Vietnam’s logistics sector faces challenges despite its rapid growth, with foreign providers dominating support services.

Within the Vietnam Private Economic Landscape (ViPEL), Mr. Pham Quoc Long, Deputy General Director of Gemadept Corporation and Chairman of the Vietnam Association of Shipping Agents, Brokers, and Maritime Services (VISABA), highlighted a critical issue. Despite Vietnam’s rise as one of the most dynamic container transport markets in the region and its proximity to leading ASEAN logistics hubs, the country still faces a logistics trade deficit. This is primarily because most support services are provided by foreign entities.

Domestic enterprises primarily engage in stevedoring and small-scale operations, controlling only about 20% of the supply chain. This limitation prevents Vietnam from becoming a global maritime hub.

For instance, the Cai Mep port cluster aims to be a regional transshipment center, but its fragmented structure forces ships to unload cargo onshore before transferring to another port.

Mr. Long emphasized the need for large-scale port investments, including maritime infrastructure, functional zones, ship repair and construction facilities, and interconnected port systems.

The total estimated investment is approximately $10 billion, to be raised from domestic and foreign enterprises alongside national budget funds. The project is expected to span 10 years and create over 20,000 jobs.

In recent years, Vietnam’s logistics sector has emerged as a regional highlight in Asia, poised to boost exports, e-commerce, and infrastructure investment.

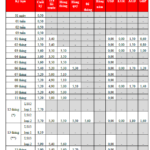

According to Mordor Intelligence, Vietnam’s logistics and freight transport market is projected to reach $52.06 billion by 2025, with robust growth anticipated in the coming years.

Other forecasts vary but unanimously acknowledge the sector’s vast potential. For example, Expert Market Research reports that Vietnam’s logistics market was valued at $80.65 billion in 2024 and is expected to reach approximately $149.98 billion by 2034, growing at a CAGR of around 6.40%.

IMARC Group estimates that Vietnam’s logistics market will reach about $30 billion in 2024 and continue to grow during the 2025-2033 period.

The Three Largest Vietnamese Seaports with a Global Freight Advantage

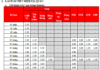

The Vietnam Maritime Administration has announced that Lloyd’s List, a renowned UK-based maritime industry magazine, has released its 2025 rankings of the top 100 container ports worldwide by cargo throughput. Notably, three Vietnamese ports have made it to this prestigious list: Ho Chi Minh City, Hai Phong, and Cai Mep.

The World is Our Oyster: Unveiling Vietnam’s $600 Billion Mega Seaport

This is a key project for the province, designed to drive economic and social development in the local area. With a focus on innovation and sustainability, this project aims to bring about positive change and improve the lives of those in the community.

The Power of Logistics: Unlocking Vietnam’s Rapidly Growing Service Sector

According to the Vietnam Logistics Service Enterprises Association (VLA), the logistics industry in Vietnam has been growing at a remarkable rate of 14% – 16% in recent years, reaching a scale of 40 – 42 billion USD annually.

The Master Plan to Transform the Group of Seaports into a ‘Promised Land’ for Major Shipping Lines

On the morning of August 28, Deputy Prime Minister Tran Hong Ha chaired a meeting with several ministries, sectors, and localities regarding the detailed draft planning for seaports, wharves, piers, moorings, water areas, and water routes for the period 2021–2030, with a vision towards 2050 (Detailed Planning for Seaport Groups). The meeting also discussed investment policies for the Saigon Gateway International Transhipment Port Project.