In the final trading session of September 2025, Vietnam’s stock market experienced a narrow range of fluctuations. At the close, the VN-Index dipped slightly by nearly 5 points to 1,661.7. Trading value on HoSE reached approximately VND 29,155 billion.

Meanwhile, foreign investors continued their net selling streak, offloading VND 1,268 billion across the market. The breakdown is as follows:

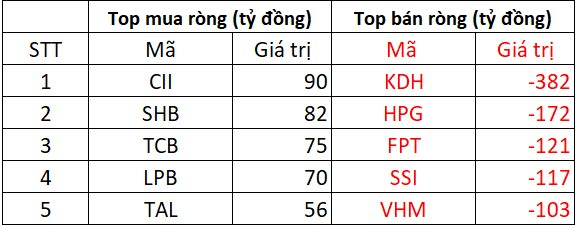

On HoSE, foreign investors net sold approximately VND 1,280 billion

On the buying side, CII and SHB led the market with net purchases of VND 90 billion and VND 82 billion, respectively. Following closely, TCB, LPB, and TAL were also net bought, with values ranging from VND 56 billion to VND 75 billion.

Conversely, the real estate stock KDH saw the heaviest net selling by foreign investors, totaling VND 382 billion. HPG was also significantly net sold, with VND 172 billion. Additionally, FPT, SSI, and VHM faced net selling of around VND 103–121 billion.

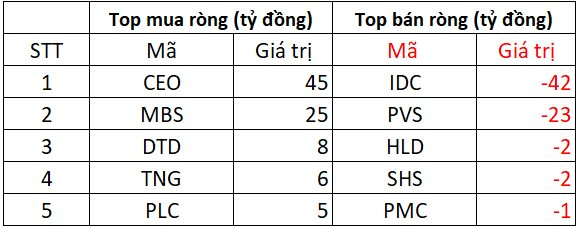

On HNX, foreign investors net bought over VND 18 billion

On the buying side, CEO and MBS were net bought by foreign investors with values of VND 25–45 billion. DTD, TNG, and PLC also saw net inflows of a few billion dong.

In contrast, IDC faced net selling of VND 42 billion, while PVS was net sold VND 23 billion. HLD, SHS, and PMC also experienced minor net selling of a few billion dong.

On UPCOM, foreign investors net sold VND 6 billion

On the buying side, VEA and DDV were net bought with values of VND 3–6 billion. MCH, ABI, and MPC also saw net purchases of VND 2 billion each.

Conversely, ACV faced net selling of VND 20 billion, while SAS was net sold VND 2 billion. MA1, HNG, and PAT also experienced minor net selling of a few hundred million dong.

Market Pulse 10/01: Recovery Momentum Spreads Across Financial Sector, VN-Index Poised for Breakout

As of 10:30 AM, the market remains bullish, with the VN-Index climbing over 3.5 points to trade at 1,665. The HNX-Index also saw a modest uptick, hovering around 273 points. Leading the charge in this upward trend are the finance, industrial, and materials sectors, which continue to make significant contributions to the overall market gains.

Market Pulse 30/09: Capital Flows Return as VN-Index Experiences Deep Correction

After a sharp decline at the start of the afternoon session, the market gradually recovered, closing near the reference level. However, the indices still ended the day in negative territory. The VN-Index closed at 1,661.7 points, down nearly 5 points, while the HNX-Index settled at 273.16 points, shedding 2 points.