According to Vietcap, as of now, no decision has been made, and there is no voting mechanism in place, contrary to the misinformation spread by some domestic securities companies. FTSE Russell held two official meetings this month: the FTSE Country Classification Advisory Committee on September 2nd and the FTSE Russell Policy Advisory Board on September 18th. The FTSE Country Classification Advisory Committee comprises market experts with technical expertise in trading, portfolio management, and custody, while the FTSE Russell Policy Advisory Board includes senior personnel from investment management firms, investment advisors, and asset owners. The identities and opinions of these experts are confidential and not shared with the public.

The FTSE Country Classification Advisory Committee formally reviews countries on the Watch List (including Vietnam) for potential upgrades or downgrades. FTSE Russell’s recommendations are submitted to the FTSE Russell Policy Advisory Board for confirmation. Subsequently, these recommendations are shared with the FTSE Index Governance Committee for final approval. The FTSE Index Governance Committee meeting is scheduled for this week.

Vietcap believes the Vietnamese market can address the remaining criteria to achieve an upgrade to Emerging status in this review.

The first criterion is the Settlement Cycle (DvP). Currently rated as “Restricted” (needs to reach “Achieved” for an upgrade), this criterion relates to the pre-funding requirement for foreign institutional investors (FIIs), meaning funds must be available at T+0 for buy orders. The Ministry of Finance issued Circular 68 in November 2024 to eliminate this requirement and introduce a new No Pre-Funding (NPF) process. Over the past 11 months, FTSE Russell has assessed the effectiveness of the NPF process and gathered feedback from market participants. Vietcap is confident this criterion can be upgraded to “Achieved.”

The second criterion is Settlement – Costs Associated with Failed Trades. This criterion was upgraded from “Unrated” to “Restricted” in March 2025 (needs to reach “Achieved” for an upgrade). Following the implementation of NPF, a failed trade processing procedure was established, with clear explanations of critical timelines and associated costs. Vietnam recorded its first and only failed trade in December 2024. The domestic securities company (Vietcap) complied with the procedures and successfully resolved the issue. This failed trade also served as a test case for FTSE Russell to validate the practicality of the failed trade process. Vietcap believes this criterion can now be upgraded to “Achieved.”

Additionally, Vietcap highlights concerns raised by FTSE Russell.

The first concern is whether domestic securities companies can handle the initial implementation and portfolio rebalancing of index funds when Vietnamese stocks are added to their portfolios. Vietcap is optimistic about the market’s capacity.

Specifically, out of 82 securities companies in Vietnam, only 10 currently offer NPF services to FIIs. Based on the NPF limit regulations (twice the equity of the securities company minus margin loan debt), the total maximum NPF capacity of these 10 companies is 132 trillion VND (5 billion USD). Considering only the top 3 securities companies by FII market share (accounting for 66% of total foreign share), the total maximum NPF capacity is approximately 40 trillion VND (1.5 billion USD). This is sufficient to meet the NPF demand of index funds, estimated to purchase at least 1 billion USD in Vietnamese stocks (whether the NPF requirement is 1.5 billion USD or 5 billion USD).

Furthermore, index funds are expected to invest in Vietnam in multiple phases (approximately 200–250 million USD over 4 to 5 phases instead of a single 1 billion USD phase), alleviating any concerns about NPF capacity.

