The latest report from the Asian Development Bank (ADB) highlights that Vietnam’s economic growth in the first half of 2025 was driven by a surge in exports, ahead of new U.S. tariffs taking effect, and domestic expansionary policies.

ADB experts caution that tariffs could slow growth in the second half of 2025. While the domestic economy is expected to remain resilient, growth is projected to moderate compared to the robust performance in the first half of the year.

Overall, the growth forecast for 2025 has been slightly revised upward from the April 2025 ADO report, but lowered for 2026. Downside risks to growth prospects stem from global uncertainties and domestic factors.

Specifically, the report analyzes that Vietnam’s economy will remain stable during 2025–2026, supported by expansionary fiscal and monetary policies. U.S. countervailing duties effective from August 7, 2025 (20% on imports and 40% on transshipments) may impact short-term growth, but economic stimulus measures are expected to mitigate these effects.

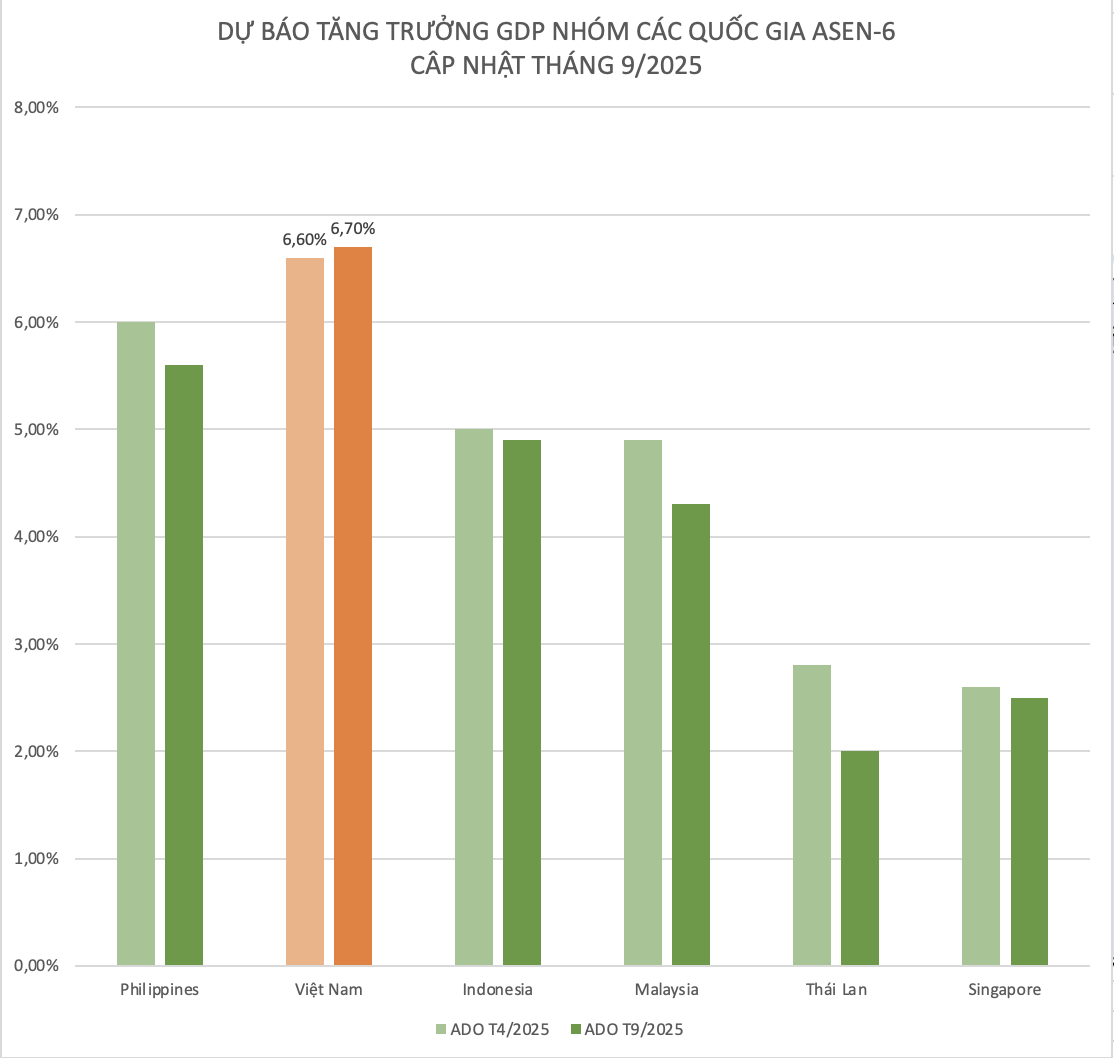

Based on this, ADB has adjusted Vietnam’s GDP growth forecast for 2025 upward to 6.7% and downward to 6.0% for 2026 (compared to 6.6% and 6.5% in the April 2025 ADO report).

Compared to other ASEAN-6 countries, Vietnam is the only nation whose GDP growth forecast for this year has been revised upward by ADB from the April report. Meanwhile, other countries saw downward adjustments of 0.1–0.8 percentage points. Thus, with an expected growth rate of 6.7% in 2025, Vietnam leads the ASEAN-6 region in GDP growth.

