Ms. Ngo Thi Nhu, a Board Member and CEO of Investment and Construction Development JSC (Investco, UPCoM: ING), has registered to purchase over 4.3 million ING shares between October 2nd and 30th. This investment aims to increase her ownership stake from 0% to 20.89% of the company’s capital, officially making her a major shareholder.

Based on the current market price of 10,500 VND per share, Ms. Nhu is expected to invest more than 45.6 billion VND to complete the transaction. Notably, ING shares have been illiquid on the market, maintaining a static price of 10,500 VND per share since late June 2025, yet still showing a nearly 12% increase over the past year.

Previously, the stock reached an all-time high of 18,700 VND per share in March 2025 before retreating by over 44% to its current level. The stock is also under trading restrictions as of August 8, 2025, due to negative equity reported in the audited semi-annual financial statements for 2025.

| ING Stock Price Performance Over the Past Year |

Deepening Business Losses

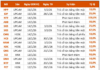

In the first six months of 2025, ING reported a record net loss of nearly 154 billion VND, compared to a loss of just over 3 billion VND in the same period last year. The company recorded no revenue, while interest expenses soared to nearly 152.5 billion VND, a 139-fold increase year-over-year. Accumulated losses as of June 2025 reached nearly 471 billion VND, driving equity into a negative balance of 211 billion VND. Total debt at the end of the period stood at over 2,553 billion VND, with more than 98% being long-term loans from Him Lam JSC.

According to the company’s explanation, the primary reason for the lack of revenue over several years stems from the Investco Green City residential project—part of functional area No. 7 in the South Ho Chi Minh City Urban Area—which is still undergoing legal completion to meet sales requirements. Despite generating no revenue since 2022, the company continues to incur operational, management, and particularly financial costs, leading to persistent losses and negative equity.

Project Rendering – Image: Investco

|

– 08:41 01/10/2025

“Masan’s Mineral Segment to Witness Significant Growth: Vietcap Predicts Surge in Tungsten Prices”

As of Q2 2025, Masan High-tech Materials has turned a corner, reporting positive profits after consecutive quarters of losses.

The Power of Vietnam’s Largest Bank: Vietcombank’s Market Capitalization Surges by a Whopping Amount, Outperforming Thousands of Listed Companies

The stock market in Vietnam witnessed an unprecedented event as Vietcombank’s market capitalization surged by a staggering $1.5 billion in a single trading session on August 27. This remarkable feat, a first in the nation’s stock market history, underscores the bank’s formidable presence and highlights the potential for significant growth in the country’s equity market.

The Master Wordsmith: Crafting Captivating Copy that Elevates Your Web Presence

Unveiling the Art of Asset Recovery: How Mr. Truong Gia Binh Retrieved a Whopping $700 Million

FPT’s stock has plummeted by over 31% since the start of the year. This sharp decline has investors concerned about the future prospects of this once-promising company. With such a significant drop, it’s clear that FPT is facing challenges that are impacting its performance and worrying shareholders. The question now is: what steps will FPT take to address this downward trend and reassure its investors?