The Ho Chi Minh City Stock Exchange (HOSE) has officially approved the listing of Nam Tan Uyen Industrial Park Joint Stock Company (stock code: NTC) on the HOSE. The total number of shares listed is nearly 24 million units.

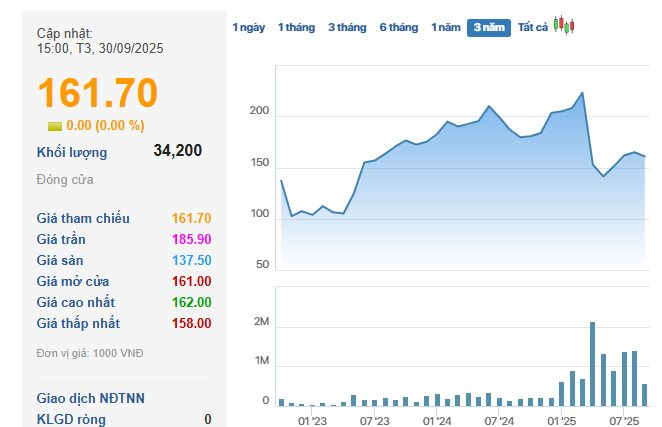

On the stock market, NTC closed the session on September 30th at 161,700 VND per share, corresponding to a market capitalization of approximately 3.9 trillion VND.

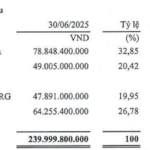

Established in 2004, Nam Tan Uyen’s shareholder structure includes three major shareholders holding 73.22% of its charter capital: Phuoc Hoa Rubber Joint Stock Company (32.85%), Vietnam Rubber Industry Group – JSC (GVR) (20.42%), and Saigon VRG Investment Joint Stock Company (19.95%).

Nam Tan Uyen is the primary developer of three industrial parks (IPs) in Tan Uyen Town, Binh Duong Province: Nam Tan Uyen IP (332 ha), Nam Tan Uyen Expanded IP (288.52 ha), and Nam Tan Uyen Expanded IP Phase 2 (346 ha).

Additionally, the company invests in several intra- and inter-industry projects, including Binh Long Rubber IP (Binh Phuoc, 37.79% ownership), Bac Dong Phu IP (Binh Phuoc, 40% ownership), Truong Phat Rubber JSC (20% ownership), and Dau Giay IP (Dong Nai, 22.17% ownership).

In terms of business performance, in the first six months of 2025, Nam Tan Uyen reported net revenue of 277 billion VND and post-tax profit of 166 billion VND, marking a 124% and 27% year-on-year increase, respectively. For 2025, the company targets revenue of nearly 793 billion VND and post-tax profit of 284 billion VND. Thus, NTC has achieved approximately 59% of its annual profit goal.

As of June 30, 2025, total assets stood at over 6.164 trillion VND, a 16% decrease from the beginning of the year. This includes cash and cash equivalents of over 27 billion VND and term deposits under 12 months totaling more than 535 billion VND. Long-term prepaid expenses account for over 72% of total assets at 4.470 trillion VND. Construction in progress surged nearly threefold to over 45 billion VND due to increased investment in Nam Tan Uyen Expanded IP Phase 2.

Total liabilities at the end of Q2 decreased by 22% year-to-date to nearly 4.889 trillion VND. Outstanding loans were recorded at 950 billion VND, while advance payments from buyers and unearned revenue totaled 3.819 trillion VND, representing 78% of total liabilities.

Sacombank Secures Spot Among Vietnam’s Top 50 Most Efficient Companies in 2025

Sacombank has once again secured its position in the Top 50 Most Effective Business Companies in Vietnam (TOP50) for 2025, ranking 14th—a remarkable 11-place leap from 2024. This achievement underscores Sacombank’s exceptional management efficiency and sustainable growth capabilities, even amidst a highly volatile market landscape.

SHB Officially Increases Chartered Capital to VND 45,942 Billion

The State Bank of Vietnam (SBV) has recently approved amendments to the charter capital outlined in the establishment and operation license of Saigon-Hanoi Commercial Joint Stock Bank (SHB). As a result, SHB’s new charter capital is now recorded at VND 45,942 billion, solidifying its position as one of the Top 5 largest private commercial banks in the system.

Nam A Bank Secures Spot in Vietnam’s Top 50 Most Efficiently Operated Companies

On September 27th, at the 2025 Corporate Governance Conference, Nam A Commercial Joint Stock Bank (Nam A Bank – HOSE: NAB) was honored among the Top 50 Most Effective Business Companies in Vietnam for 2025. This recognition aptly acknowledges the relentless efforts of Nam A Bank’s entire workforce as the institution approaches its 33rd anniversary (October 21, 1992 – October 21, 2025).