Phú Tài Corporation (HOSE: PTB) has announced the cessation of operations at its Van Ninh Stone Exploitation Enterprise (a subsidiary in Khanh Hoa province), with plans to complete all procedures by December 24, 2025.

This move is part of a strategic restructuring of its member units, as Phú Tài will merge Van Ninh Enterprise into the Khanh Hoa Stone Exploitation Enterprise to streamline operations and enhance governance quality.

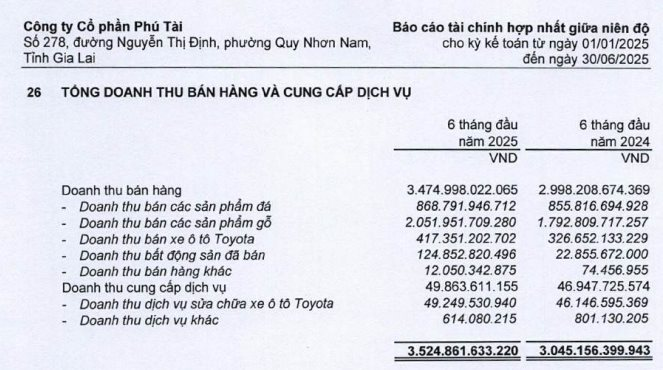

Stone mining is currently Phú Tài’s second-largest business segment, following wood and furniture manufacturing.

Previously, the company established a wholly-owned subsidiary with a charter capital of VND 50 billion. Named Phu Tai High-Grade Aluminum and Iron LLC, the new entity is headquartered in Cat Nhon Industrial Cluster (Gia Lai) and officially received its business registration on September 19, 2025.

Alongside streamlining its stone mining operations and expanding aluminum and iron production, Phú Tài plans to raise new capital through a rights issue, offering shares to existing shareholders at a 5:1 ratio and an expected price of VND 12,000 per share.

The company aims to issue nearly 13.39 million shares, raising approximately VND 160 billion. Of this, VND 116 billion will be allocated to increase capital at Phu Tai Binh Dinh Wood LLC, with the remainder invested in Phuc Tan Kieu LLC. Post-issuance, Phú Tài’s charter capital will rise from VND 670 billion to over VND 800 billion.

Meanwhile, on September 26, 2025, former President Donald Trump announced on Truth Social that the U.S. would impose tariffs of 30-50% on imported goods, including kitchen cabinets, bathroom vanities, upholstered furniture, and related products, effective October 1, 2025.

Vietcap Securities warns that Vietnamese wood export enterprises will face significant challenges in the coming period.

Phú Tài is expected to be the most heavily impacted, as the U.S. accounts for 60-70% of its wood segment revenue. The products facing tariffs of up to 50%, such as kitchen cabinets and bathroom furniture, are also Phú Tài’s primary production and export focus.

Phú Tài’s leadership hopes the U.S. will apply only one type of tariff (countervailing or protective) rather than cumulative tariffs, thereby mitigating the impact.

Despite having orders secured until the end of 2025 and into early 2026, Phú Tài’s management cannot rule out the risk of new order cancellations or delays. To counter this, the company will intensify efforts to explore new markets and reduce dependence on the U.S.

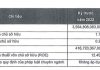

In the first half of 2025, Phú Tài reported revenue of VND 3,524 billion, a 15.8% year-on-year increase, with after-tax profit reaching nearly VND 250 billion, up 22%.

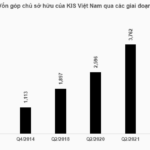

KIS Vietnam Proposes Shareholders to Approve Capital Increase Surpassing VND 4,500 Billion

KIS Vietnam Securities Corporation (KIS Vietnam) announces an extraordinary shareholders’ meeting scheduled for October 15th. The agenda includes approving a rights issue of over 78.9 million shares to existing shareholders, aiming to raise the company’s capital to more than VND 4,551 billion.

Empowering Textile Businesses: ACB Supports the New Order Cycle

Vietnam’s textile and apparel industry is rebounding strongly, with double-digit export growth and many businesses resuming hiring after a prolonged period of austerity. However, to transform this recovery into sustainable long-term success, the support of specialized financial partners like ACB is essential.

Ho Chi Minh City Unveils New Strategy to Attract Foreign Direct Investment (FDI)

On the afternoon of September 18th, during a press conference on Ho Chi Minh City’s socio-economic situation, Mr. Trần Việt Hà, Deputy Head of the Ho Chi Minh City Export Processing and Industrial Zones Authority (HEPZA), revealed that his team had surveyed and received feedback from 32 businesses exporting to the United States. The purpose of this survey was to assess the impact of retaliatory tariffs on these companies.