Image. Government Newspaper

Coteccons Construction Joint Stock Company (HoSE: CTD) has released its Annual General Meeting (AGM) documents for the 2026 fiscal year (spanning from July 1, 2025, to June 30, 2026), unveiling the most ambitious business targets in its history.

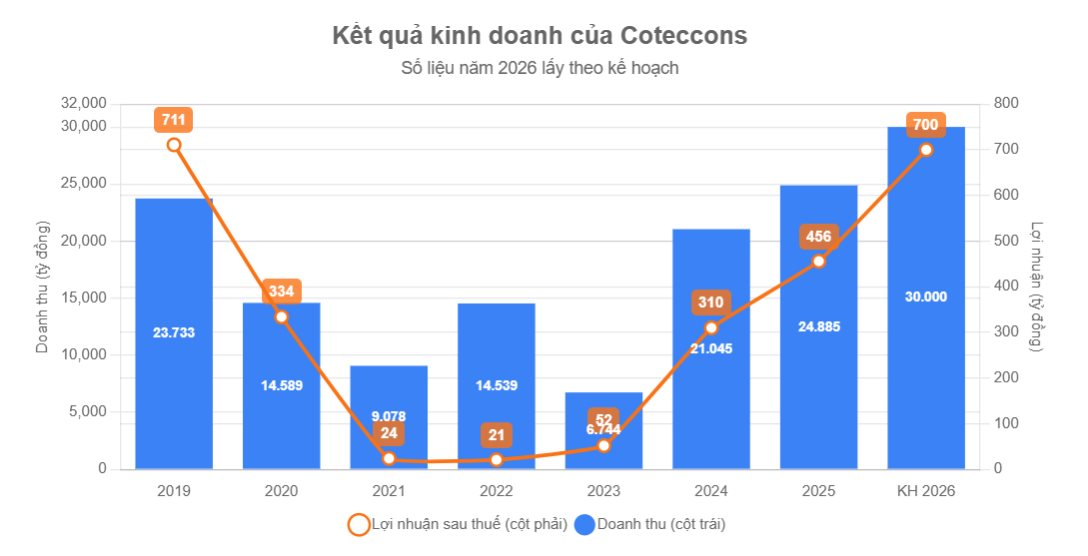

Specifically, the leadership has set a consolidated revenue target of VND 30,000 billion, a 20.6% increase compared to the previous year’s performance. This figure surpasses the company’s previous revenue peak in 2018 by approximately VND 1,440 billion. The post-tax profit goal has also been raised to VND 700 billion, reflecting a 53.5% growth.

This bold plan is underpinned by the positive business results of the 2025 fiscal year. CTD recorded a revenue of VND 24,885 billion, achieving 99.5% of its target, and a post-tax profit of VND 456 billion, exceeding the set goal by 6%.

During a recent dialogue, company executives revealed that the backlog (unsigned contracts) as of the end of Q1 2026 (September 30, 2025) reached an impressive VND 45,000–50,000 billion, laying a solid foundation for future growth.

However, Coteccons’ financial landscape also presents areas of concern. The Supervisory Board’s report highlighted a critical issue: the cash flow from core operations in 2025 was negative by VND 1,153 billion.

This is attributed to rapid revenue growth leading to slower debt recovery and increased inventory levels. Additionally, the gross profit margin declined compared to the same period last year, indicating suboptimal cost control across projects. The Supervisory Board recommends that management focus on enhancing efficiency from the bidding stage and fostering a culture of cost-effectiveness to improve profit margins.

To achieve these historic goals, Coteccons has outlined three key strategic directions. The first priority is preparing to engage more deeply in public investment and infrastructure projects. The company plans to recruit experienced personnel in working with government agencies, adopt new construction methods, and invest in additional machinery and equipment.

The second strategy involves a structured international expansion. Coteccons has already achieved initial successes, such as securing contracts in Taiwan, obtaining operational licenses in the U.S., launching a project in Kazakhstan, and finalizing procedures in Saudi Arabia. The third focus is enhancing cost efficiency and profit control from the early stages of projects.

Groundbreaking ceremony for the Long Thanh Airport package by the consortium. Image: Coteccons

Currently, the strategy to enter the infrastructure sector is evident through Coteccons’ involvement in large-scale projects. Most notably, the company plays a key role in major packages of the Long Thanh International Airport megaproject. Coteccons has partnered with industry leaders such as Construction Corporation No. 1 (CC1) and FECON to secure critical tenders.

Regarding shareholder proposals, the Coteccons Board of Directors suggests withholding dividends for the 2025 fiscal year, retaining the entire undistributed post-tax profit of VND 1,054 billion for business operations. Additionally, the company proposes issuing over 5.07 million bonus shares to increase the charter capital to VND 1,087 billion, planned for execution in the 2026–2027 fiscal year.

Will Long Thanh Airport Spur the Rise of a New Commodity City?

The Ministry of Construction has recently submitted a proposal to the Airports Corporation of Vietnam (ACV) regarding the establishment of an air logistics center integrated with a duty-free zone at Long Thanh International Airport in Dong Nai Province. This initiative aims to pave the way for a free trade area and the development of a “cargo city,” positioning the airport as a key hub for global trade and logistics.