| PMG Forms “Pine Tree” Pattern |

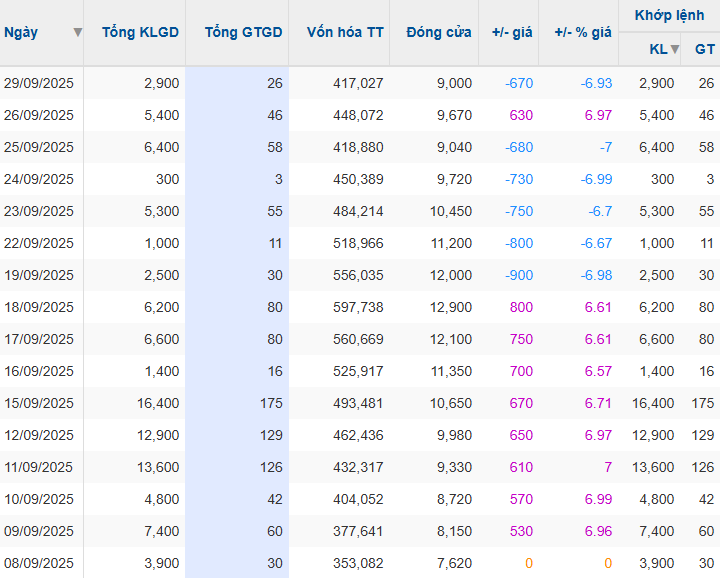

From September 19 to 25, PMG experienced five consecutive floor sessions, dropping from 12,900 VND/share to 9,040 VND/share, a 30% decline in market value.

According to PMG, the company’s production and business operations remain normal, with no unusual fluctuations affecting the stock price. The price decline is solely due to market supply and demand dynamics, and the company has taken no actions to influence the trading price. PMG is committed to complying with all legal regulations regarding information disclosure, ensuring transparency, and fulfilling its responsibilities to shareholders and investors.

For those monitoring PMG recently, these explanations are familiar, mirroring the company’s response to the consecutive ceiling sessions from September 9 to 15. Subsequently, PMG continued to rise for three more sessions, reaching 12,900 VND/share, before the decline that formed the “pine tree” pattern.

Liquidity during this period showed an upward trend but remained relatively low in absolute terms, with the highest session reaching only 175 million VND.

In the last two sessions, the stock alternated between ceiling and floor prices, summarizing the recent volatile trends. As of the close on September 29, PMG settled at 9,000 VND/share.

|

PMG Experiences Consecutive Floor Sessions After Ceiling Streak

Source: VietstockFinance

|

Regarding business performance, in the first half of 2025, the Da Nang-based household gas company reported nearly 940 billion VND in net revenue and over 10 billion VND in net profit, down 5% and 4% year-on-year, respectively. As of June 2025, PMG accumulated a loss of nearly 39 billion VND, keeping the stock under warning status.

| PMG Still Struggles with Accumulated Losses |

– 17:10 29/09/2025

Optimizing the Lottery Company: A Strategic Revamp for Financial Success

The Ha Tinh Lottery Company has been placed under special financial supervision, and if its financial situation does not improve, it may face a change of ownership or restructuring. This development underscores the importance of financial prudence and stability, especially in the lottery industry, where the stakes are high and the potential for financial pitfalls is ever-present.