The report also notes that risks to growth prospects include both internal and external factors. If the global economic environment deteriorates more than expected due to slower growth in major trading partners and increased financial market volatility, challenges to the economy will rise, particularly through weakened exports and investment flows. Uncertainty surrounding countervailing duties on transshipments could reduce trade and investment.

Domestically, while public investment reforms have yielded results, rising financial risks and delays in policy coordination limit the effectiveness of growth stimulus measures.

Key Factors for Vietnam to Sustain Growth Momentum

Assessing specific economic sectors, the report states that industrial output is expected to grow by 7.7% in 2025, driven by higher exports of manufactured goods. However, global uncertainties and high U.S. tariffs may constrain industrial production in the second half of 2025. The construction sector is expected to regain momentum as the government accelerates major infrastructure projects.

Service sector growth is forecast to remain strong at 7.4%. The sector will benefit from continued growth in finance, logistics, transportation, communications, retail, and particularly tourism and related industries.

Agriculture is projected to grow by 3.4% in 2025. Global demand for high-quality, sustainable food products, coupled with the widespread adoption of smart farming technologies, will drive this sector. However, agriculture faces risks from climate change, fragmented land holdings, limited technology access for smallholder farmers, and volatile global commodity prices.

Domestic consumption continues to be supported by accommodative monetary and fiscal policies. The expansion of retail networks, increased e-commerce penetration, and the recovery of tourism-related services will bolster domestic demand. However, weakening manufacturing and exports due to U.S. tariffs may reduce demand for logistics, finance, and business services in the second half of 2025.

“If trade tensions persist, investment could slow, impacting growth in high-value service sectors in 2026,” ADB analyzes.

Effective Public Investment is Key to Sustaining Growth and Reducing Infrastructure Bottlenecks. With public debt below 34% of GDP—well below the 60% threshold—Vietnam has significant fiscal space for growth-supporting measures. Comprehensive institutional reforms will streamline the legal environment, enhance disbursement efficiency, and boost the domestic economy. However, capacity constraints in project planning, implementation, and management at all levels continue to hinder timely disbursement.

Regarding FDI and trade, ADB experts note that tariff uncertainties are disrupting FDI and trade activities. Exports to the U.S. are likely to slow significantly after the earlier “front-loading” period, with the new 20% tariff taking effect, causing export-oriented manufacturers to delay or scale back plans.

Trade flows will also shift as businesses restructure supply chains and pricing. Imports in August began to slow, declining by 0.8% compared to July. However, in the first eight months of 2025, exports rose by 14.8% and imports by 17.9%.

For the remainder of the year, tariffs will continue to pressure trade and investment, underscoring the need to transition toward a more balanced growth model with stronger domestic demand and diversified export markets to mitigate tariff shocks.

With a favorable fiscal position, the government can implement growth stimulus measures through targeted tax cuts, reducing compliance costs for businesses, and increasing social spending for low-income households. Coordinating structural reforms to improve the business environment and labor productivity will maximize effectiveness. The budget deficit is projected to be 3.8% of GDP in 2025.

The central bank continues to maintain growth-supportive policies. Credit growth is likely to meet or exceed the 16% target for 2025, with a more flexible approach by the State Bank of Vietnam in credit management. However, concerns about asset quality, loan portfolio risks, and potential inflationary pressures persist. In the short term, rising non-performing loans and declining bank profitability will limit further monetary easing.

Closer coordination between fiscal and monetary policies will support growth, avoiding excessive pressure on monetary policy and ensuring macroeconomic stability. Long-term comprehensive legal reforms are needed to address structural challenges, including climate change adaptation, private sector competitiveness, state-owned enterprise restructuring, tax system modernization, and digital transformation. These are key to creating a more balanced growth model.

Inflation is forecast at 3.9% in 2025 and to ease slightly to 3.8% in 2026. Lower global energy prices have contributed to reduced transportation costs, a significant component of the consumer price basket. However, government adjustments to healthcare, education, and electricity prices continue to create inflationary pressures. Accelerated public investment disbursement and high credit growth may increase material and service prices. Currency depreciation could further fuel inflation through higher import costs.

MobiFone and SOVICO Partner to Develop Multi-Utility Telecom Technology Ecosystem

Yesterday in Hanoi, MobiFone Telecommunications Corporation and SOVICO Group signed a comprehensive Memorandum of Understanding (MoU), marking the beginning of a transformative journey to build a multi-utility technology and service ecosystem. This partnership aims to drive national development, empower businesses, and enhance services for the people.

Proposing Fresh Content Ideas on Deposit Insurance

Some argue that the insurance payout limit of 125 million VND has become outdated in relation to today’s living standards, necessitating a more flexible adjustment.

Asian Bank Revises Vietnam’s Growth Forecast Upward

The Asian Development Bank (ADB) has revised its growth forecast for Vietnam, projecting a 6.7% expansion in 2025, while adjusting the 2026 outlook to 6.0%. The latest report underscores Vietnam’s promising trajectory but emphasizes the need for accelerated structural reforms and sustainable infrastructure investments to sustain this momentum.

AEON Văn Giang: The New Shopping & Dining Destination in Eastern Hanoi

On October 2nd, AEON Vietnam will unveil its 11th shopping center, AEON Van Giang, in Hung Yen province. This landmark opening signifies a major step in AEON’s market expansion strategy, offering residents a modern, safe, and convenient destination for shopping and dining.