Stock Investors Begin to Incur Heavy Losses

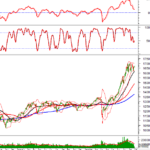

After retreating from the 1,700-point peak, the VN-Index continued to fluctuate within a narrow range, primarily consolidating around the 1,660-point mark. By the end of the week, the index edged up 0.13% to close at 1,660 points, maintaining its position above the psychological support level of 1,600 points. In contrast, the VN30-Index dipped 0.37% to 1,852 points, while the HNX-Index hovered around 276 points. The overall market movement revealed a clear exploratory stance: declining early in the week, recovering toward the end, but with significant divergence and low liquidity.

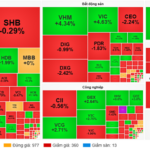

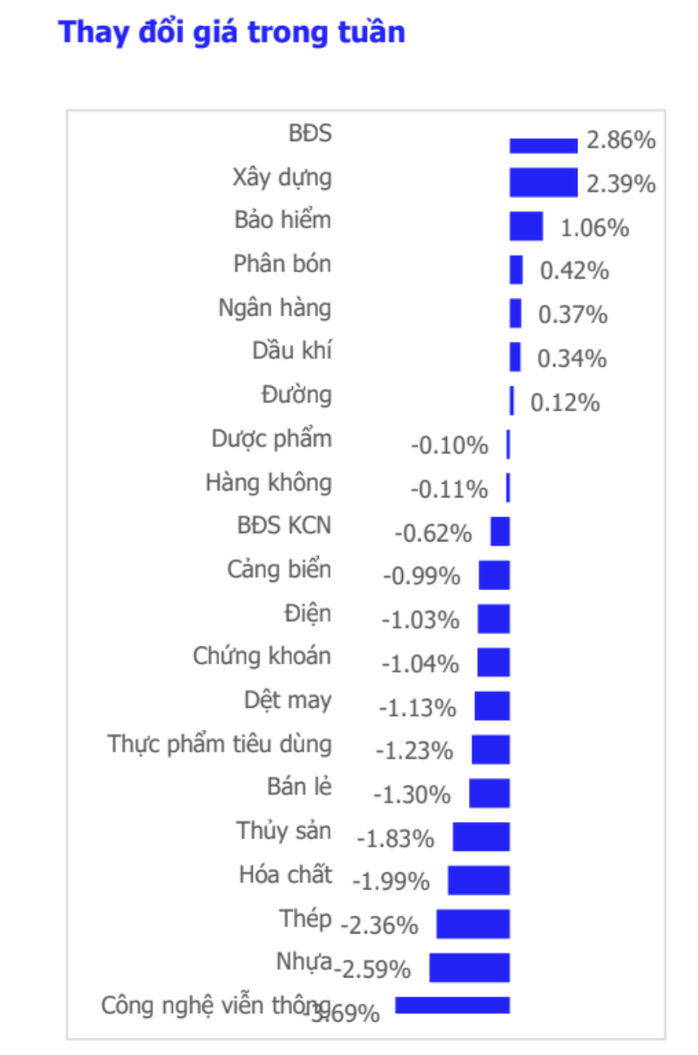

Sector performance was notably mixed. Construction saw positive gains, while insurance, energy, and industrial zones rebounded. Conversely, technology, telecommunications, steel, retail, ports, real estate, securities, and fertilizers faced downward pressure.

Interestingly, despite the index closing the week in the green, many investors experienced a “green on the outside, red on the inside” scenario: their portfolios remained in the red compared to the 1,700-point peak, as most stocks underperformed relative to the index.

The VN-Index closed the week in the green, but many investors’ accounts are significantly underwater compared to the 1,700-point peak.

According to SHS Securities, liquidity on the HoSE has declined for the second consecutive week, with average matching volume falling to approximately 910 million units per session—a notable decrease from the 1.67 billion units per session recorded in August. The cautious sentiment is evident as only a handful of large-cap stocks drove the index higher, while the rest of the market remained subdued.

Foreign investors continued their net selling streak for the 10th consecutive week, offloading a net 7,355 billion VND this week alone. Year-to-date, their net selling value has reached 96,522 billion VND. This prolonged selling pressure has further dampened domestic investor sentiment, particularly during upward movements.

Although the VN-Index is just 40 points shy of its historical high, many investor accounts have reported losses of 10–15%. For those with high margin ratios, the decline could be as steep as 20–25%. Ms. Thanh Hoàng from Ho Chi Minh City shared that her portfolio of banking and securities stocks has been stagnant for 2–3 weeks, with several holdings dropping 10–15% following the correction from the 1,700-point level. This has made capital rotation challenging amid the market’s tight liquidity.

What Should Investors Do?

Mr. Nguyễn Thái Học, an analyst at Pinetree Securities, described last week’s market as “green on the outside, red on the inside.” In the final two sessions, VIC and VHM alone contributed over 14 points to the VN-Index, yet the overall index only inched up by 3 points, highlighting the market’s weak breadth.

“Low liquidity indicates that new investors remain hesitant to enter, while existing holders are reluctant to sell at lower prices. While real estate and public investment show signs of recovery, their capitalization is insufficient to drive broader market momentum,” he noted.

According to Mr. Học, the market landscape is unlikely to change significantly in the upcoming trading week: narrow trading ranges, declining liquidity, and limited capital flow. A tug-of-war scenario remains likely, with potential retests of support levels before a clearer trend emerges. A pullback to around 1,600 points cannot be ruled out, especially if foreign investors persist in their net selling trend.

A positive note is that the banking sector is showing signs of forming a short-term bottom. If it stabilizes, it could serve as an anchor, helping the index maintain its foundation and accumulate strength to challenge the previous peak in the near future.

CSI Securities believes the probability of a breakout next week is low unless liquidity improves significantly. Investors should maintain a moderate stock allocation, focusing on stocks with tight accumulation patterns, strong Q3 earnings, and exposure to public investment disbursements or unique narratives (industrial zones, construction, select energy and utilities).

For portfolios in profit, technical pullbacks can be leveraged to increase positions, but strict stop-loss discipline is essential. For underwater portfolios, margin usage should be minimized, and holdings should be restructured toward stocks demonstrating relative strength compared to the broader market.

Sector stock price movements over the past week. Source: CSI

Vietnam Stock Market Outlook for the Year-End: Expert Insights

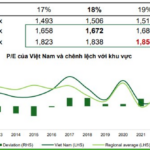

Market experts and leading securities firms unanimously predict that the stock market retains significant growth potential in the final months of the year.

Market Pulse 29/09: VIC and VHM Lead the Index, Foreign Investors Offload SSI

The robust support from VIC and VHM propelled the index into positive territory, despite the broader market leaning towards selling pressure. At the mid-session break, the VN-Index climbed over 8 points (+0.49%), reaching 1,668.76 points, while the HNX-Index rose by 0.17%, settling at 276.54 points. Market breadth showed 373 gainers, 250 decliners, and 977 unchanged stocks.

Technical Analysis Afternoon Session 29/09: Stochastic Oscillator Signals a Buy Opportunity

The VN-Index has continued its recovery trajectory, successfully testing a robust support level and breaking above the Bollinger Bands’ Middle Line. Meanwhile, the HNX-Index remains in a state of consolidation, trading sideways within a Triangle pattern.