The VN-Index has experienced a rollercoaster ride throughout the first three quarters of 2025, marked by sudden dips following tariff shocks and subsequent rebounds to new all-time highs.

Low interest rates have drawn domestic capital back into the market, causing liquidity to surge dramatically. Trading volumes on HoSE have reached record levels, with several sessions hitting $2-3 billion in matched orders.

As the market enters the final quarter of the year, what factors will trigger the next breakout for the VN-Index?

From a monetary and policy perspective, Mr. Nguyen Trong Dinh Tam, Deputy Director of ASEAN Securities Corporation’s Analysis Division, remains optimistic about the stock market’s prospects in Q4/2025. He cites favorable macroeconomic policies, including a low-interest-rate environment, accelerated credit growth, and increased public investment disbursement. Mr. Tam forecasts Vietnam’s 2025 credit growth to reach 17%, surpassing the initial target of 16%.

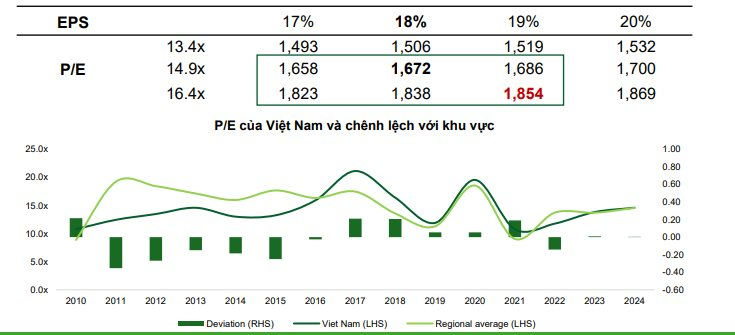

Additionally, the VN-Index’s valuation remains significantly lower than previous monetary expansion cycles, with a forward P/E of 13.3x for 2025F. The potential market upgrade, the IPO wave, and the digital asset narrative are expected to further boost market sentiment.

While CPI may rise due to abundant VND supply, inflation in 2025 is projected to remain well below the government’s target of 4.5%.

The USD/VND exchange rate, though still elevated compared to early 2025 (up 3.5% YTD according to Vietcombank’s selling rate), is expected to cool down in the final months. This is attributed to increased USD supply from remittances, international tourist spending, and the State Bank’s interventions since August 2025 (selling forward USD with cancellable options).

On the capital flow front, despite persistent net selling by foreign investors, domestic capital is anticipated to offset this impact. Low deposit rates are encouraging local investors to seek higher-yielding, liquid assets like stocks.

From a technical perspective, ASEANSC analysts predict a consolidation phase for the VN-Index, with immediate support at 1,600 points, before entering the next uptrend targeting 1,800 +/- by year-end (based on the Elliot Wave model).

Similarly, Vietcombank Securities (VCBS) recently reported that the stock market has significant upside potential in the final months of the year.

VCBS estimates the VN-Index’s P/E to range between 13.4x and 16.4x, with a base-case target of 1,672 points and a bullish target of 1,854 points by year-end. This outlook is supported by (1) potential market upgrades, (2) aggressive growth-boosting policies, and (3) continued diplomatic successes.

Analysts believe that low interest rates and robust credit growth in the final months will sustain market liquidity and elevate sector P/E ratios to new highs, propelling the VN-Index to fresh peaks.

With ambitious economic growth targets, a capitalization-focused investment strategy for the final months of 2025 should prioritize large-cap stocks, particularly in sectors reflecting Vietnam’s internal strengths: Banking, Securities, Real Estate, Retail, and Energy.

In his latest Facebook post, La Giang Trung, CEO of Passion Investment, argues that compared to 2020-2021, market participation is even stronger, while valuations remain lower. “In relative terms, August 2025 is comparable to December 2020 in terms of market cycle, valuation, volatility, and stock segment performance,” Mr. Trung analyzes.

He emphasizes the importance of focusing on the big picture and long-term trends. As long as liquidity remains abundant, the market has room to rise. Short-term fluctuations or individual stock movements won’t alter the long-term trajectory. With capital and liquidity 2-3 times higher than the 2020-2021 cycle, and valuations only halfway to previous peaks, “the VN-Index will surpass even the most optimistic investor expectations,” the expert asserts.

Foreign Investors’ Massive Sell-Off: Unveiling the Focus of the VNĐ 800 Billion Offload on September 29th

In the afternoon trading session, VPB and GEX emerged as the top net buyers in the market, with net purchase values of 114 billion and 111 billion, respectively.

Market Pulse 29/09: VIC and VHM Lead the Index, Foreign Investors Offload SSI

The robust support from VIC and VHM propelled the index into positive territory, despite the broader market leaning towards selling pressure. At the mid-session break, the VN-Index climbed over 8 points (+0.49%), reaching 1,668.76 points, while the HNX-Index rose by 0.17%, settling at 276.54 points. Market breadth showed 373 gainers, 250 decliners, and 977 unchanged stocks.