienced fluctuations and faced selling pressure in mid and small-cap stocks. The VN-Index closed with a gain of 5.78 points (+0.35%), reaching 1,666.48 points. Amid this context, foreign investors (NĐTNN) continued their net selling streak, offloading over 807 billion VND across the market.

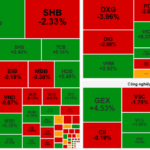

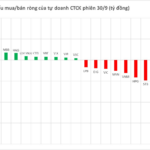

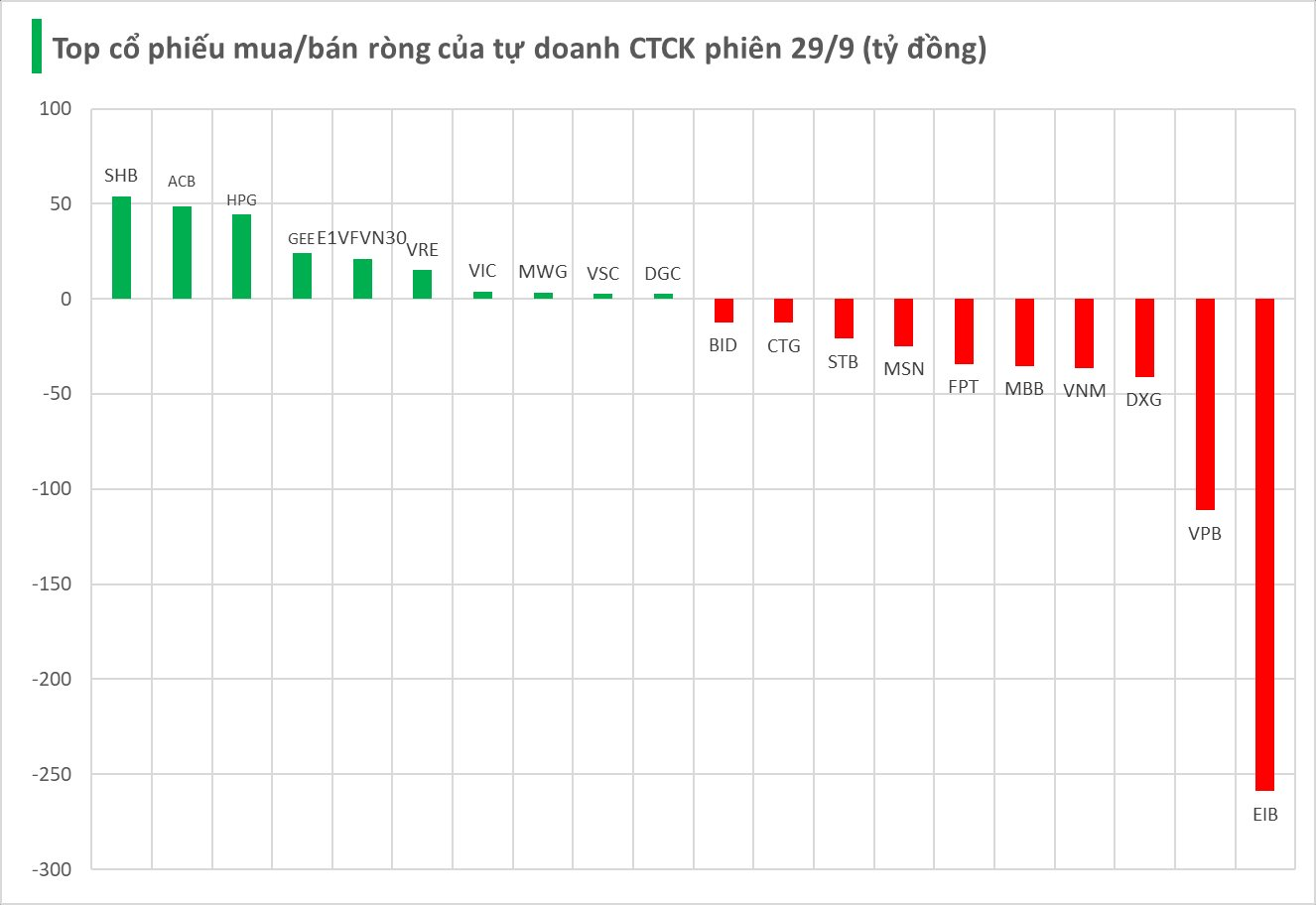

Securities firms’ proprietary trading desks net sold 486 billion VND on the HoSE.

Specifically, securities firms were most active in net selling EIB, with a value of -259 billion VND, followed by VPB (-111 billion), VNM (-36 billion), MBB (-35 billion), and FPT (-34 billion VND). Other stocks also saw notable net selling pressure, including MSN (-25 billion), STB (-21 billion), CTG (-13 billion), and BID (-12 billion VND).

Conversely, SHB led the net buying list with 54 billion VND. ACB ranked second with 48 billion VND, followed by HPG (44 billion), GEE (24 billion), E1VFVN30 (21 billion), VRE (15 billion), VIC (4 billion), MWG (3 billion), VSC (3 billion), and DGC (2 billion VND).

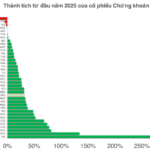

Over 90% of Stock Charts Signal a Downtrend: What’s Driving the Market Decline?

The stock market has entered a brief cooling-off period, while leading indicator sectors are experiencing widespread adjustments ahead of several significant market events.

Vietstock Daily September 30, 2025: Market Polarization Persists

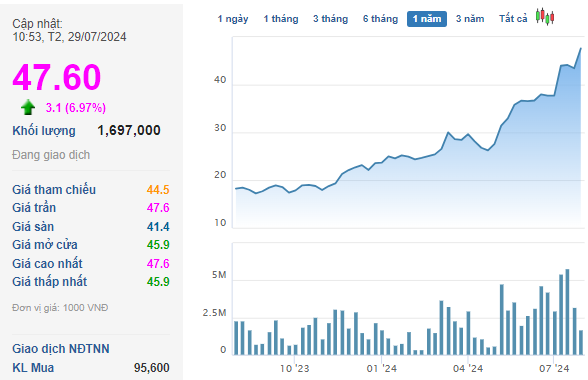

The VN-Index has rebounded, surpassing the Middle line of the Bollinger Bands. However, trading volume has declined for the fourth consecutive session, remaining below the 20-session average, indicating persistent investor caution. Meanwhile, the Stochastic Oscillator has already signaled a buy opportunity. If the MACD follows suit with a similar signal in upcoming sessions, the potential for sustained upward momentum will strengthen.