Russia’s Natural Gas Exports to China: A Strategic Shift with Significant Price Concessions

According to Oilprice, Russia’s 2026 budget outlook reveals plans to sell natural gas to China at prices significantly lower than those offered to Europe and Turkey in the coming years. The draft, published by Russia’s Ministry of Economic Development, indicates that gas exports to China will be at least 27% cheaper than European and Turkish rates over the next three years. This gap is projected to widen to 38% by 2025.

These figures underscore the concessions Russia is making as it pivots its energy exports eastward, following its near-exclusion from the European market. Massive volumes of Siberian gas are now being redirected through the Power of Siberia pipeline, with the Power of Siberia-2 project—capable of delivering 50 billion cubic meters annually to northern China—in active development.

However, this stable outlet comes at a steep cost: Russia is accepting prices far below its previous European rates. Russian officials have openly acknowledged this trade-off. Gazprom CEO Alexei Miller confirmed the lower prices for China, while President Vladimir Putin framed it as a “competitive advantage” for Beijing.

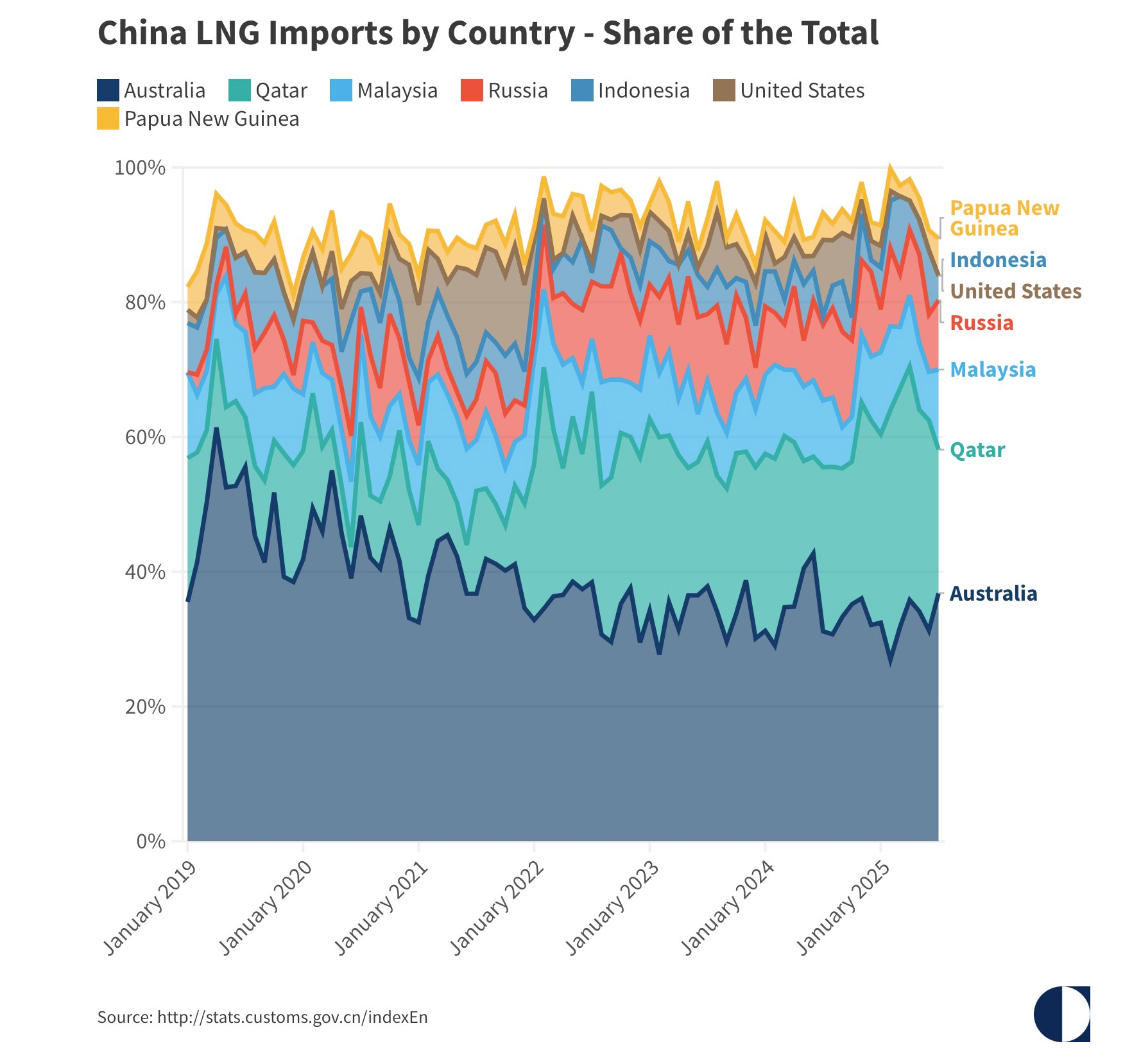

China’s LNG Imports by Country (January 2019 – January 2025)

China, meanwhile, employs more cautious rhetoric. Official statements emphasize “market-based pricing” and “competitive terms,” but media outlets like Guancha and Cnyes confirm that Moscow has offered Beijing preferential rates compared to Western clients.

This dynamic highlights China’s superior bargaining position as a long-term, high-volume consumer of Russian energy amid global supply chain shifts. While securing stable gas exports, Russia faces significantly reduced revenue per unit, placing substantial financial strain on Gazprom, already reeling from the loss of its highest-paying European customers.

Additionally, China’s access to discounted pipeline gas could reshape regional markets. Armed with low-cost supplies, Beijing gains leverage in spot LNG negotiations with other providers, intensifying competition across Asia.

Natural gas has become a cornerstone of China’s strategic vision. Through massive investments in extraction, transportation, and LNG infrastructure, China overtook Japan as the world’s top LNG importer in 2023, purchasing 72 million tons compared to Japan’s 66 million. In 2024, imports rose to 78 million tons, with 6% sourced from the U.S.

LNG has also served as a diplomatic tool in U.S.-China relations. During Donald Trump’s first term, Beijing used LNG purchases to ease trade deficit tensions. In Trump’s second term, China proposed increasing U.S. LNG imports, though with less success.