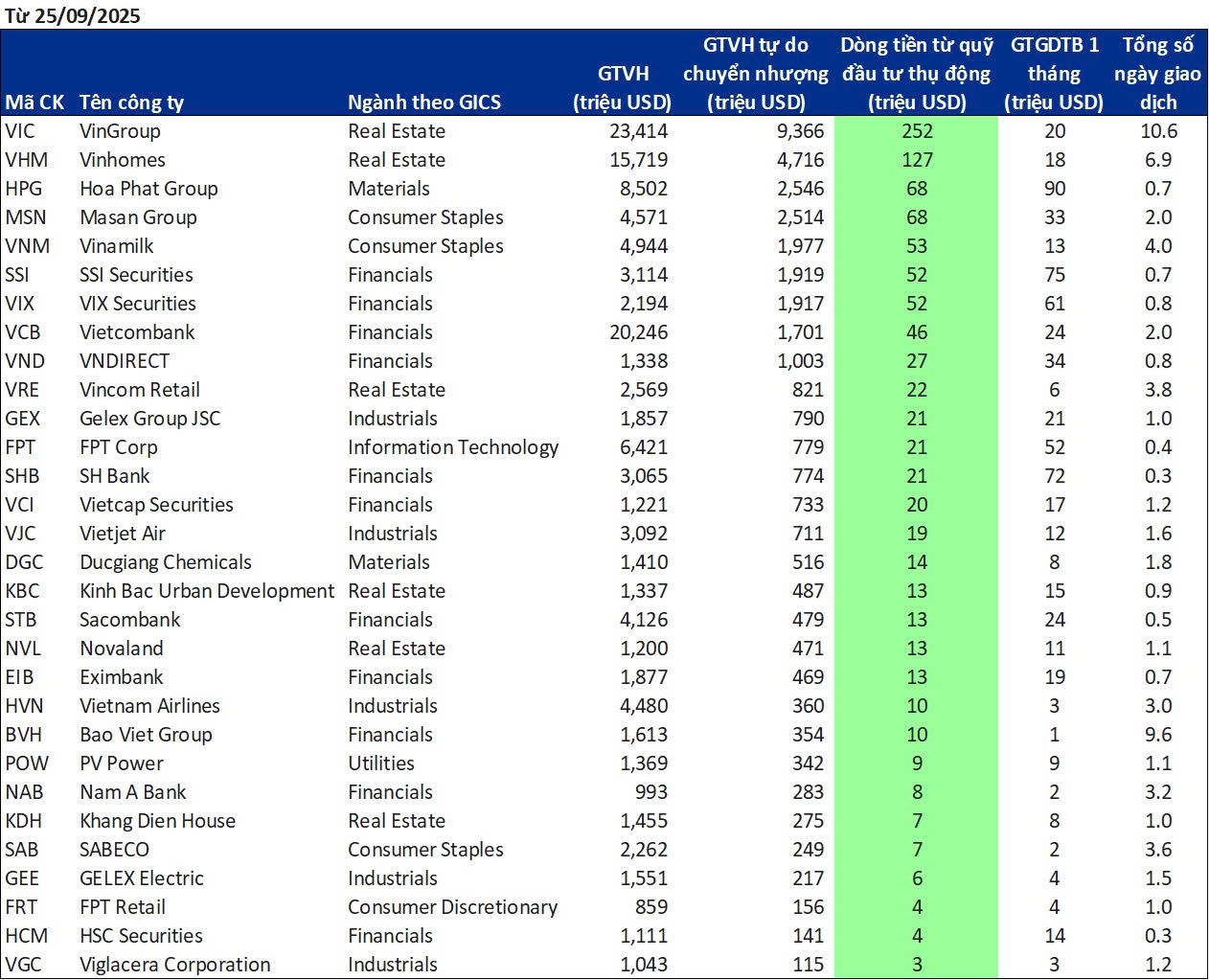

List of 30 potential stocks that index funds may add to their portfolios. Source: Vietcap

|

Another concern is whether index funds, which must sell securities in another Emerging Market (typically a T+2 market) to buy Vietnamese stocks, can meet the first cash check deadline at 3 PM on T+1 under NPF and avoid domestic securities companies having to post collateral for insufficient funds.

The primary solution is an Auto-FX agreement between the investor and the custodian bank, where the custodian bank guarantees funds as long as the FX order is submitted before the deadline (usually by 1 PM on T+1). This ensures smooth NPF transactions, eliminates the risk of insufficient funds, and prevents domestic securities companies from needing to post collateral. Based on recent discussions, Vietcap confirms that index funds already have similar Auto-FX agreements for other markets. In the absence of Auto-FX, index funds have until 3 PM on T+3 (at the latest) to transfer funds domestically to avoid failed trades.

Additionally, the account opening process has been considered a significant administrative burden for FIIs. The State Bank of Vietnam issued an official dispatch to commercial banks and foreign bank branches, requiring compliance with new regulations outlined in Circular 03 and Circular 25. This dispatch urges banks to strictly and promptly implement the new rules to shorten the account opening process. The most significant change is the elimination of consular legalization requirements for account opening documents. As a result, the account opening process for FIIs is expected to take only about 2 weeks, depending on cooperation between the domestic custodian bank and the investor.

With these analyses, Vietcap is highly confident that FTSE Russell will announce a positive outcome for Vietnam next Wednesday (October 8th).

– 15:29 30/09/2025

Asian Bank Revises Vietnam’s Growth Forecast Upward

The Asian Development Bank (ADB) has revised its growth forecast for Vietnam, projecting a 6.7% expansion in 2025, while adjusting the 2026 outlook to 6.0%. The latest report underscores Vietnam’s promising trajectory but emphasizes the need for accelerated structural reforms and sustainable infrastructure investments to sustain this momentum.

Revolutionary Proposal to Resolve Land Valuation Challenges

The proposed land price list is meticulously structured based on land type, region, and location. Provincial People’s Councils determine the land price table every five years, with the next update set to be announced and implemented starting January 1, 2026. Revisions and additions will be made as necessary to ensure accuracy and relevance.

The IPO Season Arrives: Largest Capital Raise Since 2018

After years of stagnation, Vietnam’s primary market is entering its most vibrant IPO season since 2018, with a wave of major corporations simultaneously launching plans to raise billions of dollars in capital.