UP Securities Joint Stock Company (UPSC) has announced the preparatory documents for the 2nd Extraordinary General Meeting of Shareholders in 2025, scheduled for the morning of October 21, 2025, in Hanoi.

One of the key agenda items to be reviewed at the meeting is the plan to offer shares to existing shareholders to double the charter capital.

Accordingly, UPSC plans to issue over 32 million shares, with a rights ratio of 1:1, meaning shareholders holding 1 share are entitled to purchase an additional 1 new share.

Shareholders with purchase rights may only transfer these rights once. The recipient of the transferred rights cannot further transfer them to a third party.

The issued shares will not be subject to transfer restrictions. The implementation is expected to take place in 2025, following the completion of the stock dividend issuance.

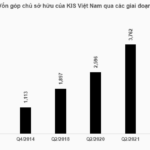

The offering price is set at 10,000 VND per share, with an estimated total proceeds of 320.5 billion VND. The share offering aims to increase the company’s operational capital, expand margin lending capabilities, and enhance underwriting capacity.

Upon completion of this offering, UPSC’s charter capital will double from 323.7 billion VND (after dividend distribution) to 644.3 billion VND.

At the upcoming meeting, the UPSC Board of Directors will also propose the cancellation of the public bond issuance plan previously approved at the 2025 Annual General Meeting of Shareholders.

After reassessing market conditions and business investment needs, the Board proposes an alternative plan to issue up to 300 billion VND in public bonds.

Specifically, the company plans to issue up to 3 million bonds with a face value of 100,000 VND each. These bonds are non-convertible, non-warranted, and unsecured, establishing a direct debt obligation for the issuer.

The bond interest rate and term will be determined by the Board of Directors. The anticipated 300 billion VND in proceeds will be allocated as follows: 50% to supplement capital for proprietary trading and underwriting, and 50% for margin lending.

In other developments, UP Securities previously announced that October 1, 2025, will be the record date for shareholders to receive stock dividends for 2024. The rights ratio is 25:2, meaning shareholders holding 25 shares will receive an additional 2 new shares.

Bustling Businesses Distribute Dividends

Sao Mai Group Corporation issued over 37 million shares as dividends, while Tien Thinh Group Corporation distributed more than 2.26 million shares as 2024 dividends at an 11% rate. Meanwhile, DIC Corp offered 150 million shares to existing shareholders at 12,000 VND per share, aiming to raise 1.8 trillion VND.

Vinaconex-ITC Welcomes New Chairman, Accelerates Cát Bà Amatina Project Under Fresh Ownership

Vinaconex-ITC’s shareholder structure has undergone a significant transformation with the addition of four new shareholders: Hanoi Anpha Real Estate Trading Floor LLC, Imperia An Phu LLC, Silver Field International Trading LLC, and Phu Quoc East Zone LLC.

Revitalizing Leadership: Vinaconex-ITC’s Strategic Overhaul Propels Cát Bà Amatina Project Forward

On September 26th in Hanoi, Vinaconex Tourism Investment and Development Joint Stock Company (Vinaconex-ITC, UPCoM: VCR) held its 2025 Extraordinary General Meeting of Shareholders. The meeting approved the early termination of the 2021-2026 Board of Directors and Board of Supervisors term, while also electing additional members and completing the personnel structure for the 2025-2030 term.