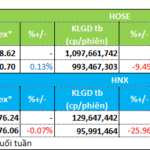

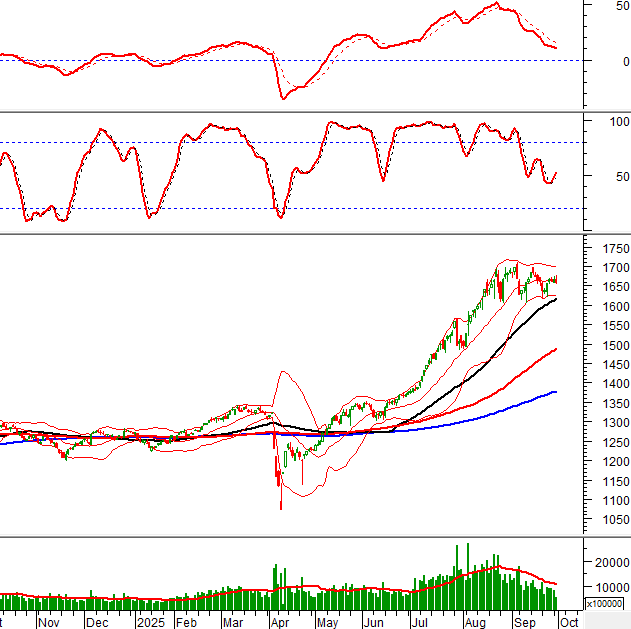

Technical Signals of VN-Index

During the morning trading session on September 30, 2025, the VN-Index continued to oscillate around the Middle line of the Bollinger Bands.

Although the Stochastic Oscillator indicator has given a buy signal again, the fluctuation process has not yet ended. The author expects the old August 2025 bottom to hold firm in the coming period.

Technical Signals of HNX-Index

During the morning trading session on September 30, 2025, the HNX-Index declined significantly, testing the lower edge of the Triangle pattern.

The Bollinger Bands are expanding again, and the index is below the Middle line, so investors need to exercise caution.

LPB – Loc Phat Joint Stock Commercial Bank of Vietnam

During the morning of September 30, 2025, the LPB stock price increased, accompanied by a Big White Candle pattern and a trading volume expected to exceed the average by the end of the session, indicating a positive investor sentiment.

Additionally, the stock price continues to closely follow the Upper Band of the Bollinger Bands, while the MACD indicator continues to rise after giving a buy signal. This suggests that the optimistic outlook is maintained.

Currently, LPB has set a new 52-week high and is retesting the old August 2025 peak (equivalent to the 47,500-49,100 range). If the price successfully surpasses this range, the upward trend will be more sustainable.

VRE – Vincom Retail Joint Stock Company

During the morning trading session on September 30, 2025, the VRE stock price surged, accompanied by a Rising Window pattern and a breakthrough in trading volume, exceeding the 20-session average, indicating more active investor trading.

Currently, VRE has set a new 52-week high, with the MACD indicator continuing to rise after giving a buy signal and crossing above the 0 level. This reinforces the medium-term upward trend.

(*) Note: The analysis in this article is based on realtime data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change when the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:08 September 30, 2025

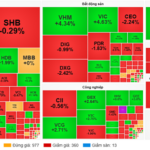

Vietstock Daily September 30, 2025: Market Polarization Persists

The VN-Index has rebounded, surpassing the Middle line of the Bollinger Bands. However, trading volume has declined for the fourth consecutive session, remaining below the 20-session average, indicating persistent investor caution. Meanwhile, the Stochastic Oscillator has already signaled a buy opportunity. If the MACD follows suit with a similar signal in upcoming sessions, the potential for sustained upward momentum will strengthen.

Market Pulse 29/09: Continued Divergence in Market Trends

At the close of trading, the VN-Index climbed 5.78 points (+0.35%) to reach 1,666.48, while the HNX-Index dipped 0.91 points (-0.33%) to 275.15. Market breadth favored decliners, with 469 stocks falling and 258 advancing. Similarly, the VN30 basket saw red dominate, as 18 members declined, 10 rose, and 2 remained unchanged.