Closing the session on September 29, the VN-Index ended at 1,666 points, up 5 points (+0.35%).

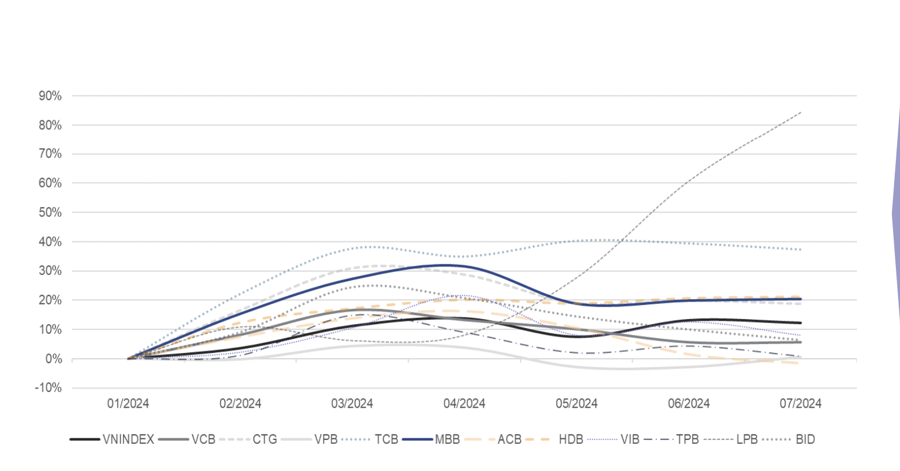

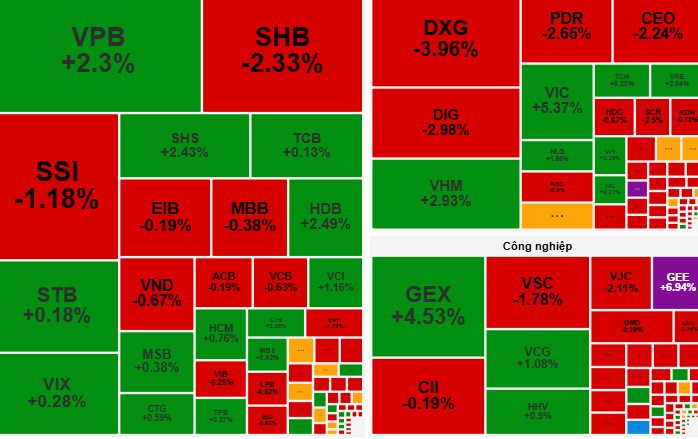

The Vietnamese stock market concluded the September 29 trading session with a modest gain, yet not without its share of volatility. The VN-Index opened below the reference point due to heavy selling pressure from banking and securities groups but quickly reversed course thanks to strong demand for Vingroup ecosystem’s blue-chip stocks.

By mid-morning, the index hovered narrowly around the 1,660–1,670 range, reflecting a clear divergence across sectors. Public investment stocks stood out, with VCG rising 2.71% and HHV gaining 0.60%, while red dominated with 199 decliners versus only 94 advancers.

In the afternoon session, a similar pattern emerged, with the index fluctuating tightly around 1,665 points. Blue-chip divergence persisted as FPT, MSN, and MWG faced heavy selling from institutional investors. Contrasting the morning, real estate and public investment stocks were offloaded, narrowing gains. A rare bright spot came from the livestock sector, with HAG up 3.14%, DBC rising 2.78%, and BAF adding 1.0%.

At the close, the VN-Index settled at 1,666 points, up 5 points (+0.35%).

VCBS Securities forecasts the market will continue to trade within the 1,660–1,670 range, with sharply divided sector flows. “Investors should hold stocks in uptrends and reduce leverage in pressured names. Key sectors to watch include banking and livestock,” VCBS advises.

Rong Viet Securities (VDSC) notes the market’s struggle to surpass the 1,663 resistance, with cautious buying support at this level. To regain upward momentum, stronger absorption of supply is needed for stability. Conversely, weak buying could lead to a downturn.

“Nearly 39 Trillion VND Poised to Flow into Vinhomes’ Coffers?”

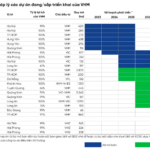

VPBank Securities forecasts that VHM will generate 38.716 trillion VND from large-scale land sales in 2025, primarily from its flagship projects: Golden City, Green City, and Green Paradise.

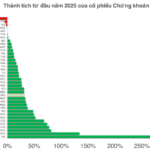

The IPO Boom Amidst a Stock Market Frenzy

Vietnam’s Initial Public Offering (IPO) market is experiencing an unprecedented boom, fueled by a surging stock market, new regulatory reforms, and a credit explosion.