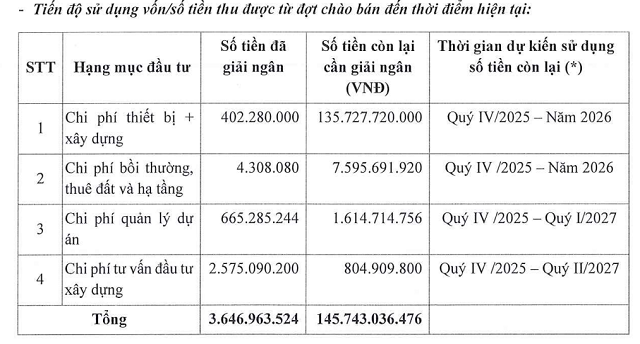

As planned, the disbursement phase is expected to take place from Q4/2024 to the end of 2025. However, by the end of September, TNB had only spent approximately VND 3.6 billion, equivalent to 2.4% of the raised funds, primarily on construction investment consulting fees (VND 2.6 billion). The remaining funds will continue to be utilized from Q4/2025 to Q2/2027, with the key focus on construction and equipment procurement expected to be completed in 2026. The company stated that the progress changes have led to a slower disbursement schedule than initially planned.

Source: TNB

|

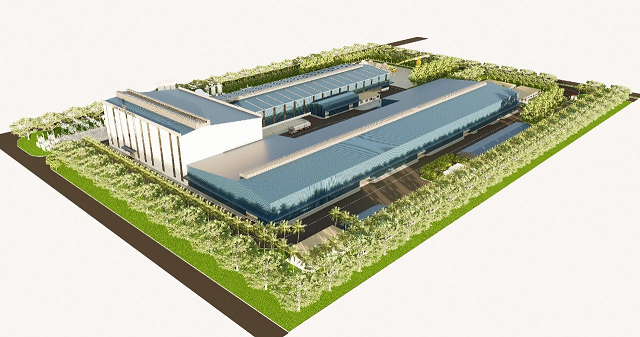

Rendering of Nha Be Steel’s expansion project. Source: TNB

|

Following the offering, VNSteel’s ownership in TNB increased from 69.07% to 84.77%, with the charter capital rising to VND 294 billion. The additional issued shares are restricted from transfer for one year. The total investment for the expansion project is approximately VND 450 billion, including VND 157 billion in equity and over VND 292 billion in commercial loans. The primary goal is to help TNB secure a steady supply of billets, reduce external dependency, stabilize steel rolling production, and optimize costs to enhance competitiveness.

In 2025, TNB aims to produce and sell 110,000 tons of rolled steel, a 16% increase compared to 2024. However, the company forecasts market challenges due to unrecovered demand and oversupply from cheap Chinese steel imports. The lack of a billet production stage makes TNB vulnerable to raw material price fluctuations.

The first half of 2025 showed promising business results. Revenue reached nearly VND 774 billion, a 16% increase year-over-year; after-tax profit was VND 2.2 billion, up 7%. For the full year, TNB targets VND 1.6 trillion in revenue and VND 4 billion in after-tax profit, the highest in four years, with approximately half of the plan already achieved.

As of the end of June, short-term receivables stood at VND 146 billion, and inventory at VND 179 billion, representing a significant portion of TNB‘s total assets. Short-term debt was VND 212 billion, equivalent to 32% of total assets, a substantial decrease from 53% before the capital increase through the offering to the parent company.

Nha Be Steel originated as Viet Thanh Steel (VITHACO) before 1975 and later became a state-owned enterprise under the Ministry of Machinery and Metallurgy. After several name changes, the company was officially equitized in 2008, becoming a subsidiary of the Vietnam Steel Corporation.

In 2013, the company completed the relocation of its entire factory from the old District 7 (Ho Chi Minh City) to Nhon Trach 2 Industrial Park (Dong Nai), launching a steel rolling mill with a capacity of 180,000 tons/year. Currently, Nha Be Steel is implementing a project to add a billet production stage with a capacity of 150,000 tons/year to secure raw materials and improve production efficiency.

Will Nha Be Steel receive more capital from VNSteel soon?

– 10:08 30/09/2025

The Stock Market Ahead of the Trading Session: “Hot Seat” of an Insurer with a Controlling Shareholder After Two Years

The position of Chairman of the Board for this insurance conglomerate has been vacant since August 2022. A challenging yet rewarding opportunity awaits a seasoned leader to step into this role and steer the company towards continued success.