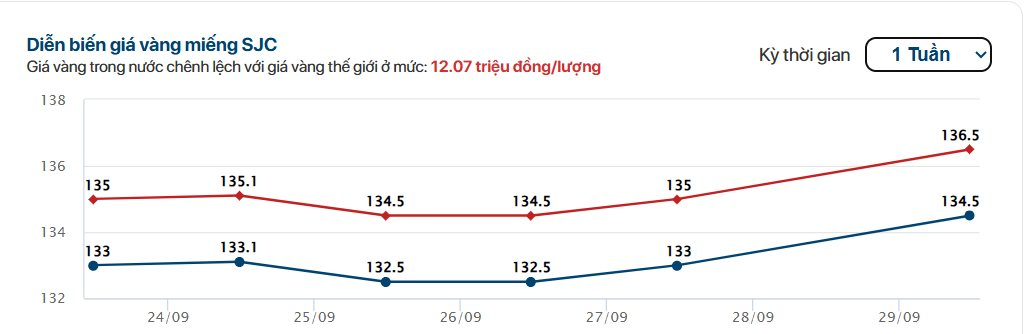

This morning, Mi Hong Gold (Ho Chi Minh City) continued to adjust the price of gold rings to VND 131.8 – 133.3 million per tael (buy – sell), an increase of VND 1.6 million per tael in both buying and selling compared to the same time yesterday. Meanwhile, the price of gold bars at Mi Hong rose to VND 135.5 – 136.5 million per tael, up by VND 1.5 million per tael.

At other brands, the price of gold bars from Bao Tin Minh Chau, PNJ, DOJI, and SJC Company is currently listed at VND 134.5 – 136.5 million per tael, unchanged from the previous day’s closing session.

Gold price fluctuations over the past week. (Source: Cafef)

The price of gold rings at these companies remains unchanged from yesterday’s closing session. Specifically, Bao Tin Minh Chau keeps the price of gold rings at VND 130.6 – 133.6 million per tael; PNJ and DOJI at VND 129.9 – 132.9 million per tael; and SJC Company at VND 129.7 – 132.4 million per tael. Compared to the same time yesterday, the price of gold bars and gold rings at these companies has increased by an average of VND 1 million per tael.

In the global market, gold is currently trading at $1,838 per ounce. Gold prices experienced a volatile start to the week, repeatedly hitting new highs driven by safe-haven demand amid concerns of a potential U.S. government shutdown.

The current focus is on the U.S. Congress passing a short-term spending bill before the deadline on Wednesday to avoid a government shutdown. The bill currently only funds the government until mid-November. Congressional leaders are expected to meet with President Trump at the White House today for negotiations.

This uncertainty has pressured the U.S. dollar at the start of the week, boosting gold prices. Analysts suggest that investors are turning to gold as a preferred safe-haven asset, despite warnings of overheating. Last weekend, the world’s largest gold ETF, SPDR Gold Trust, added another 18 tons of gold. However, total holdings by global ETFs remain significantly lower than the 2020 record.

Meanwhile, global stock markets saw mild fluctuations overnight, ranging from sideways to upward movements. U.S. stock indices are expected to open in the green as the New York session begins.

According to experts, gold prices are currently hovering around new record levels. Political instability in the U.S. is pressuring the dollar, further fueling the rise of the precious metal. However, in the short term, the market faces high risks of a deep correction or technical consolidation phase. Nonetheless, the long-term trend remains bullish, with gold expected to continue setting new price highs.

Deutsche Bank recently raised its gold price forecast to $4,000 per ounce by the end of 2025, citing record demand from central banks, a weakening U.S. dollar, and prolonged uncertainties surrounding the Fed’s independence. Meanwhile, Goldman Sachs also increased its 2025 year-end forecast to $3,700 per ounce (from $3,300 previously), presenting an even more optimistic scenario where gold could reach $4,500 per ounce.

Unbelievable Low Prices on Plain Gold Rings at Small Stores as of September 25th

The price of 99.99% pure gold rings in numerous small shops across Ho Chi Minh City is currently trading on par with the global market rate.

Governor Requests the State Bank to Increase Gold Supply to Stabilize the Market Without Exploiting Policies

Are there any other adjustments you would like to make to this text? I can perform additional edits if you wish.

“The Prime Minister has instructed the State Bank to closely monitor global and domestic gold price fluctuations and, within its authority, promptly employ the necessary solutions and tools as stipulated to stabilize the gold market and reduce the gap between international and domestic gold prices.”

The Ever-Rising Gold Price: To Control or Let Go?

The dynamic nature of the gold market has once again come to the forefront as global gold prices witness a downturn, while domestic gold prices soar. This contrasting movement has resulted in a significant gap of 21.4 million VND per tael between the local SJC gold bar and its global counterpart. Experts advocate for a hands-off approach, suggesting that the gold market be allowed to self-regulate to avoid potential repercussions on the exchange rate and the economy at large if intervention through imports were to take place.

Gold’s Non-Stop Rally Has Investors on Edge: “I Need to Sell 22 SJC Gold Bars at VND 155 Million per Tael”

“The gold market is buzzing with excitement as the SJC gold bar prices surge! This is your chance to shine and make some lucrative investments. Stay ahead of the game and be a part of this exciting opportunity. Will the prices continue to soar? Stay tuned and keep an eye on the latest updates to make informed decisions.”