The steel industry consistently attracts investor attention due to its steady growth. However, not all companies within the sector are thriving.

Many steel companies are facing operational challenges. (Image: B.L)

Recently, in the consolidated financial report for Q2/2025, Pomina recorded a net revenue of 461 billion VND, a 25% decline compared to the same period last year. Despite this, the company reported a loss of 170 billion VND due to high interest expenses eroding profits. This marks the 13th consecutive quarter of significant losses for Pomina, with 12 quarters exceeding 100 billion VND in losses.

As of Q2/2025, Pomina’s accumulated losses reached nearly 2.9 trillion VND. The company’s total assets stand at 9.498 trillion VND, but its liabilities amount to 9.502 trillion VND, resulting in a negative equity of over 4 billion VND.

Pomina’s primary revenue source is from processing activities, while its plant remains temporarily suspended. The company’s stock, POM, is currently restricted from trading due to the non-submission of audited financial reports for 2023 and 2024.

Amid Pomina’s struggles, several companies have expressed interest in acquiring it. However, the sale of 51% of Pomina’s shares to Japan’s Nansei failed due to foreign ownership limits capped at 50%. Negotiations with Thaco Industries also fell through.

Pomina’s greatest hope now lies with the Vietnam Steel Corporation (VNSteel). Both parties have signed a memorandum of understanding to establish Pomina Phu My Company and are in detailed negotiations to finalize the company’s formation in Q1/2026. VNSteel is expected to aid Pomina’s recovery, complete audits, and lift trading restrictions by 2026.

Steel companies are experiencing mixed business performances. (Image: Dai Viet)

Another industry giant, Nam Kim Steel, is also facing challenges. In Q2/2025, its revenue reached just over 3.8 trillion VND, a 33% drop compared to the same period last year. Net profit stood at 92 billion VND, a 58% decline year-over-year.

For the first six months of the year, Nam Kim Steel achieved a revenue of nearly 7.9 trillion VND, a 28% decrease from the previous year. Net profit was 157 billion VND, down 58% year-over-year.

The company’s revenue was significantly impacted by its export channel, as the U.S. implemented new tariffs and other countries strengthened trade protection measures. In the first half of the year, export revenue plummeted by over 50% compared to the same period last year, reaching just over 3.68 trillion VND.

Domestic revenue, however, partially offset this decline, reaching 4.248 trillion VND, a 21% increase year-over-year.

Dong A Steel is also caught in the downturn. In Q2/2025, the company reported a revenue of 4.257 trillion VND, a 29% decrease from the previous year, with net profit at 88 billion VND, down 49% year-over-year.

For the first six months, Dong A Steel’s net revenue was 8.233 trillion VND, an 18% decline from the same period last year, with net profit at 150 billion VND, down 44% year-over-year.

In the Q3 financial report for the 2024-2025 fiscal year (April 1 – June 30), Hoa Sen Group recorded a revenue of over 9.5 trillion VND, a 12% decrease from the previous year. Net profit was approximately 274 billion VND, matching the previous year’s figure.

For the first nine months, Hoa Sen achieved a revenue of nearly 28.2 trillion VND, a slight 3.3% decrease year-over-year. Profit reached 647 billion VND, down 7% from the same period last year. Hoa Sen maintained its profit margins by reducing selling expenses, increasing financial income, and improving gross profit margins.

Some steel companies are achieving positive business results. (Image: Dai Viet)

While some companies are struggling, others in the steel industry continue to show strong growth and stable profits.

In Q2/2025, Hoa Phat reported a revenue of approximately 36 trillion VND, with a net profit of 4.3 trillion VND. For the first six months, the company achieved a revenue of around 74 trillion VND, with a profit of over 7.6 trillion VND. These positive results are attributed to increased production of HRC (hot-rolled coil) and construction steel.

In Q2/2025, Vietnam Steel Corporation (VNSteel) recorded a revenue of over 10.6 trillion VND, a 5% increase year-over-year. Net profit was approximately 268 billion VND, up 39% from the previous year.

For the first six months, VNSteel’s revenue exceeded 20.66 trillion VND, a 17% increase year-over-year. Net profit reached 369 billion VND, up 54% from the same period last year. VNSteel’s success is driven by improved gross profit margins and increased financial income.

According to Tran Thi Thuy Dung, Head of Securities Consulting at Mirae Asset, global steel demand is recovering modestly at 1-2% annually, primarily driven by the construction and mechanical engineering sectors.

Vietnam is expected to benefit from public investment and a domestic real estate recovery but faces competition from China and trade barriers in export markets.

Additionally, the shift toward green transformation and higher environmental standards will be crucial for long-term success, requiring advanced technology and higher capital costs but opening opportunities for exports to premium and sustainable markets.

Dung also highlights challenges in the steel industry, such as excess capacity in segments like coated steel and steel pipes, which could pressure profit margins if domestic consumption does not match production levels.

Fluctuations in raw material prices (iron ore, coal, energy) and exchange rates can also quickly impact production costs and profits.

Furthermore, evolving international trade policies and legal frameworks will require companies to adapt swiftly, increasing risks for key export products.

Steel Giant Hoa Phat Records Impressive Production Figures: 31,800 Tons Per Day in August, a 34% Surge Year-on-Year

The lion’s share of crude steel output, a substantial 75%, is attributed to the Hoa Phat Dung Quat Integrated Steel Mill, with the remainder hailing from the Hoa Phat Hai Duong Integrated Steel Mill and the Hoa Phat Hung Yen Steel Rolling Mill.

“Hòa Phát to Reach 40,000 Tons of Crude Steel Production Capacity Per Day Starting Q4 2025”

In August 2025, Hoa Phat Group achieved a remarkable milestone in steel production, reaching a liquid steel output of 953,000 tons, equivalent to an impressive 31,800 tons per day. This figure marks a significant 34% increase compared to the same period last year, showcasing the company’s exceptional growth and dominance in the steel industry.

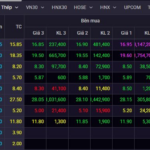

Steel Stocks are Turning “Green and Purple”: What’s the Deal?

From the depths of April 2025, stocks such as HPG, TVN, NKG, HSG, and TLH have surged by double-digit percentages.